Question: Solve by hand, show all work 7) (30 points) Luke has $150,000 to invest and is considering the following two investment opportunities. Fund A requires

Solve by hand, show all work

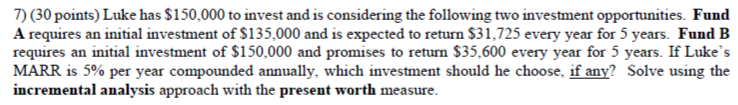

7) (30 points) Luke has $150,000 to invest and is considering the following two investment opportunities. Fund A requires an initial investment of $135,000 and is expected to return $31,725 every year for 5 years. Fund B requires an initial investment of $150,000 and promises to return $35,600 every year for 5 years. If Luke's MARR is 5% per year compounded annually, which investment should he choose, if any? Solve using the incremental analysis approach with the present worth measure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts