Question: solve both of the que Question 12 Beech has asked you for help. He began trading on 1 January 20x3 and has been maintaining his

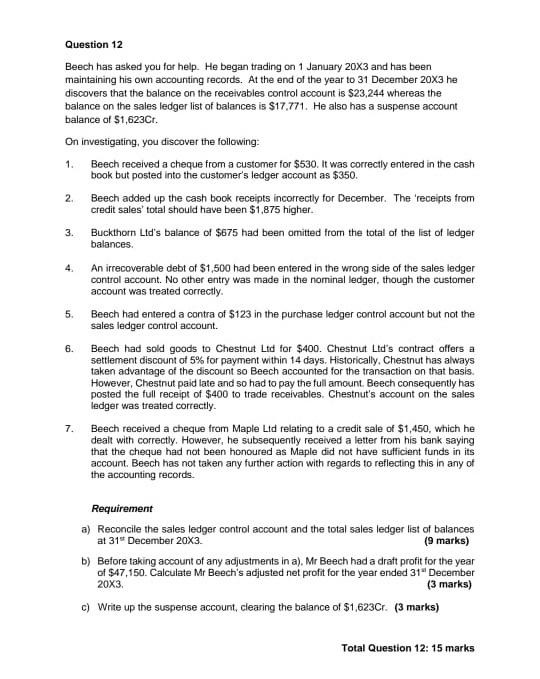

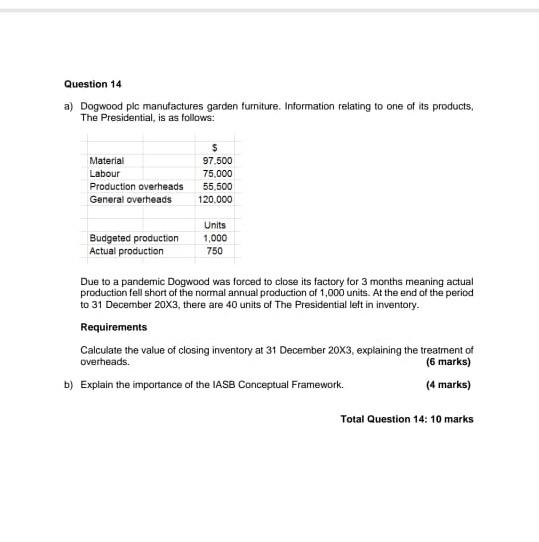

Question 12 Beech has asked you for help. He began trading on 1 January 20x3 and has been maintaining his own accounting records. At the end of the year to 31 December 20x3 he discovers that the balance on the receivables control account is $23,244 whereas the balance on the sales ledger list of balances is $17.771. He also has a suspense account balance of S1,623Cr. On investigating, you discover the following: 1. Beech received a cheque from a customer for $530. It was correctly entered in the cash book but posted into the customer's ledger account as $350. Beech added up the cash book receipts incorrectly for December. The 'receipts from credit sales' total should have been $1,875 higher Buckthorn Ltd's balance of $675 had been omitted from the total of the list of ledger 2. 3. balances 4. 5. 6. An irrecoverable debt of $1,500 had been entered in the wrong side of the sales ledger control account. No other entry was made in the nominal ledger, though the customer account was treated correctly. Beech had entered a contra of $123 in the purchase ledger control account but not the sales ledger control account. Beech had sold goods to Chestnut Ltd for $400. Chestnut Lid's contract offers a settlement discount of 5% for payment within 14 days. Historically, Chestnut has always taken advantage of the discount so Beech accounted for the transaction on that basis However, Chestnut paid late and so had to pay the full amount. Beech consequently has posted the full receipt of $400 to trade receivables. Chestnut's account on the sales ledger was treated correctly. Beech received a cheque from Maple Ltd relating to a credit sale of $1,450, which he dealt with correctly. However, he subsequently received a letter from his bank saying that the cheque had not been honoured as Maple did not have sufficient funds in its account. Beech has not taken any further action with regards to reflecting this in any of the accounting records. 7. Requirement a) Reconcile the sales ledger control account and the total sales ledger list of balances at 31 December 20X3 (9 marks) b) Before taking account of any adjustments in a), Mr Beech had a draft profit for the year of 547,150. Calculate Mr Beech's adjusted net profit for the year ended 31 December 20X3 (3 marks) c) Write up the suspense account, clearing the balance of $1,623Cr. (3 marks) Total Question 12: 15 marks Question 14 a) Dogwood pic manufactures garden furniture. Information relating to one of its products, The Presidential, is as follows: Material Labour Production overheads General overheads 97.500 75.000 55,500 120.000 Budgeted production Actual production Units 1,000 750 Due to a pandemic Dogwood was forced to close its factory for 3 months meaning actual production fell short of the normal annual production of 1,000 units. At the end of the period to 31 December 20X3, there are 40 units of The Presidential left in inventory. Requirements Calculate the value of closing inventory at 31 December 20X3, explaining the treatment of (6 marks) b) Explain the importance of the IASB Conceptual Framework. (4 marks) Overheads. Total Question 14: 10 marks Question 12 Beech has asked you for help. He began trading on 1 January 20x3 and has been maintaining his own accounting records. At the end of the year to 31 December 20x3 he discovers that the balance on the receivables control account is $23,244 whereas the balance on the sales ledger list of balances is $17.771. He also has a suspense account balance of S1,623Cr. On investigating, you discover the following: 1. Beech received a cheque from a customer for $530. It was correctly entered in the cash book but posted into the customer's ledger account as $350. Beech added up the cash book receipts incorrectly for December. The 'receipts from credit sales' total should have been $1,875 higher Buckthorn Ltd's balance of $675 had been omitted from the total of the list of ledger 2. 3. balances 4. 5. 6. An irrecoverable debt of $1,500 had been entered in the wrong side of the sales ledger control account. No other entry was made in the nominal ledger, though the customer account was treated correctly. Beech had entered a contra of $123 in the purchase ledger control account but not the sales ledger control account. Beech had sold goods to Chestnut Ltd for $400. Chestnut Lid's contract offers a settlement discount of 5% for payment within 14 days. Historically, Chestnut has always taken advantage of the discount so Beech accounted for the transaction on that basis However, Chestnut paid late and so had to pay the full amount. Beech consequently has posted the full receipt of $400 to trade receivables. Chestnut's account on the sales ledger was treated correctly. Beech received a cheque from Maple Ltd relating to a credit sale of $1,450, which he dealt with correctly. However, he subsequently received a letter from his bank saying that the cheque had not been honoured as Maple did not have sufficient funds in its account. Beech has not taken any further action with regards to reflecting this in any of the accounting records. 7. Requirement a) Reconcile the sales ledger control account and the total sales ledger list of balances at 31 December 20X3 (9 marks) b) Before taking account of any adjustments in a), Mr Beech had a draft profit for the year of 547,150. Calculate Mr Beech's adjusted net profit for the year ended 31 December 20X3 (3 marks) c) Write up the suspense account, clearing the balance of $1,623Cr. (3 marks) Total Question 12: 15 marks Question 14 a) Dogwood pic manufactures garden furniture. Information relating to one of its products, The Presidential, is as follows: Material Labour Production overheads General overheads 97.500 75.000 55,500 120.000 Budgeted production Actual production Units 1,000 750 Due to a pandemic Dogwood was forced to close its factory for 3 months meaning actual production fell short of the normal annual production of 1,000 units. At the end of the period to 31 December 20X3, there are 40 units of The Presidential left in inventory. Requirements Calculate the value of closing inventory at 31 December 20X3, explaining the treatment of (6 marks) b) Explain the importance of the IASB Conceptual Framework. (4 marks) Overheads. Total Question 14: 10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts