Question: solve both For questions 29 to 30, please read the following case: Biltmore Industries expects free cash flow of $10 million each year. Biltmore's corporate

solve both

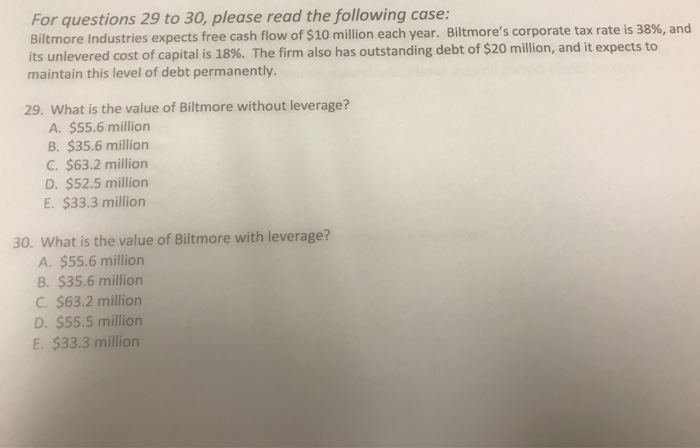

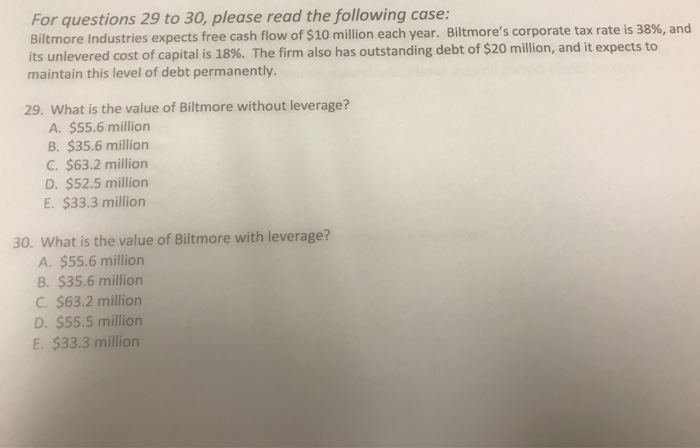

For questions 29 to 30, please read the following case: Biltmore Industries expects free cash flow of $10 million each year. Biltmore's corporate tax rate is 38%, and its unlevered cost of capital is 18%. The firm also has outstanding debt of $20 million, and it expects to maintain this level of debt permanently. 29. What is the value of Biltmore without leverage? A. $55.6 million B. $35.6 million C. $63.2 million D. $52.5 million E. $33.3 million 30. What is the value of Biltmore with leverage? A. $55.6 million B. $35.6 million C. $63.2 million D. $55.5 million E. $33.3 million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock