Question: Solve both second and third please 2. The potential decline of the portfolio value below some critical limit is an important issue in portfolio selection.

Solve both second and third please

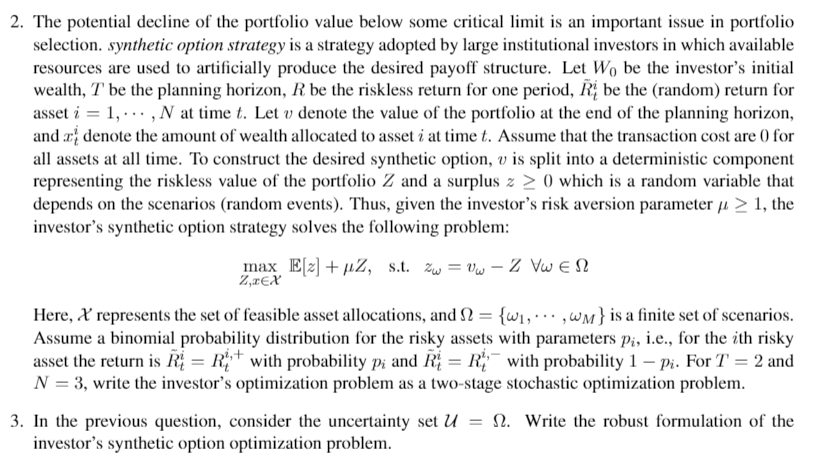

2. The potential decline of the portfolio value below some critical limit is an important issue in portfolio selection. synthetic option strategy is a strategy adopted by large institutional investors in which available resources are used to artificially produce the desired payoff structure. Let W, be the investor's initial wealth, T be the planning horizon, R be the riskless return for one period, R; be the (random) return for asset i = 1,..., N at time t. Let v denote the value of the portfolio at the end of the planning horizon, and x denote the amount of wealth allocated to asset i at time t. Assume that the transaction cost are 0 for all assets at all time. To construct the desired synthetic option, v is split into a deterministic component representing the riskless value of the portfolio 2 and a surplus z > 0) which is a random variable that depends on the scenarios (random events). Thus, given the investor's risk aversion parameter p > 1, the investor's synthetic option strategy solves the following problem: max E[2] + m2, s.t. w = ww Z VW EN 2,2X Here, X represents the set of feasible asset allocations, and 2 = {W1, ... , WM} is a finite set of scenarios. Assume a binomial probability distribution for the risky assets with parameters pi, i.e., for the ith risky asset the return is Rj = R+ with probability pi and R = R' with probability 1 pi. For T = 2 and N = 3, write the investor's optimization problem as a two-stage stochastic optimization problem. 3. In the previous question, consider the uncertainty set U 12. Write the robust formulation of the investor's synthetic option optimization problem. 2. The potential decline of the portfolio value below some critical limit is an important issue in portfolio selection. synthetic option strategy is a strategy adopted by large institutional investors in which available resources are used to artificially produce the desired payoff structure. Let W, be the investor's initial wealth, T be the planning horizon, R be the riskless return for one period, R; be the (random) return for asset i = 1,..., N at time t. Let v denote the value of the portfolio at the end of the planning horizon, and x denote the amount of wealth allocated to asset i at time t. Assume that the transaction cost are 0 for all assets at all time. To construct the desired synthetic option, v is split into a deterministic component representing the riskless value of the portfolio 2 and a surplus z > 0) which is a random variable that depends on the scenarios (random events). Thus, given the investor's risk aversion parameter p > 1, the investor's synthetic option strategy solves the following problem: max E[2] + m2, s.t. w = ww Z VW EN 2,2X Here, X represents the set of feasible asset allocations, and 2 = {W1, ... , WM} is a finite set of scenarios. Assume a binomial probability distribution for the risky assets with parameters pi, i.e., for the ith risky asset the return is Rj = R+ with probability pi and R = R' with probability 1 pi. For T = 2 and N = 3, write the investor's optimization problem as a two-stage stochastic optimization problem. 3. In the previous question, consider the uncertainty set U 12. Write the robust formulation of the investor's synthetic option optimization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts