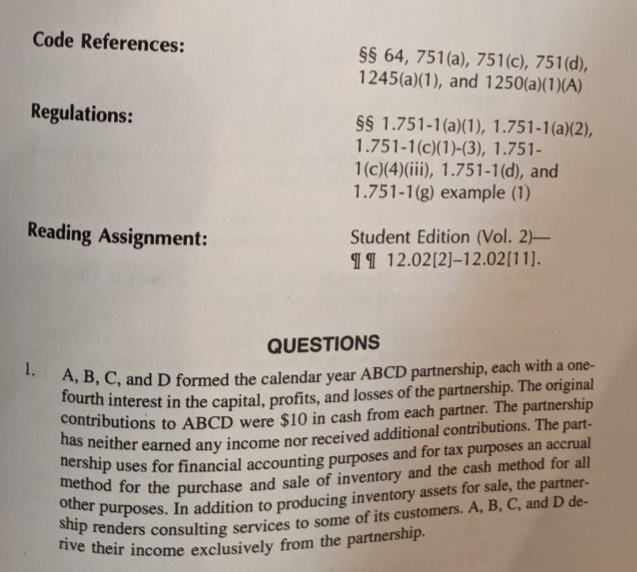

Question: Solve and explain Code References: SS 64, 751(a), 751(c), 751(d), 1245(a)(1), and 1250(a)(1)(A) Regulations: SS 1.751-1(a)(1), 1.751-1(a)(2), 1.751-1(c)(1)-(3), 1.751- 1 (c)(4)(iii), 1.751-1(d), and 1.751-1(g) example

Solve and explain

![example (1) Reading Assignment: Student Edition (Vol. 2)- 49 12.02[2]-12.02[11]. QUESTIONS 1.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673b9d3add00a_122673b9d3aa9547.jpg)

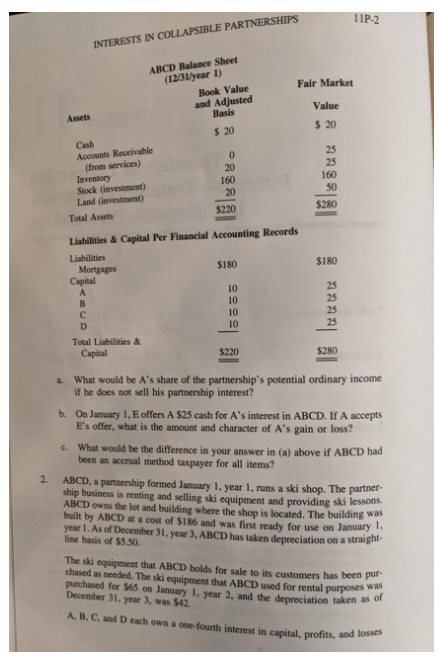

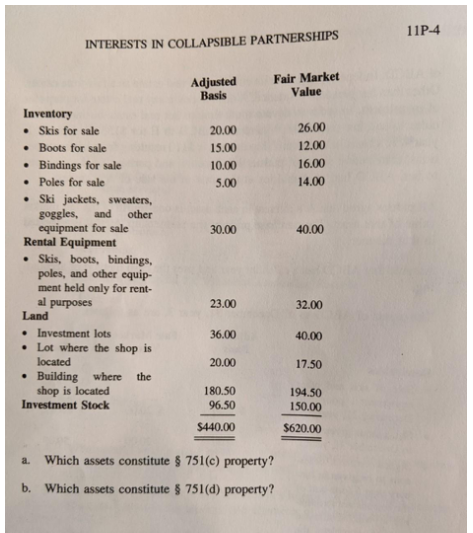

Code References: SS 64, 751(a), 751(c), 751(d), 1245(a)(1), and 1250(a)(1)(A) Regulations: SS 1.751-1(a)(1), 1.751-1(a)(2), 1.751-1(c)(1)-(3), 1.751- 1 (c)(4)(iii), 1.751-1(d), and 1.751-1(g) example (1) Reading Assignment: Student Edition (Vol. 2)- 49 12.02[2]-12.02[11]. QUESTIONS 1. A, B, C, and D formed the calendar year ABCD partnership, each with a one- fourth interest in the capital, profits, and losses of the partnership. The original contributions to ABCD were $10 in cash from each partner. The partnership has neither earned any income nor received additional contributions. The part- nership uses for financial accounting purposes and for tax purposes an accrual method for the purchase and sale of inventory and the cash method for all other purposes. In addition to producing inventory assets for sale, the partner- ship renders consulting services to some of its customers. A, B, C, and D de- rive their income exclusively from the partnership.11P-2 INTERESTS IN COLLAPSIBLE PARTNERSHIPS ABCD Balance Sheet (12/31/year 1) Book Value Fair Market and Adjusted Basis Value Asicis $ 20 $ 20 Cash Accounts Receivable 0 25 (from services) 20 25 Inventory 160 160 Stock (investment) 50 Land (investment) Total Assets $220 $280 Liabilities & Capital Per Financial Accounting Records Liabilities Mortgages $180 $180 Capital A 10 25 B 10 25 10 25 10 25 Total Liabilities & Capital $220 $280 What would be A's share of the partnership's potential ordinary income if he does not sell his partnership interest? b. On January 1. E offers A $25 cash for A's interest in ABCD. If A accepts E's offer, what is the amount and character of A's gain or loss? e. What would be the difference in your answer in (a) above if ABCD had been an accrual method taxpayer for all items? 2. ABCD, a partnership formed January 1, year 1, runs a ski shop. The partner- ship business is renting and selling ski equipment and providing ski lessons. ABCD owns the lot and building where the shop is located. The building was built by ABCD at a cost of $186 and was first ready for use on January 1. year 1. As of December 31, year 3, ABCD has taken depreciation on a straight- line basis of $5.50. The ski equipment that ABCD holds for sale to its customers has been pur- chased as needed. The ski equipment that ABCD used for rental purposes was purchased for $65 on January 1. year 2, and the depreciation taken as of December 31. year 3, was $42. A. B. C, and D each own a one-fourth interest in capital, profits, and losses1 1P-3 PROBLEM 11 of ABCD. Independently, A sells unimproved real estate as a full-time career. Other than her personal residence, A does not own any real estate for purposes of investment. In order to devote more time to her real estate business, A de- cides to sell her partnership interest in ABCD to E for $155 on January 1, year 4. A's basis in her partnership interest is $1 10 resulting from her contribu- tions, distributive share of partnership income, and partnership distributions to her. ABCD had no liabilities at the time of the sale of A's interest. All parties agree that A's interest in each asset is one-fourth of the fair market value of that asset. The purchase price of the partnership interest is allocated in that manner. Assume that ABCD has a calendar year and uses the cash method of account- ing The assets of ABCD as of December 31, year 3, are as follows: Adjusted Fair Market Basis Value Face Receivables . Sale of skis and other equipment prior to December 31, year 3. $ 0,00 $ 20100 $50.00 . Ski lessons given prior to December 31, year 3. 20.00 50.00 . Signed contracts for les- sons to be given in Jan- uary year 5 (one-half of the lessons are termina- ble at will). Estimated cost to complete the contracts is $10 which was taken into account in arriving at the fair market value. 0.00 30100 50100 . Sale of common stock of XYW. Inc. which has been held for less than one year and was a capi- tal asset, payable in year 4. The basis is equal to the stock's basis prior to sale. 400 [Table continued on next page.|1 1P-4 INTERESTS IN COLLAPSIBLE PARTNERSHIPS Adjusted Fair Market Basis Value Inventory . Skis for sale 20.00 26.00 Boots for sale 15.00 12.00 Bindings for sale 10.00 16.00 Poles for sale 5.00 14,00 . Ski jackets, sweaters, goggles, and other equipment for sale 30.00 40.00 Rental Equipment . Skis, boots, bindings, poles, and other equip- ment held only for rent- al purposes 23.00 32.00 Land . Investment lots 36.00 40.00 . Lot where the shop is located 20.00 17.50 . Building where shop is located 180.50 194.50 Investment Stock 96.50 150.00 $440.00 $620.00 a. Which assets constitute $ 751(c) property? b. Which assets constitute 5 751(d) property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts