Question: SOLVE ANSWER ALL. WILL DISLIKE FOR WRONG ONE AND IF ANSWERED PARTLY. IF GOING TO SOLVE ONLY ONE, JUST SKIP THE QUESTION. a. Find the

SOLVE ANSWER ALL. WILL DISLIKE FOR WRONG ONE AND IF ANSWERED PARTLY. IF GOING TO SOLVE ONLY ONE, JUST SKIP THE QUESTION.

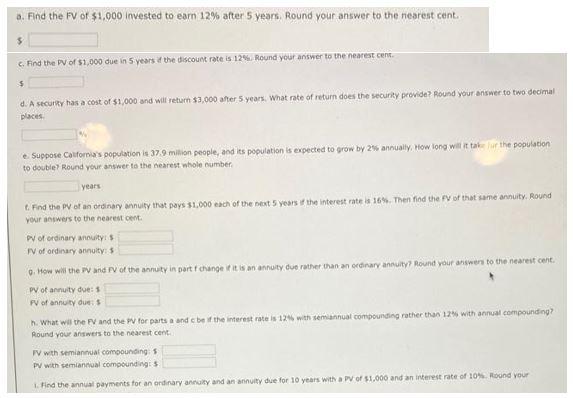

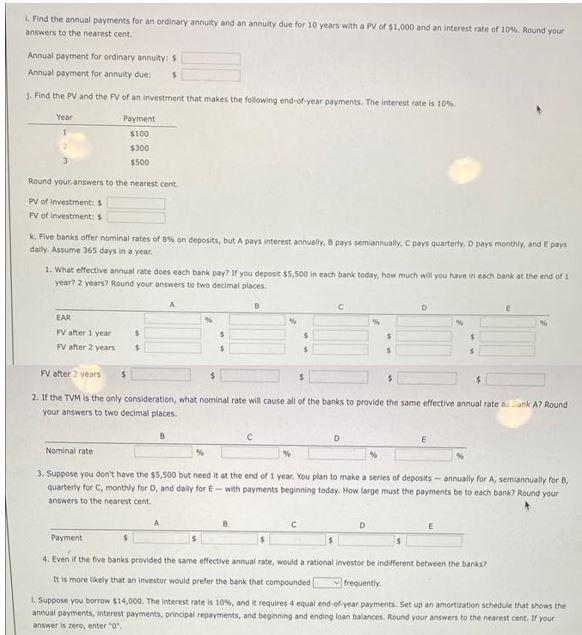

a. Find the FV of $1,000 invested to eam 12% after 5 years. Round your answer to the nearest cent. 5. c. Find the DN of $1,000 due in 5 years d the discoun rote is 12% Round your answer to the nearest cent. d. A securier has a cost of $1,000 and will return $3,000 after 5 years. What nate of return does the securiy provide? Round your answer to two decimal pleces. e. Suppose Calformas oopulation is 37.9 milion people, and its population is expected to grow by 2% annualiy, How iong will it tak- lur the population to doutiel Round your answer to the cearest nhole number. years t. Find the PV of an ordinary annuity that pays 11,000 each of the peat 5 years it the interest rate as 16%. Then fiad the fV of that sine ansuity. Round veur answers to the neacest cent. Dof ofdinary anowity: F of ordinary annuity:s Q. How wil the Fw and FV of the annuty in part f thinge it it is an annuty due rather than an codenary ancuity? Round your answen to the neareif cent. P of arnuty due: 1 FV of annuty dueis h. What wa the V and the of for parts a and cbe if the interest rate is 12.5 wat semannual compounding rather than 12% with annual compounding? Round your answes to the nearent cent. F wth semianewal compounding 5 PV wth semiandoal compounding: $ 1. Hind the annual payments toc an ondinary ancuity and an annuity due for 10 years with a Dof 3.000 and an inserest rate of 10%. Roond vour 1. Find the anasal payments for an oreinary annuity and an annuity due for 10 years wath a fr of $1,000 and an interest rate of 10%. Round your answers to the nearest cent: Annual payment for ordinary annuity: $ Annual payment for annulty dues 3. Find the PV and the FV of an inwestment that makes the following end-of-year payments. The interest rate is I0\%: Round yourianswers to the fearest cent, PV of inestment: 5 PV of investment: 9 k. Five barks offer nominal rates of 8% on deposits, but A pays interest annolly, 8 pays semiannually, C pays quarterly, D pays michthly, and E pays dally. Assume 365 days in a yeac. 1. What effective annuel rate does each bank pary? If you deposit, 55,500 in each bank todsy, how much will you have in esch bank at the end of I year? 2 yeats? Round your answers to two decimal places. 2. If the TVM is the only consideration, what nominal rate will cause all of the banks to provide the same effective annual rate a Zank A? Round your answers to two decimal places. 3. Suppose you doat have the 35,500 but need it at the end of 1 year, You plan to make a series of deposits - annually for A, semiannually for B, quarterly for C, monthly for O, and dally for E - with payments beginning today. How large must the payments be to each bank? Round your ansiarers to the nearest cent. 4. Even if the five banks provided the same effective annual rate, would a rational investor be indifferent between the barks? It is more likely that an inveitor would prefer the bank thet compounded frequently. 1. Suppose you borrow 514,000 . The interest rate is 10%, and it requires 4 equal end-ofyear payments. 5et up an amortiration schedule that ahows the annual payments, interest payments, principal repoyments, and beginning and ending loan balances. Round your answers to the neareit cent, If your answer is zero, enter " 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts