Question: solve both question please 18. You are considering a butterfly spread for ZEUS (Olympic Steel) currently trading for $17.67 per share ask. You study the

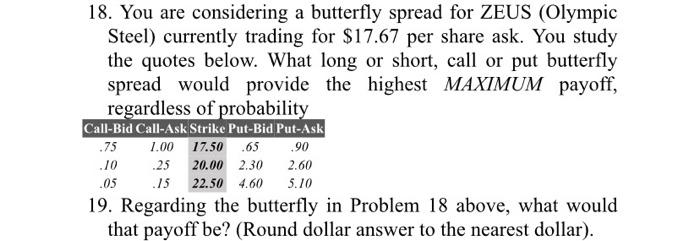

18. You are considering a butterfly spread for ZEUS (Olympic Steel) currently trading for $17.67 per share ask. You study the quotes below. What long or short, call or put butterfly spread would provide the highest MAXIMUM payoff, regardless of probability Call-Bid Call-Ask Strike Put-Bid Put-Ask .75 1.00 17.50 .65 90 -25 2.30 .05 .75 22.50 4.60 5.10 19. Regarding the butterfly in Problem 18 above, what would that payoff be? (Round dollar answer to the nearest dollar). .10 20.00 2.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts