Question: Solve all three quickly within 35 minutes and get two upvotes immediately. Questions 10-15 refer to the following. Barbara can seek financing by issuing either

Solve all three quickly within 35 minutes and get two upvotes immediately.

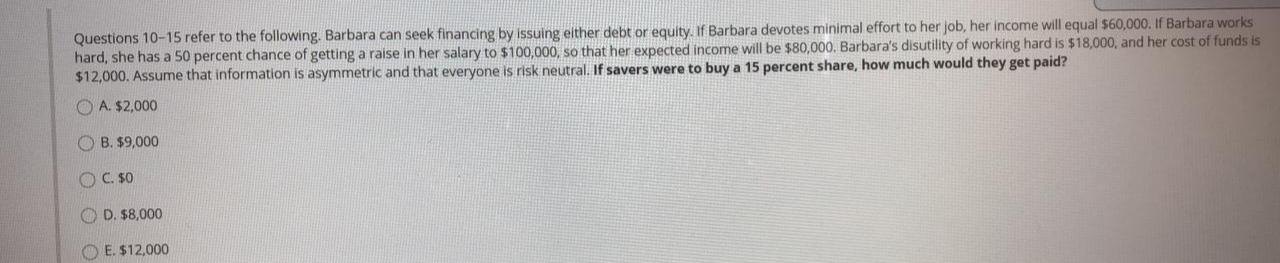

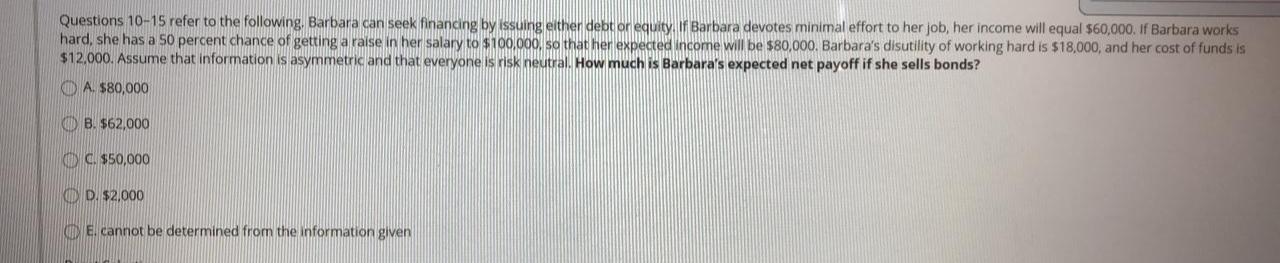

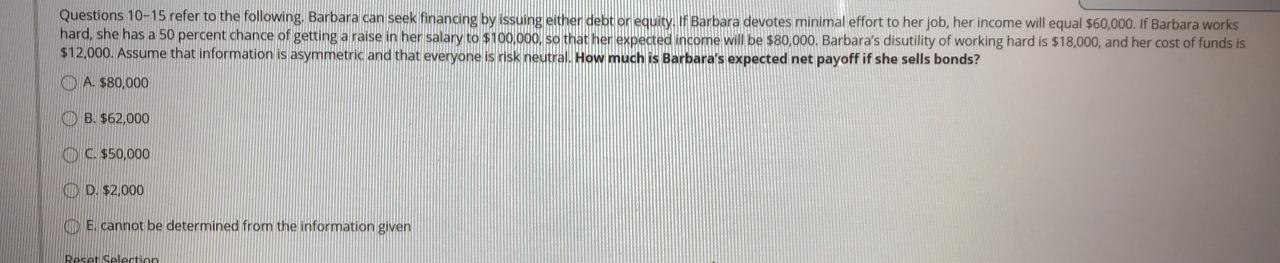

Questions 10-15 refer to the following. Barbara can seek financing by issuing either debt or equity. If Barbara devotes minimal effort to her job, her income will equal $60,000. If Barbara works hard, she has a 50 percent chance of getting a raise in her salary to $100,000, so that her expected income will be $80,000, Barbara's disutility of working hard is $18,000, and her cost of funds is $12,000. Assume that information is asymmetric and that everyone is risk neutral. If savers were to buy a 15 percent share, how much would they get paid? O A. $2,000 O B. $9,000 OC. $0 D. $8,000 E. $12,000 Questions 10-15 refer to the following. Barbara can seek financing by issuing either debt or equity. If Barbara devotes minimal effort to her job, her income will equal $60,000. If Barbara works hard, she has a 50 percent chance of getting a raise in her salary to $100,000, so that her expected income will be $80,000. Barbara's disutility of working hard is $18,000, and her cost of funds is $12.000. Assume that information is asymmetric and that everyone is risk neutral. How much is Barbara's expected net payoff if she sells bonds? A. $80,000 CD B. $62,000 C. $50,000 ODD. $2,000 El cannot be determined from the information given Questions 10-15 refer to the following. Barbara can seek financing by issuing either debt or equity. If Barbara devotes minimal effort to her job, her income will equal $60,000. If Barbara works hard, she has a 50 percent chance of getting a raise in her salary to $100.000, so that her expected income will be $80,000. Barbara's disutility of working hard is $18,000, and her cost of funds is $12,000. Assume that information is asymmetric and that everyone is risk neutral. How much is Barbara's expected net payoff if she sells bonds? A. $80,000 B. $62,000 0 C $50,000 D. $2,000 E. cannot be determined from the information given Reset selection Questions 10-15 refer to the following. Barbara can seek financing by issuing either debt or equity. If Barbara devotes minimal effort to her job, her income will equal $60,000. If Barbara works hard, she has a 50 percent chance of getting a raise in her salary to $100,000, so that her expected income will be $80,000, Barbara's disutility of working hard is $18,000, and her cost of funds is $12,000. Assume that information is asymmetric and that everyone is risk neutral. If savers were to buy a 15 percent share, how much would they get paid? O A. $2,000 O B. $9,000 OC. $0 D. $8,000 E. $12,000 Questions 10-15 refer to the following. Barbara can seek financing by issuing either debt or equity. If Barbara devotes minimal effort to her job, her income will equal $60,000. If Barbara works hard, she has a 50 percent chance of getting a raise in her salary to $100,000, so that her expected income will be $80,000. Barbara's disutility of working hard is $18,000, and her cost of funds is $12.000. Assume that information is asymmetric and that everyone is risk neutral. How much is Barbara's expected net payoff if she sells bonds? A. $80,000 CD B. $62,000 C. $50,000 ODD. $2,000 El cannot be determined from the information given Questions 10-15 refer to the following. Barbara can seek financing by issuing either debt or equity. If Barbara devotes minimal effort to her job, her income will equal $60,000. If Barbara works hard, she has a 50 percent chance of getting a raise in her salary to $100.000, so that her expected income will be $80,000. Barbara's disutility of working hard is $18,000, and her cost of funds is $12,000. Assume that information is asymmetric and that everyone is risk neutral. How much is Barbara's expected net payoff if she sells bonds? A. $80,000 B. $62,000 0 C $50,000 D. $2,000 E. cannot be determined from the information given Reset selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts