Question: solve and show your solution Problem 1-25 (AICPA Adapted) ent Company, a realty entity, maintains escrow accounts and pays real estate taxes for the mortgage

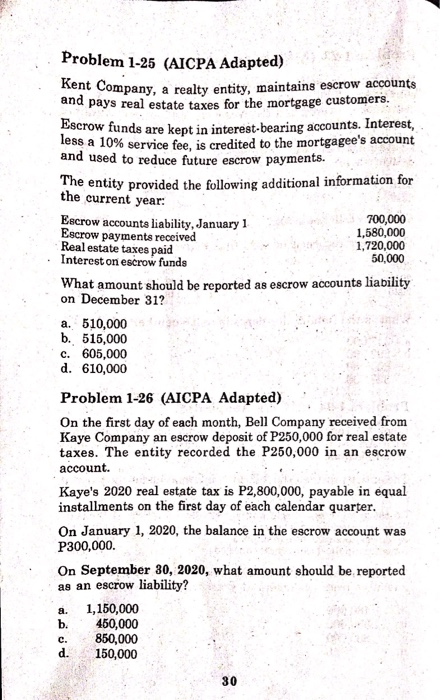

Problem 1-25 (AICPA Adapted) ent Company, a realty entity, maintains escrow accounts and pays real estate taxes for the mortgage customers. Escrow funds are kept in interest-bearing accounts. Interest, less a 10% service fee, is credited to the mortgagee's account and used to reduce future escrow payments. The entity provided the following additional information for the current year: Escrow accounts liability, January 1 700,000 Escrow payments received 1,580,000 Real estate taxes paid 1,720,000 Interest on escrow funds 50,000 What amount should be reported as escrow accounts liability on December 31? a. 510,000 b. 515,000 c. 605,000 d. 610,000 Problem 1-26 (AICPA Adapted) On the first day of each month, Bell Company received from Kaye Company an escrow deposit of P250,000 for real estate taxes. The entity recorded the P250,000 in an escrow account. Kaye's 2020 real estate tax is P2,800,000, payable in equal installments on the first day of each calendar quarter. On January 1, 2020, the balance in the escrow account was P300,000. On September 30, 2020, what amount should be reported as an escrow liability? a. 1,150,000 b. 450,000 850,000 d. 150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts