Question: solve and show work please. thanks Section B 22. (a) Farside Corporation follows a strict residual dividend policy. Its optimal capitat structure is 75% debt

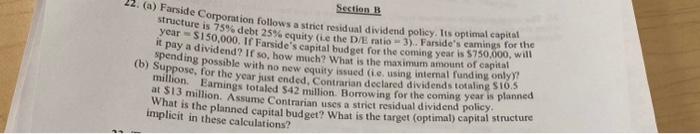

Section B 22. (a) Farside Corporation follows a strict residual dividend policy. Its optimal capitat structure is 75% debt 25% equity (i.e the D/E ratio =3 ). Farside's camings for the year =$150,000. If Farside's capital budget for the coming year is $750,000, will it pay a dividend? If so, how much? What is the maximam amount of capital spending possible with no new equity issued (i.e. using internal funding only)? (b) Suppose, for the year fust ended, Contrarian declared dividend totaling $10.5. milion. Eamings totaled 542 million. Borrowing for the coming year is planned at $13 million. Assume Contrarian uses a striet residual dividend policy. What is the planned capital budget? What is the target (optimal) capital structure implicit in these calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts