Question: Solve Both Parts Part One: Compute the net present value, profitabiliy index, and internal rate of return for each options Part two: Oriole Clinic is

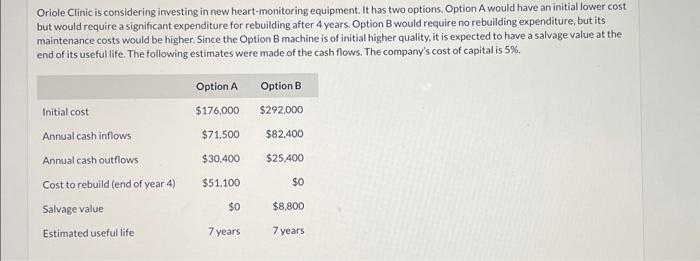

Oriole Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts