Question: Solve and show work using excel. If a firm can buy a machine for $80000, takes an investment tax credit of 15%, and lease out

Solve and show work using excel.

Solve and show work using excel.

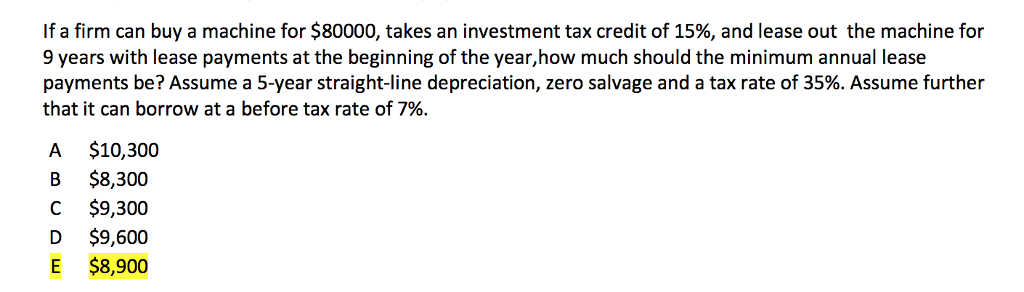

If a firm can buy a machine for $80000, takes an investment tax credit of 15%, and lease out the machine for 9 years with lease payments at the beginning of the year,how much should the minimum annual lease payments be? Assume a 5-year straight-line depreciation, zero salvage and a tax rate of 35%. Assume further that it can borrow at a before tax rate of 7%. A $10,300 B $8,300 C $9,300 D $9,600 E $8,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts