Question: solve correctly for a thumbs up! :) In cell D10, by using cell references and the Excel RATE function, calculate the interest rate that should

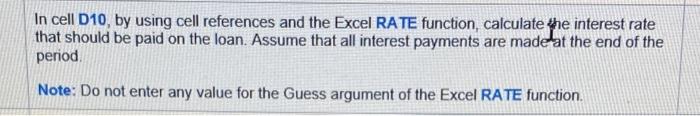

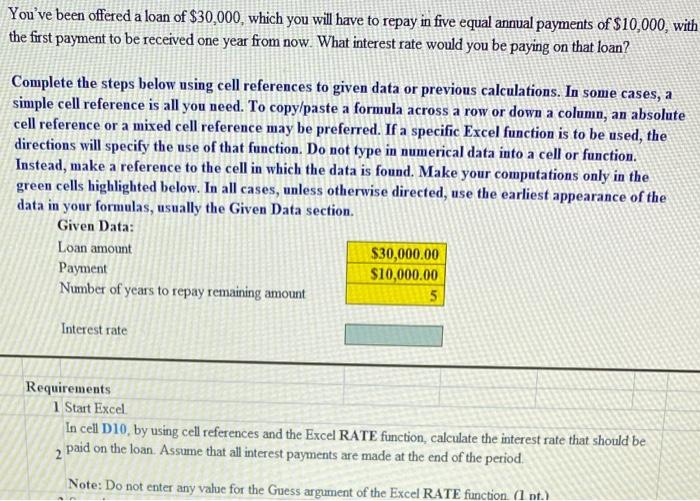

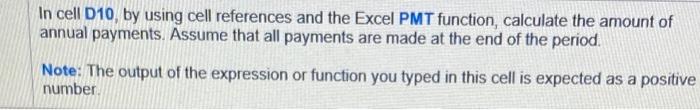

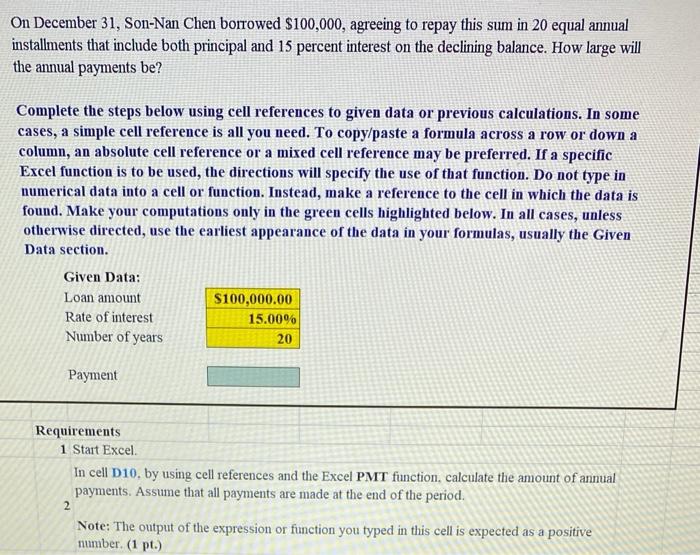

In cell D10, by using cell references and the Excel RATE function, calculate the interest rate that should be paid on the loan. Assume that all interest payments are made at the end of the period Note: Do not enter any value for the Guess argument of the Excel RATE function. You've been offered a loan of $30,000, which you will have to repay in five equal annual payments of $10,000, with the first payment to be received one year from now. What interest rate would you be paying on that loan? a Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the green cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Given Data: Loan amount $30,000.00 Payment $10,000.00 Number of years to repay remaining amount 5 Interest rate Requirements 1 Start Excel In cell D10, by using cell references and the Excel RATE function, calculate the interest rate that should be 2 paid on the loan. Assume that all interest payments are made at the end of the period. Note: Do not enter any value for the Guess argument of the Excel RATE function (Int.) In cell D10, by using cell references and the Excel PMT function, calculate the amount of annual payments. Assume that all payments are made at the end of the period. Note: The output of the expression or function you typed in this cell is expected as a positive number On December 31, Son-Nan Chen borrowed $100,000, agreeing to repay this sum in 20 equal annual installments that include both principal and 15 percent interest on the declining balance. How large will the annual payments be? Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the green cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Given Data: Loan amount $100,000.00 Rate of interest 15.00% Number of years 20 Payment Requirements 1 Start Excel In cell D10. by using cell references and the Excel PMT function, calculate the amount of annual payments. Assume that all payments are made at the end of the period. 2 Note: The output of the expression or function you typed in this cell is expected as a positive number. (1 pt.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts