Question: Solve and explain Code References: SS 751(b) and 702(a)(7) Regulations: SS 1.751-1(b) and 1.751-1 (g) example (2) QUESTIONS The ABCD partnership has the following balance

Solve and explain

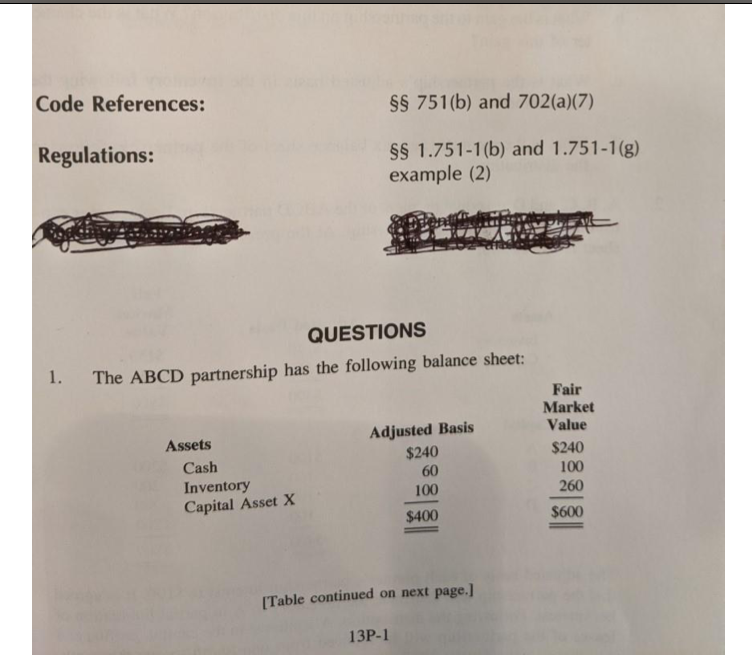

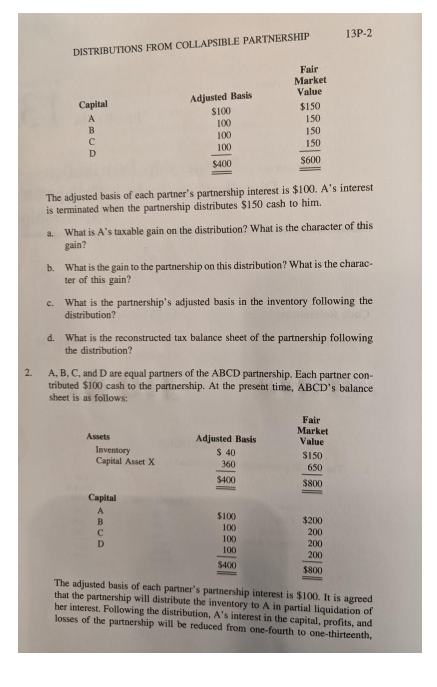

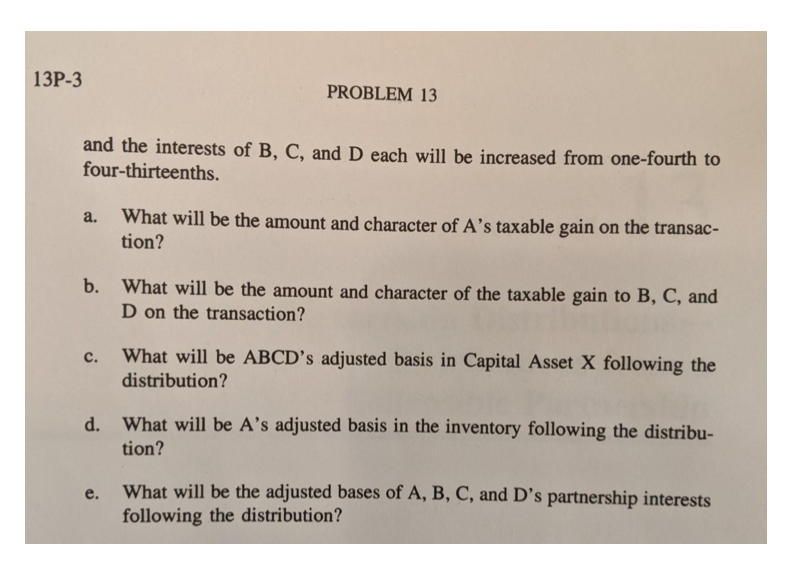

Code References: SS 751(b) and 702(a)(7) Regulations: SS 1.751-1(b) and 1.751-1 (g) example (2) QUESTIONS The ABCD partnership has the following balance sheet: 1. Assets Cash Inventory Capital Asset X Adjusted Basis $240 60 100 Fair Market Value $240 100 260 $600 $400 [Table continued on next page.] 13P-1 13P-2 DISTRIBUTIONS FROM COLLAPSIBLE PARTNERSHIP Capital B D Adjusted Basis $100 100 100 100 $400 Fair Market Value $150 150 150 150 S600 The adjusted basis of each partner's partnership interest is $100. A's interest is terminated when the partnership distributes $150 cash to him. a. What is A's taxable gain on the distribution? What is the character of this gain? c. b. What is the gain to the partnership on this distribution? What is the charac- ter of this gain? What is the partnership's adjusted basis in the inventory following the distribution? d. What is the reconstructed tax balance sheet of the partnership following the distribution? A, B, C, and D are equal partners of the ABCD partnership. Each partner con- tributed $100 cash to the partnership. At the present time, ABCD's balance sheet is as follows: 2. Assets Inventory Capital Asset X Adjusted Basis $ 40 360 $400 Fair Market Value SISO 650 $800 Capital A B D $100 100 100 100 $400 $200 200 200 200 $800 The adjusted basis of each partner's partnership interest is $100. It is agreed that the partnership will distribute the inventory to A in partial liquidation of her interest. Following the distribution, A's interest in the capital, profits, and losses of the partnership will be reduced from one-fourth to one-thirteenth, 13P-3 PROBLEM 13 and the interests of B, C, and D each will be increased from one-fourth to four-thirteenths. a. What will be the amount and character of A's taxable gain on the transac- tion? b. What will be the amount and character of the taxable gain to B, C, and D on the transaction? c. What will be ABCD's adjusted basis in Capital Asset X following the distribution? d. What will be A's adjusted basis in the inventory following the distribu- tion? e. What will be the adjusted bases of A, B, C, and D's partnership interests following the distribution? Code References: SS 751(b) and 702(a)(7) Regulations: SS 1.751-1(b) and 1.751-1 (g) example (2) QUESTIONS The ABCD partnership has the following balance sheet: 1. Assets Cash Inventory Capital Asset X Adjusted Basis $240 60 100 Fair Market Value $240 100 260 $600 $400 [Table continued on next page.] 13P-1 13P-2 DISTRIBUTIONS FROM COLLAPSIBLE PARTNERSHIP Capital B D Adjusted Basis $100 100 100 100 $400 Fair Market Value $150 150 150 150 S600 The adjusted basis of each partner's partnership interest is $100. A's interest is terminated when the partnership distributes $150 cash to him. a. What is A's taxable gain on the distribution? What is the character of this gain? c. b. What is the gain to the partnership on this distribution? What is the charac- ter of this gain? What is the partnership's adjusted basis in the inventory following the distribution? d. What is the reconstructed tax balance sheet of the partnership following the distribution? A, B, C, and D are equal partners of the ABCD partnership. Each partner con- tributed $100 cash to the partnership. At the present time, ABCD's balance sheet is as follows: 2. Assets Inventory Capital Asset X Adjusted Basis $ 40 360 $400 Fair Market Value SISO 650 $800 Capital A B D $100 100 100 100 $400 $200 200 200 200 $800 The adjusted basis of each partner's partnership interest is $100. It is agreed that the partnership will distribute the inventory to A in partial liquidation of her interest. Following the distribution, A's interest in the capital, profits, and losses of the partnership will be reduced from one-fourth to one-thirteenth, 13P-3 PROBLEM 13 and the interests of B, C, and D each will be increased from one-fourth to four-thirteenths. a. What will be the amount and character of A's taxable gain on the transac- tion? b. What will be the amount and character of the taxable gain to B, C, and D on the transaction? c. What will be ABCD's adjusted basis in Capital Asset X following the distribution? d. What will be A's adjusted basis in the inventory following the distribu- tion? e. What will be the adjusted bases of A, B, C, and D's partnership interests following the distribution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts