Question: solve both e index model has been estimated for Stocks A and B with the following results: = 0.03 +0.7 RM + CA nB =

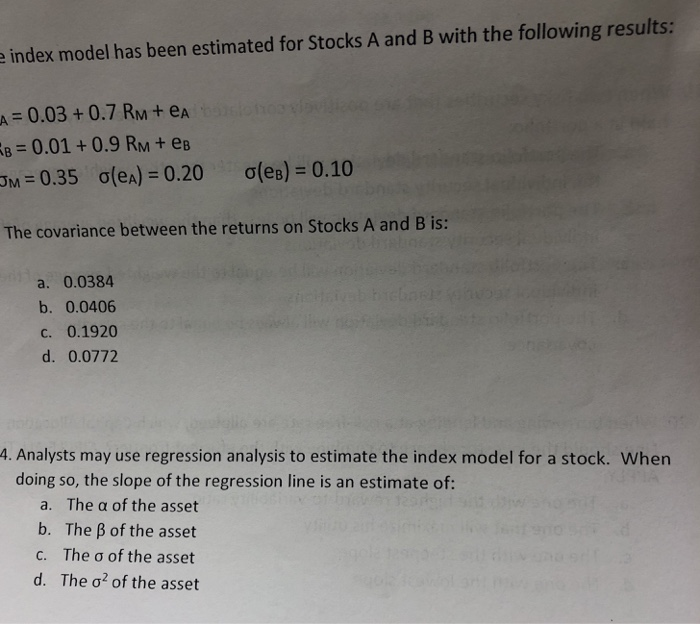

e index model has been estimated for Stocks A and B with the following results: = 0.03 +0.7 RM + CA nB = 0.01 +0.9 RM + CB JM = 0.35 olea) = 0.20 oeb) = 0.10 The covariance between the returns on Stocks A and B is: a. 0.0384 b. 0.0406 C. 0.1920 d. 0.0772 4. Analysts may use regression analysis to estimate the index model for a stock. When doing so, the slope of the regression line is an estimate of: a. The a of the asset b. The of the asset C. The o of the asset d. The o2 of the asset e index model has been estimated for Stocks A and B with the following results: = 0.03 +0.7 RM + CA nB = 0.01 +0.9 RM + CB JM = 0.35 olea) = 0.20 oeb) = 0.10 The covariance between the returns on Stocks A and B is: a. 0.0384 b. 0.0406 C. 0.1920 d. 0.0772 4. Analysts may use regression analysis to estimate the index model for a stock. When doing so, the slope of the regression line is an estimate of: a. The a of the asset b. The of the asset C. The o of the asset d. The o2 of the asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts