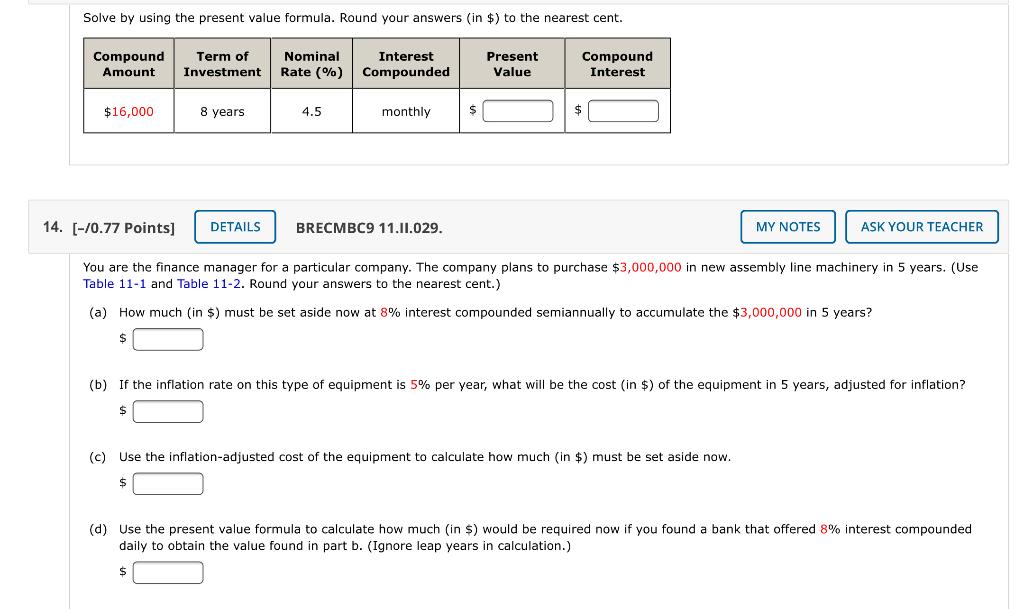

Question: Solve by using the present value formula. Round your answers (in $) to the nearest cent. Compound Amount Term of Investment Nominal Rate (%) Interest

Solve by using the present value formula. Round your answers (in $) to the nearest cent. Compound Amount Term of Investment Nominal Rate (%) Interest Compounded Present Value Compound Interest $16,000 8 years 4.5 monthly $ $ 14. [-70.77 Points) DETAILS BRECMBC9 11.11.029. MY NOTES ASK YOUR TEACHER You are the finance manager for a particular company. The company plans to purchase $3,000,000 in new assembly line machinery in 5 years. (Use Table 11-1 and Table 11-2. Round your answers to the nearest cent.) (a) How much (in $) must be set aside now at 8% interest compounded semiannually to accumulate the $3,000,000 in 5 years? (b) If the inflation rate on this type of equipment is 5% per year, what will be the cost (in $) of the equipment in 5 years, adjusted for inflation? $ (c) Use the inflation-adjusted cost of the equipment to calculate how much (in $) must be set aside now. (d) Use the present value formula to calculate how much in $) would be required now daily to obtain the value found in part b. (Ignore leap years in calculation.) you found a bank that offered 8% interest compounded $ Solve by using the present value formula. Round your answers (in $) to the nearest cent. Compound Amount Term of Investment Nominal Rate (%) Interest Compounded Present Value Compound Interest $16,000 8 years 4.5 monthly $ $ 14. [-70.77 Points) DETAILS BRECMBC9 11.11.029. MY NOTES ASK YOUR TEACHER You are the finance manager for a particular company. The company plans to purchase $3,000,000 in new assembly line machinery in 5 years. (Use Table 11-1 and Table 11-2. Round your answers to the nearest cent.) (a) How much (in $) must be set aside now at 8% interest compounded semiannually to accumulate the $3,000,000 in 5 years? (b) If the inflation rate on this type of equipment is 5% per year, what will be the cost (in $) of the equipment in 5 years, adjusted for inflation? $ (c) Use the inflation-adjusted cost of the equipment to calculate how much (in $) must be set aside now. (d) Use the present value formula to calculate how much in $) would be required now daily to obtain the value found in part b. (Ignore leap years in calculation.) you found a bank that offered 8% interest compounded $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts