Question: Solve as much as you can from these questions, please. (a) An interest rate derivative trader wants to infer the risk-neutral default probability from CDS

Solve as much as you can from these questions, please.

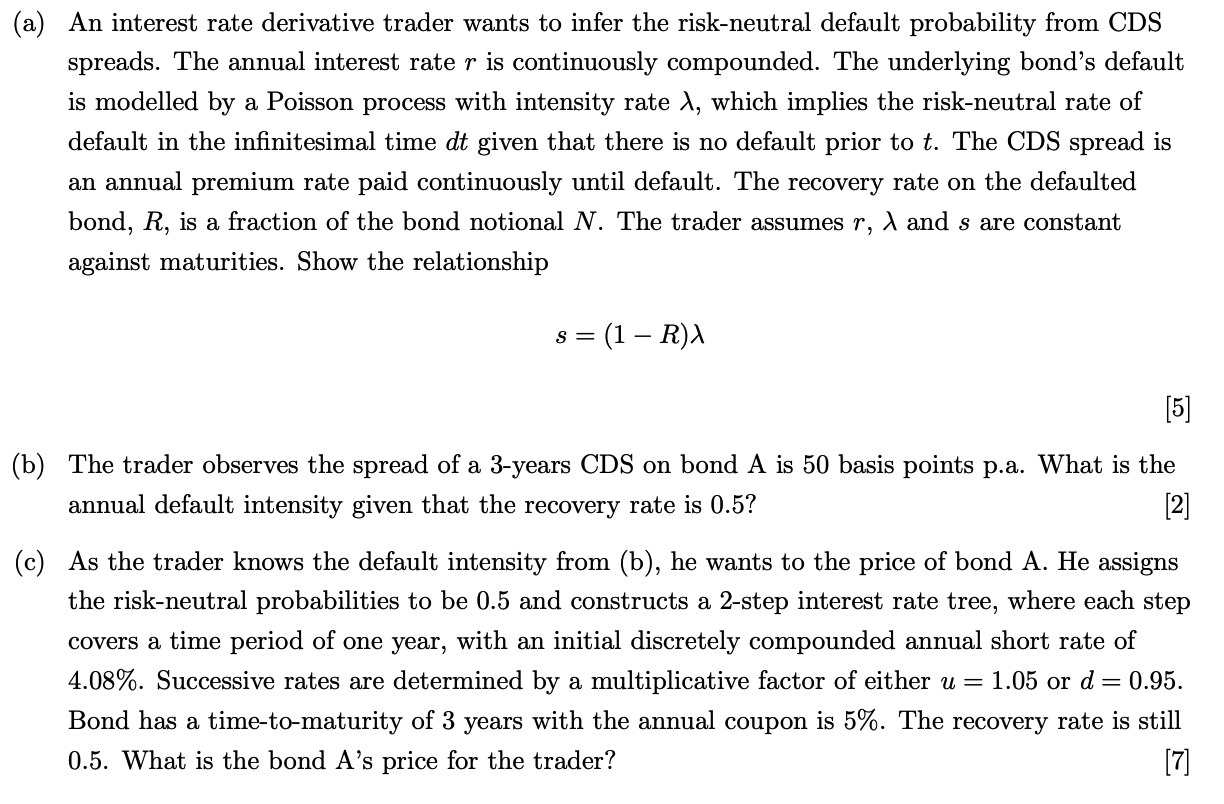

(a) An interest rate derivative trader wants to infer the risk-neutral default probability from CDS spreads. The annual interest rate r is continuously compounded. The underlying bond's default is modelled by a Poisson process with intensity rate 1, which implies the risk-neutral rate of default in the infinitesimal time dt given that there is no default prior to t. The CDS spread is an annual premium rate paid continuously until default. The recovery rate on the defaulted bond, R, is a fraction of the bond notional N. The trader assumes r, I and s are constant against maturities. Show the relationship S= - (1 RX [5] (b) The trader observes the spread of a 3-years CDS on bond A is 50 basis points p.a. What is the annual default intensity given that the recovery rate is 0.5? [2] (c) As the trader knows the default intensity from (b), he wants to the price of bond A. He assigns the risk-neutral probabilities to be 0.5 and constructs a 2-step interest rate tree, where each step covers a time period of one year, with an initial discretely compounded annual short rate of 4.08%. Successive rates are determined by a multiplicative factor of either u = 1.05 or d = 0.95. Bond has a time-to-maturity of 3 years with the annual coupon is 5%. The recovery rate is still 0.5. What is the bond A's price for the trader? [7] (a) An interest rate derivative trader wants to infer the risk-neutral default probability from CDS spreads. The annual interest rate r is continuously compounded. The underlying bond's default is modelled by a Poisson process with intensity rate 1, which implies the risk-neutral rate of default in the infinitesimal time dt given that there is no default prior to t. The CDS spread is an annual premium rate paid continuously until default. The recovery rate on the defaulted bond, R, is a fraction of the bond notional N. The trader assumes r, I and s are constant against maturities. Show the relationship S= - (1 RX [5] (b) The trader observes the spread of a 3-years CDS on bond A is 50 basis points p.a. What is the annual default intensity given that the recovery rate is 0.5? [2] (c) As the trader knows the default intensity from (b), he wants to the price of bond A. He assigns the risk-neutral probabilities to be 0.5 and constructs a 2-step interest rate tree, where each step covers a time period of one year, with an initial discretely compounded annual short rate of 4.08%. Successive rates are determined by a multiplicative factor of either u = 1.05 or d = 0.95. Bond has a time-to-maturity of 3 years with the annual coupon is 5%. The recovery rate is still 0.5. What is the bond A's price for the trader? [7]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts