Question: Solve All Show all work please PART 1 Multiple Choice Record your answers on the answer sheet pro- vided by your teacher or on a

Solve All

Show all work please

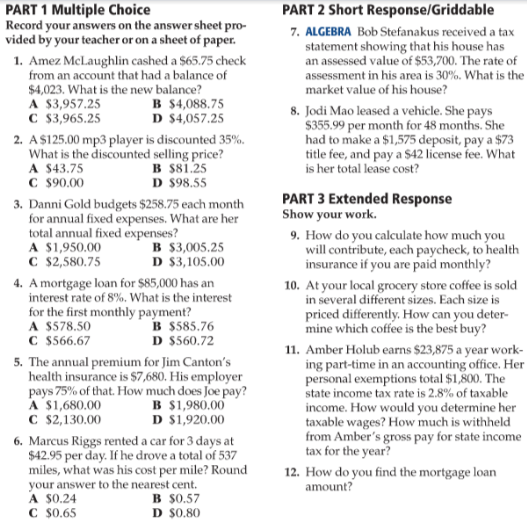

PART 1 Multiple Choice Record your answers on the answer sheet pro- vided by your teacher or on a sheet of paper. 1. Amez McLaughlin cashed a $65.75 check from an account that had a balance of $4,023. What is the new balance? A $3,957.25 B $4,088.75 C$3,965.25 D $4,057.25 2. A $125.00 mp3 player is discounted 35%. What is the discounted selling price? A $43.75 B $81.25 C $90.00 D $98.55 3. Danni Gold budgets $258.75 each month for annual fixed expenses. What are her total annual fixed expenses? A $1,950.00 B $3,005.25 C $2,580.75 D $3,105.00 4. A mortgage loan for $85,000 has an interest rate of 8%. What is the interest for the first monthly payment? A $578.50 B $585.76 C $566.67 D $560.72 5. The annual premium for Jim Canton's health insurance is $7,680. His employer pays 75% of that. How much does Joe pay? A $1,680.00 B $1,980,00 C $2,130.00 D $1,920.00 6. Marcus Riggs rented a car for 3 days at $42.95 per day. If he drove a total of 537 miles, what was his cost per mile? Round your answer to the nearest cent. A $0.24 B $0.57 C$0.65 D $0.80 PART 2 Short Response/Griddable 7. ALGEBRA Bob Stefanakus received a tax statement showing that his house has an assessed value of $53,700. The rate of assessment in his area is 30%. What is the market value of his house? 8. Jodi Mao leased a vehicle. She pays $355.99 per month for 48 months. She had to make a $1,575 deposit, pay a $73 title fee, and pay a $42 license fee. What is her total lease cost? PART 3 Extended Response Show your work. 9. How do you calculate how much you will contribute, each paycheck, to health insurance if you are paid monthly? 10. At your local grocery store coffee is sold in several different sizes. Each size is priced differently. How can you deter- mine which coffee is the best buy? 11. Amber Holub earns $23,875 a year work- ing part-time in an accounting office. Her personal exemptions total $1,800. The state income tax rate is 2.8% of taxable income. How would you determine her taxable wages? How much is withheld from Amber's gross pay for state income tax for the year? 12. How do you find the mortgage loan amount? PART 1 Multiple Choice Record your answers on the answer sheet pro- vided by your teacher or on a sheet of paper. 1. Amez McLaughlin cashed a $65.75 check from an account that had a balance of $4,023. What is the new balance? A $3,957.25 B $4,088.75 C$3,965.25 D $4,057.25 2. A $125.00 mp3 player is discounted 35%. What is the discounted selling price? A $43.75 B $81.25 C $90.00 D $98.55 3. Danni Gold budgets $258.75 each month for annual fixed expenses. What are her total annual fixed expenses? A $1,950.00 B $3,005.25 C $2,580.75 D $3,105.00 4. A mortgage loan for $85,000 has an interest rate of 8%. What is the interest for the first monthly payment? A $578.50 B $585.76 C $566.67 D $560.72 5. The annual premium for Jim Canton's health insurance is $7,680. His employer pays 75% of that. How much does Joe pay? A $1,680.00 B $1,980,00 C $2,130.00 D $1,920.00 6. Marcus Riggs rented a car for 3 days at $42.95 per day. If he drove a total of 537 miles, what was his cost per mile? Round your answer to the nearest cent. A $0.24 B $0.57 C$0.65 D $0.80 PART 2 Short Response/Griddable 7. ALGEBRA Bob Stefanakus received a tax statement showing that his house has an assessed value of $53,700. The rate of assessment in his area is 30%. What is the market value of his house? 8. Jodi Mao leased a vehicle. She pays $355.99 per month for 48 months. She had to make a $1,575 deposit, pay a $73 title fee, and pay a $42 license fee. What is her total lease cost? PART 3 Extended Response Show your work. 9. How do you calculate how much you will contribute, each paycheck, to health insurance if you are paid monthly? 10. At your local grocery store coffee is sold in several different sizes. Each size is priced differently. How can you deter- mine which coffee is the best buy? 11. Amber Holub earns $23,875 a year work- ing part-time in an accounting office. Her personal exemptions total $1,800. The state income tax rate is 2.8% of taxable income. How would you determine her taxable wages? How much is withheld from Amber's gross pay for state income tax for the year? 12. How do you find the mortgage loan amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts