Question: Solve both question 1 and question 2 without using excel. Thank you Impairment of Asset QUESTION 1: An entity has purchased the whole of the

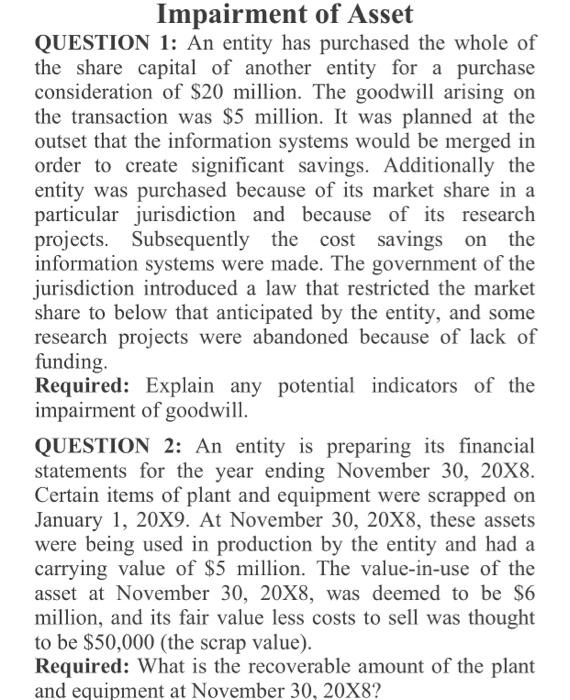

Impairment of Asset QUESTION 1: An entity has purchased the whole of the share capital of another entity for a purchase consideration of $20 million. The goodwill arising on the transaction was $5 million. It was planned at the outset that the information systems would be merged in order to create significant savings. Additionally the entity was purchased because of its market share in a particular jurisdiction and because of its research projects. Subsequently the cost savings on the information systems were made. The government of the jurisdiction introduced a law that restricted the market share to below that anticipated by the entity, and some research projects were abandoned because of lack of funding Required: Explain any potential indicators of the impairment of goodwill. QUESTION 2: An entity is preparing its financial statements for the year ending November 30, 20X8. Certain items of plant and equipment were scrapped on January 1, 20X9. At November 30, 20X8, these assets were being used in production by the entity and had a carrying value of $5 million. The value-in-use of the asset at November 30, 20X8, was deemed to be $6 million, and its fair value less costs to sell was thought to be $50,000 (the scrap value). Required: What is the recoverable amount of the plant and equipment at November 30, 20X8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts