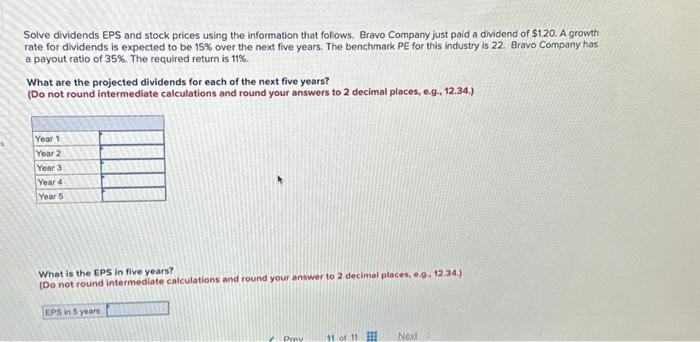

Question: Solve dividends EPS and stock prices using the information that follows. Eravo Company just paid a dividend of $120. A growth rate for dividends is

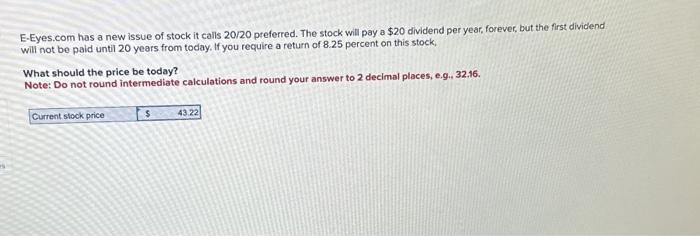

Solve dividends EPS and stock prices using the information that follows. Eravo Company just paid a dividend of $120. A growth rate for dividends is expected to be 15% over the next five years. The benchmark PE for this industry is 22 . Bravo Company has a payout ratio of 35%. The required return is 11%. What are the projected dividends for each of the next five years? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 12.34.) What is the EPS in five years? (Do not round intermediate calculations and round your answer to 2 decimal ploces, e.9., 12.34.) E-Eyes.com has a new issue of stock it calls 20/20 preferred. The stock will pay a $20 dividend per year, forever, but the first dividend will not be paid until 20 years from today. If you require a return of 8.25 percent on this stock. What should the price be today? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts