Question: solve all questions please 1. Answer both A and B questions A What is Value Added Tax? How to calculate the VAT to be paid

solve all questions please

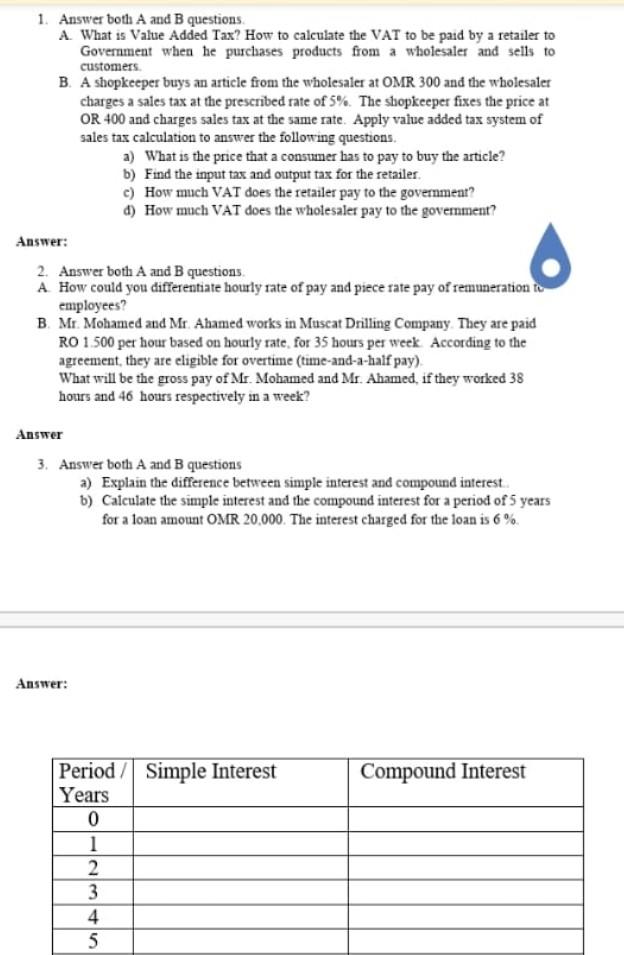

1. Answer both A and B questions A What is Value Added Tax? How to calculate the VAT to be paid by a retailer to Government when he purchases products from a wholesaler and sells to customers B. A shopkeeper buys an article from the wholesaler at OMR 300 and the wholesaler charges a sales tax at the prescribed rate of 5%. The shopkeeper fixes the price at OR 400 and charges sales tax at the same rate. Apply value added tax system of sales tax calculation to answer the following questions a) What is the price that a consumer has to pay to buy the article? b) Find the input tax and output tax for the retailer c) How much VAT does the retailer pay to the government? d) How mch VAT does the wholesaler pay to the government? Answer: 2. Answer both A and B questions A How could you differentiate hourly rate of pay and piece rate pay of remuneration to employees? B. Mr Mohamed and Mr. Ahamed works in Muscat Drilling Company. They are paid RO 1.500 per hour based on hourly rate, for 35 hours per week According to the agreement, they are eligible for overtime (time-and-a-half pay) What will be the gross pay of Mr. Mohamed and Mr. Ahamed, if they worked 38 hours and 46 hours respectively in a week? Answer 3. Answer both A and B questions a) Explain the difference between simple interest and compound interest. b) Calculate the simple interest and the compound interest for a period of 5 years for a loan amount OMR 20.000. The interest charged for the loan is 6 %. Answer: Compound Interest Period / Simple Interest Years 0 1 2 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts