Question: solve e2 part it's my second time posting same question On December 31, 2019, Clean and White Linen Supplies Ltd. had the following account balances:

solve e2 part it's my second time posting same question

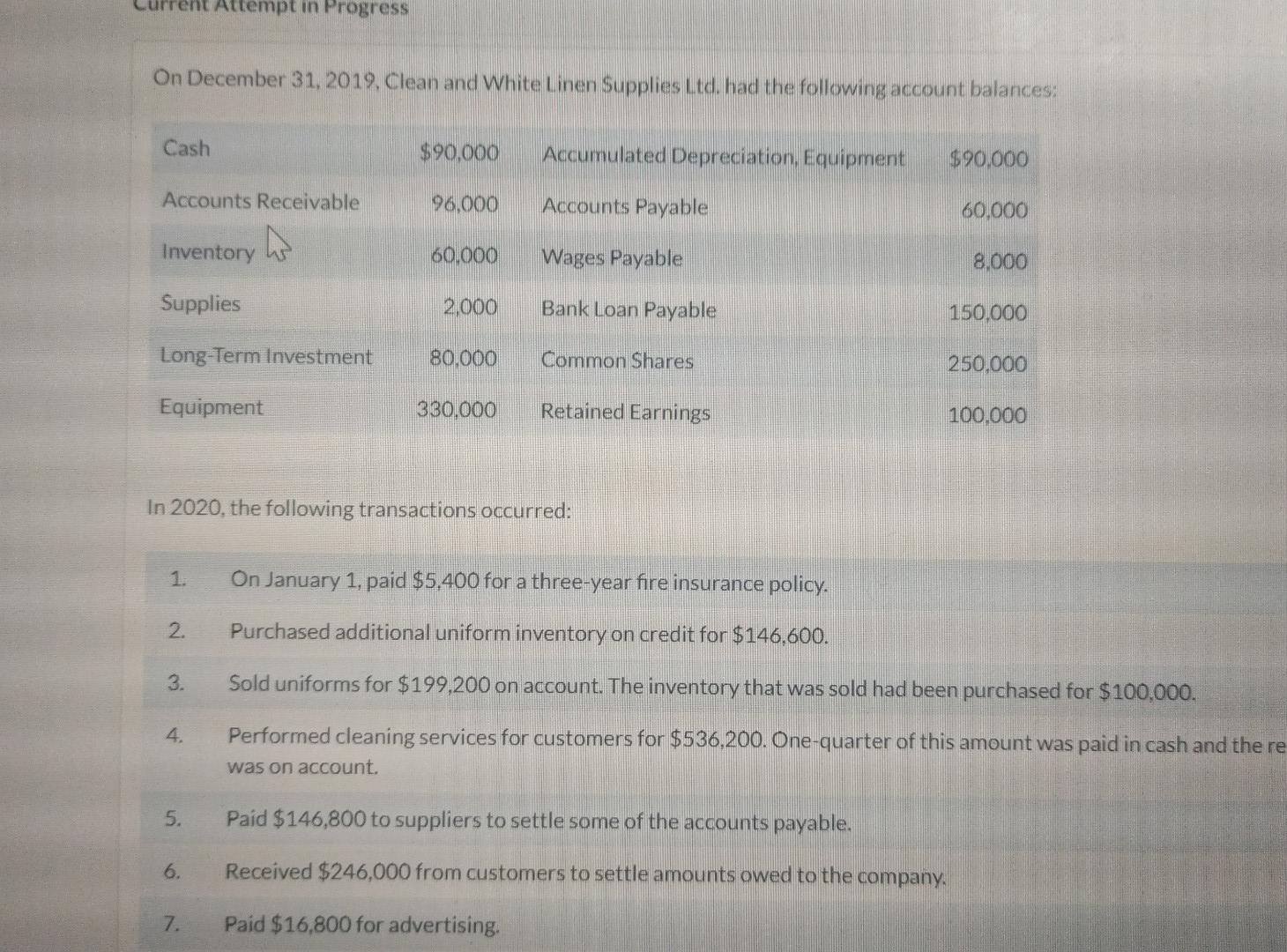

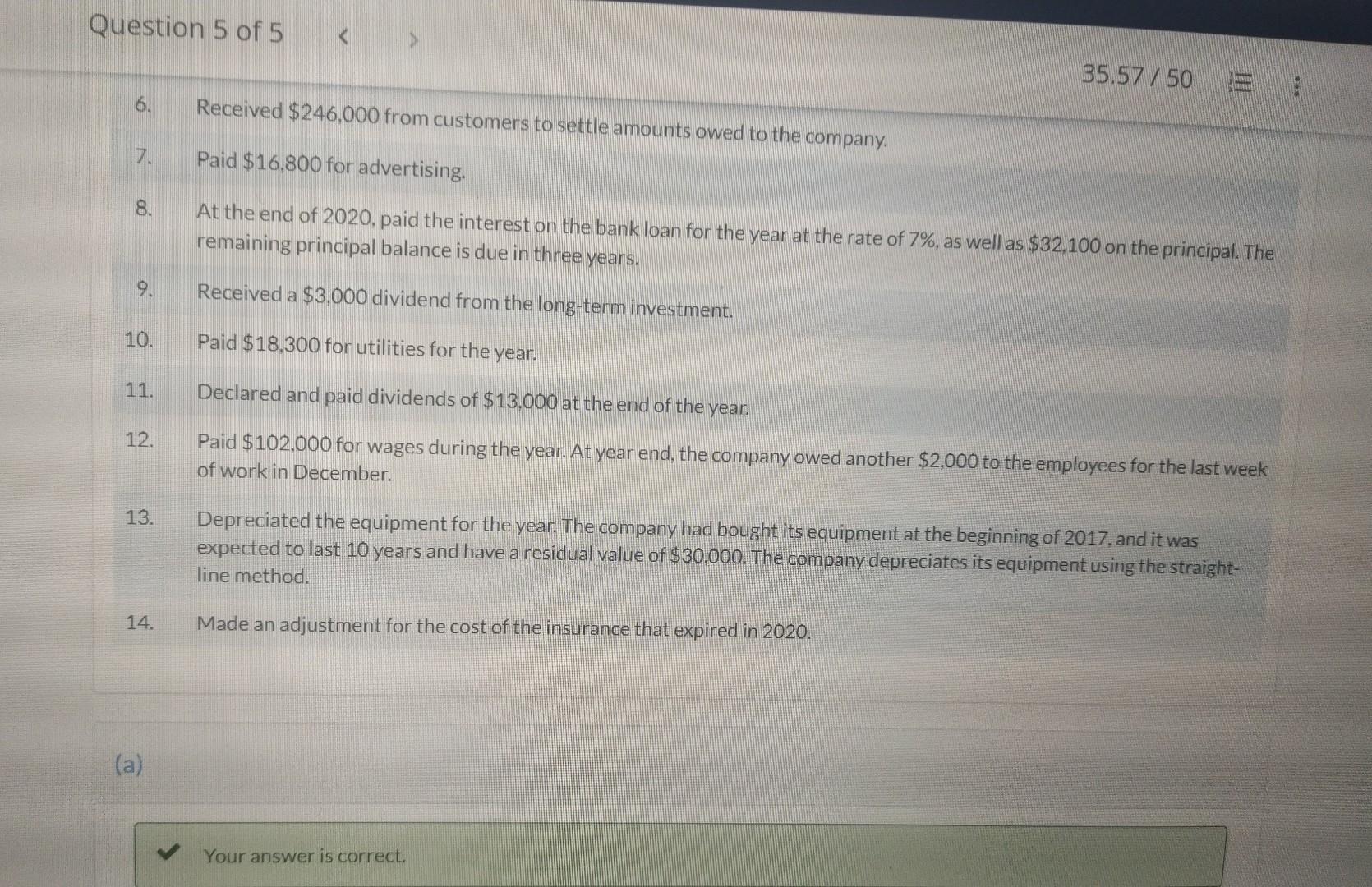

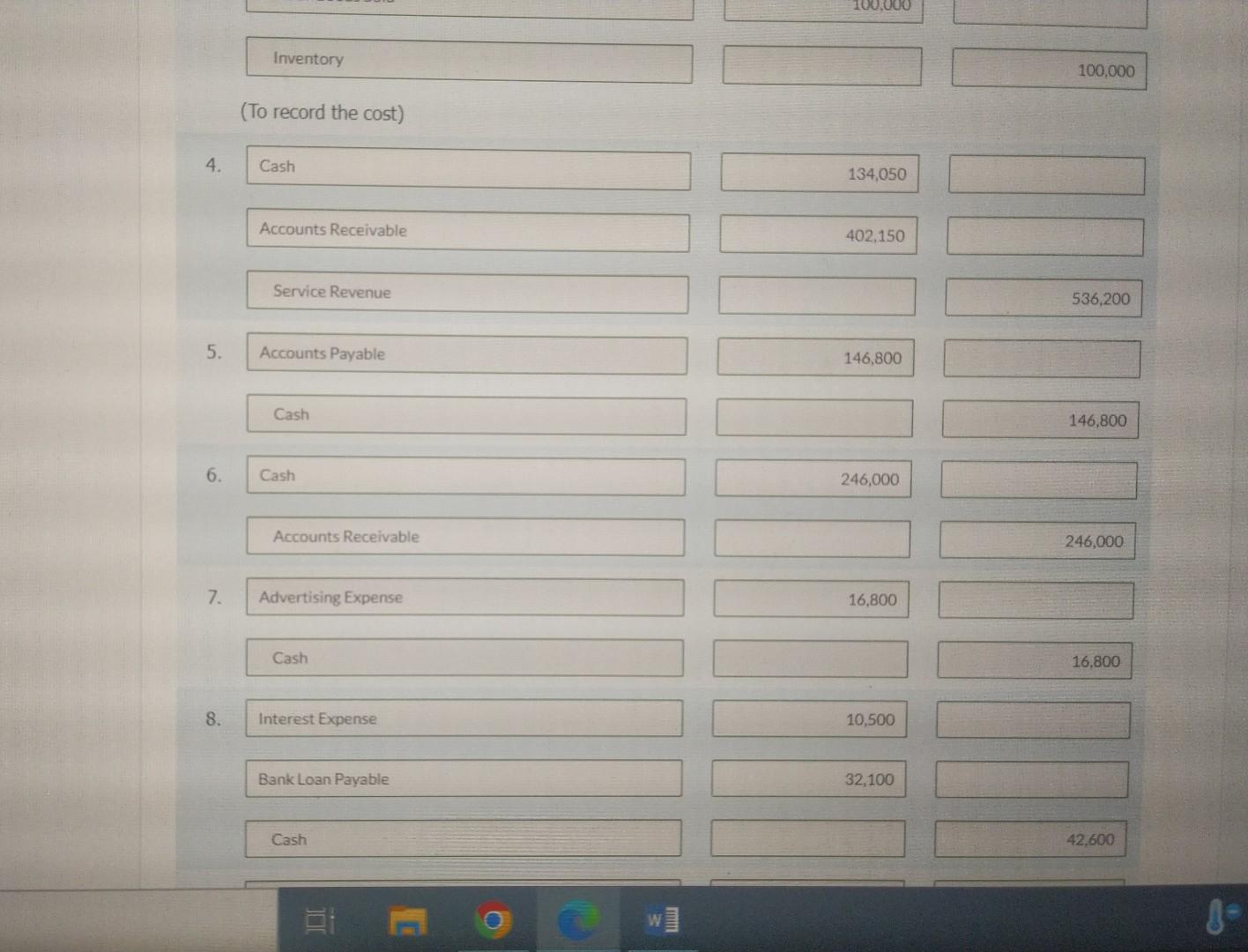

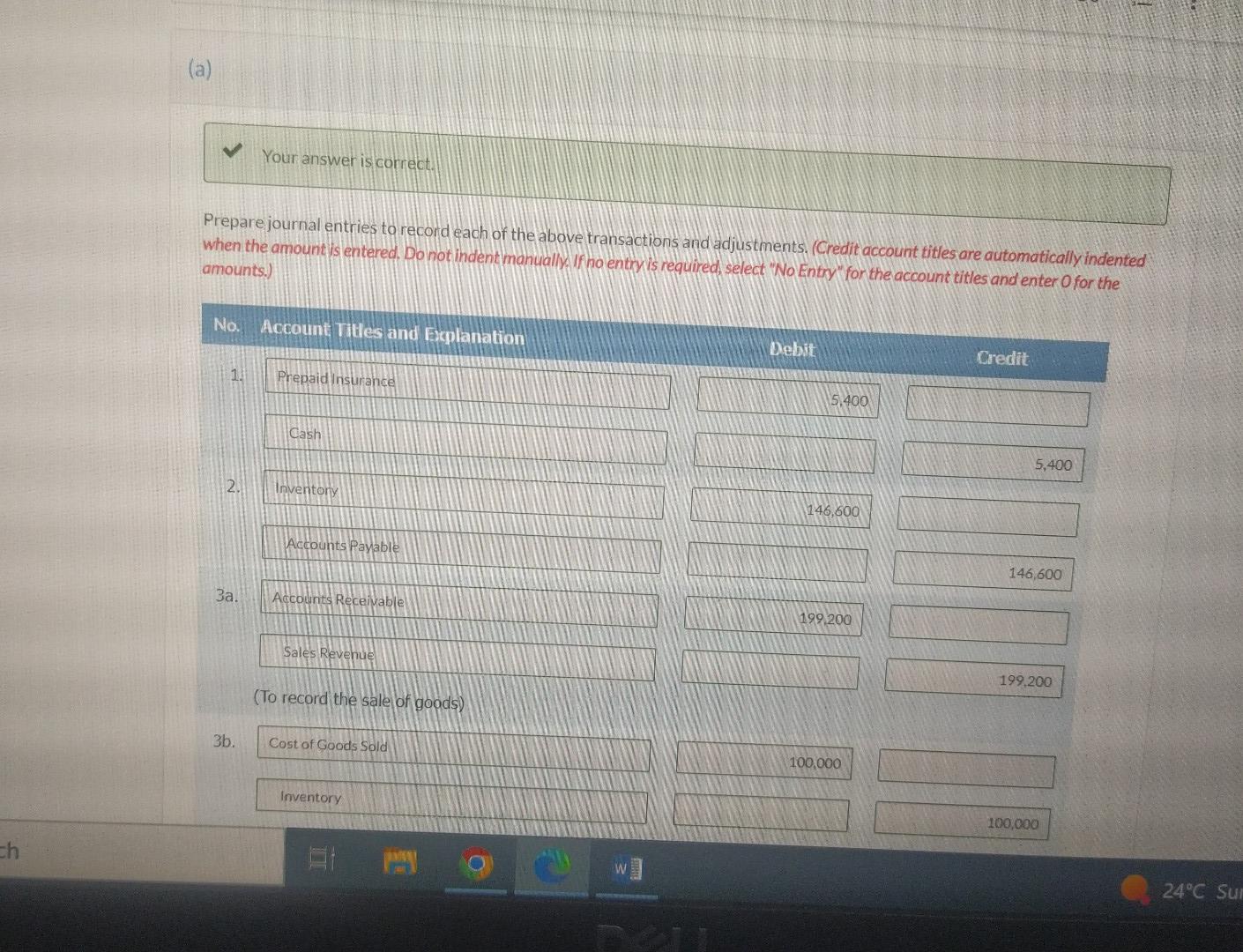

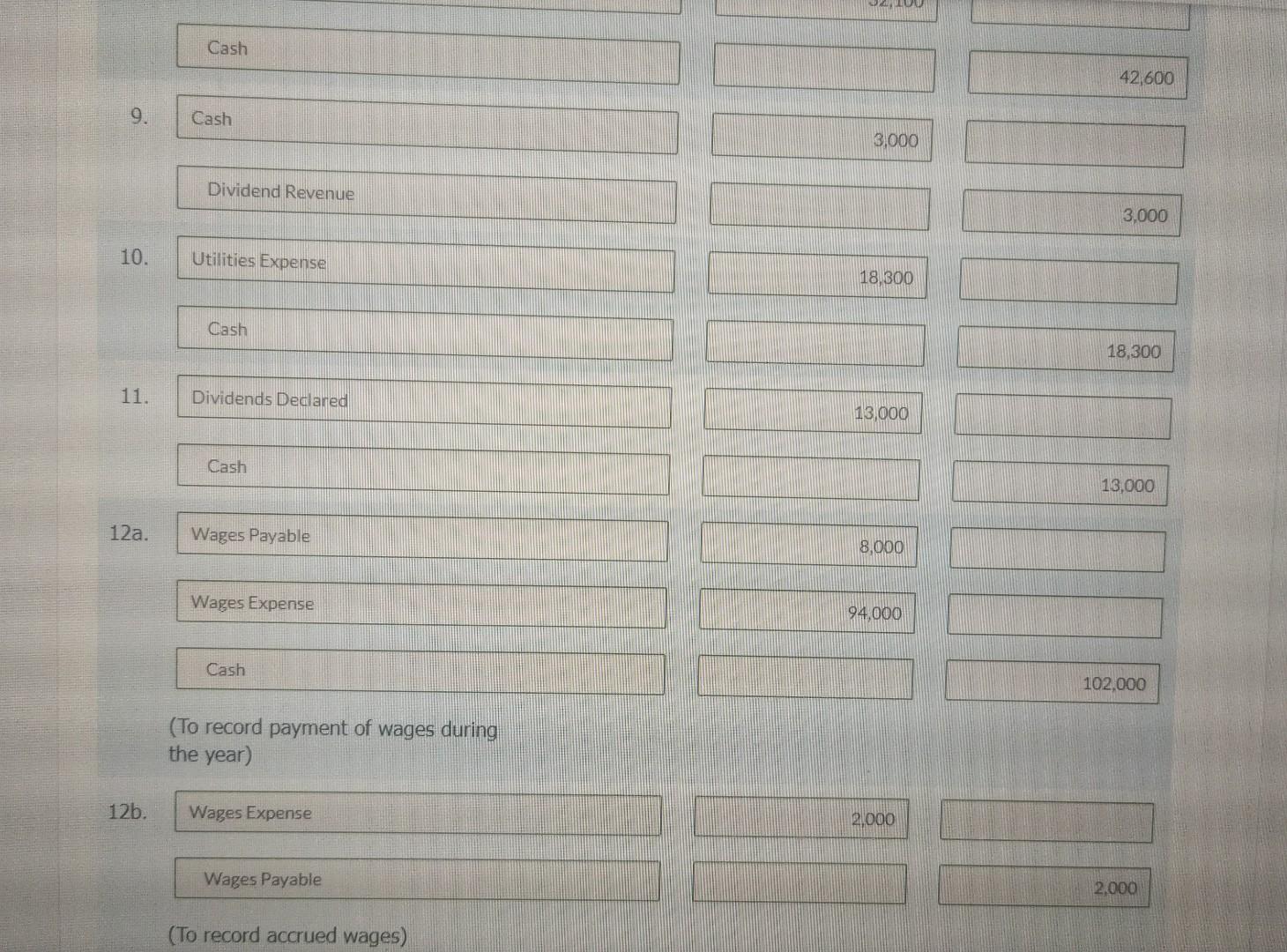

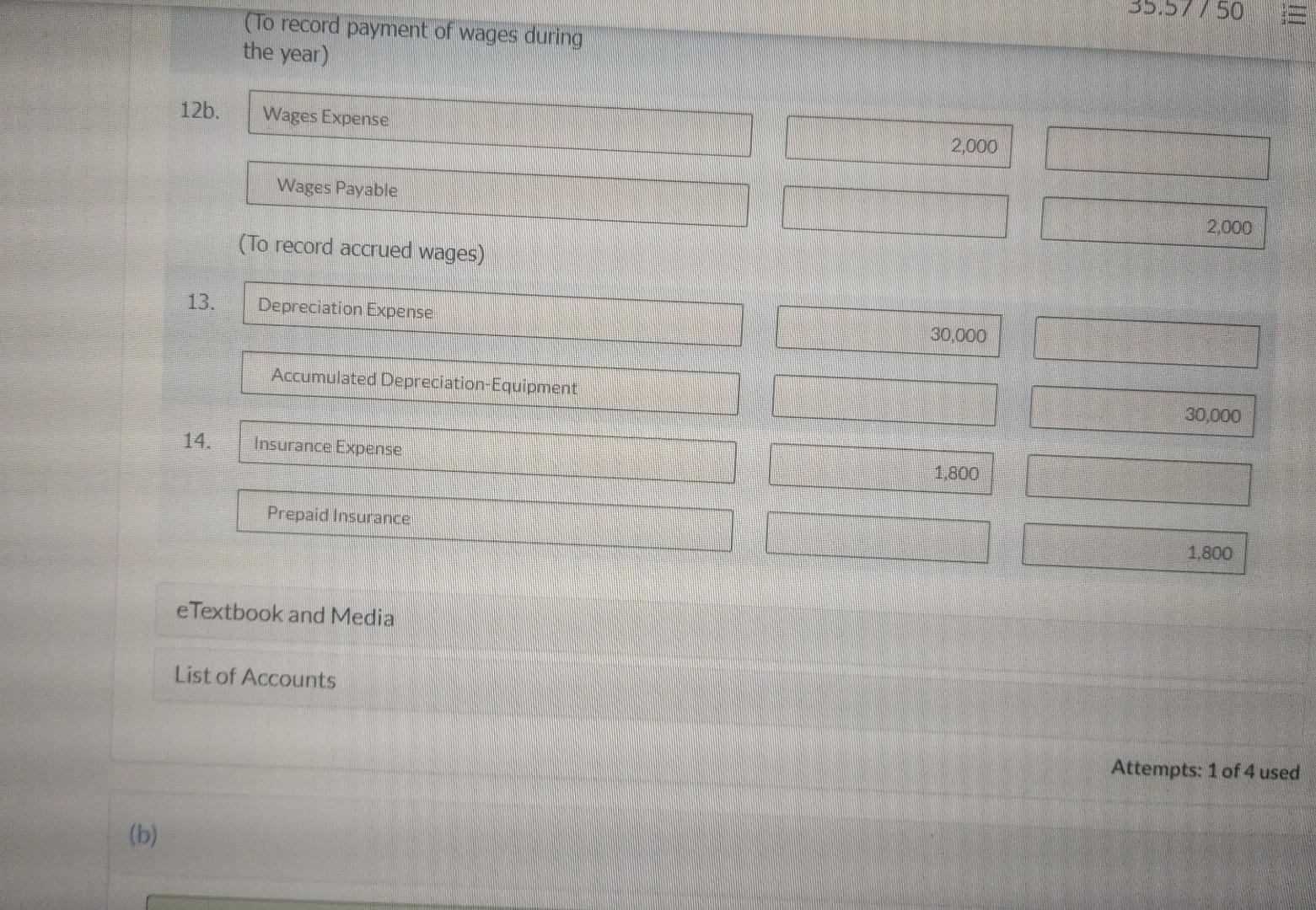

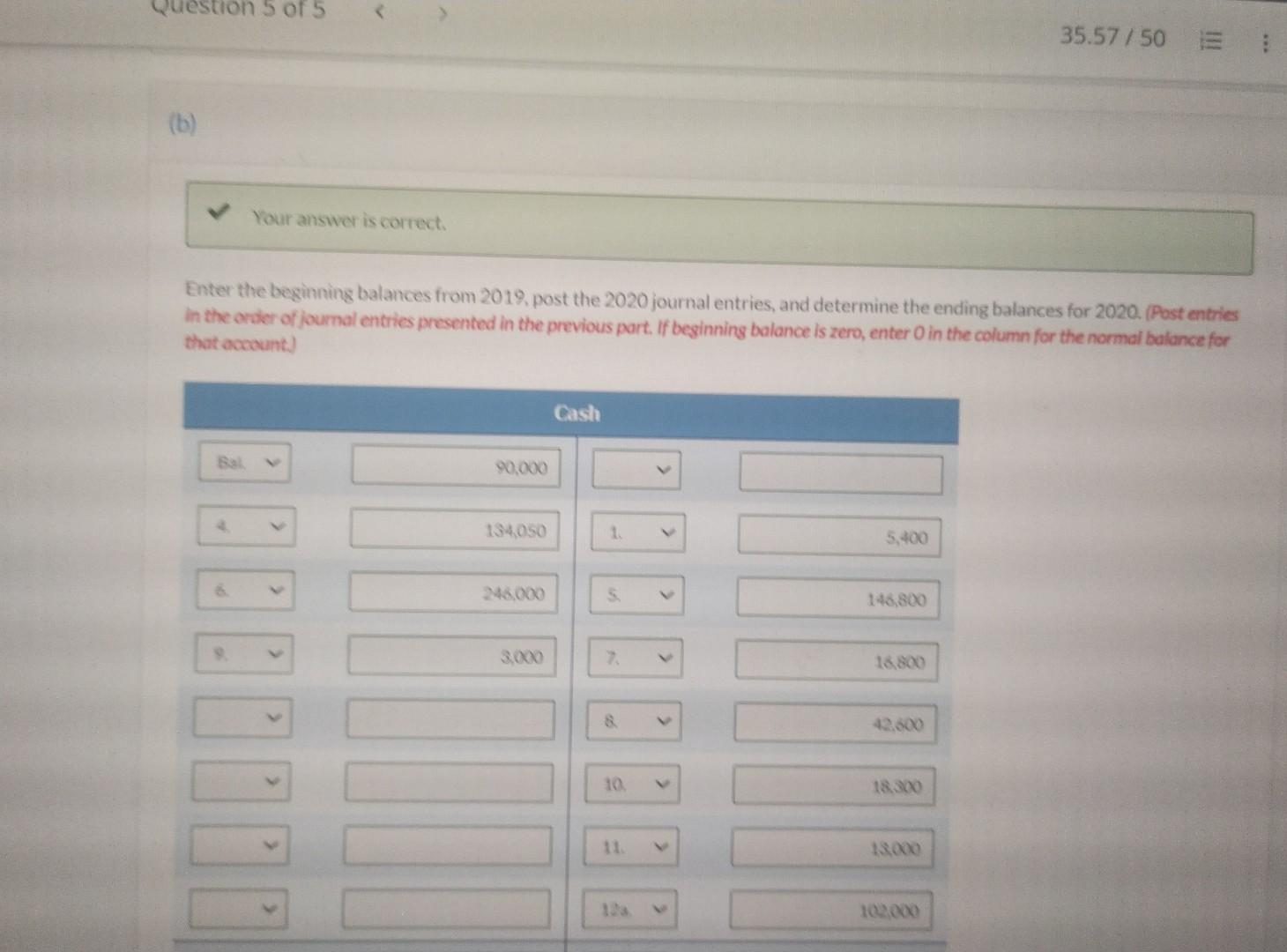

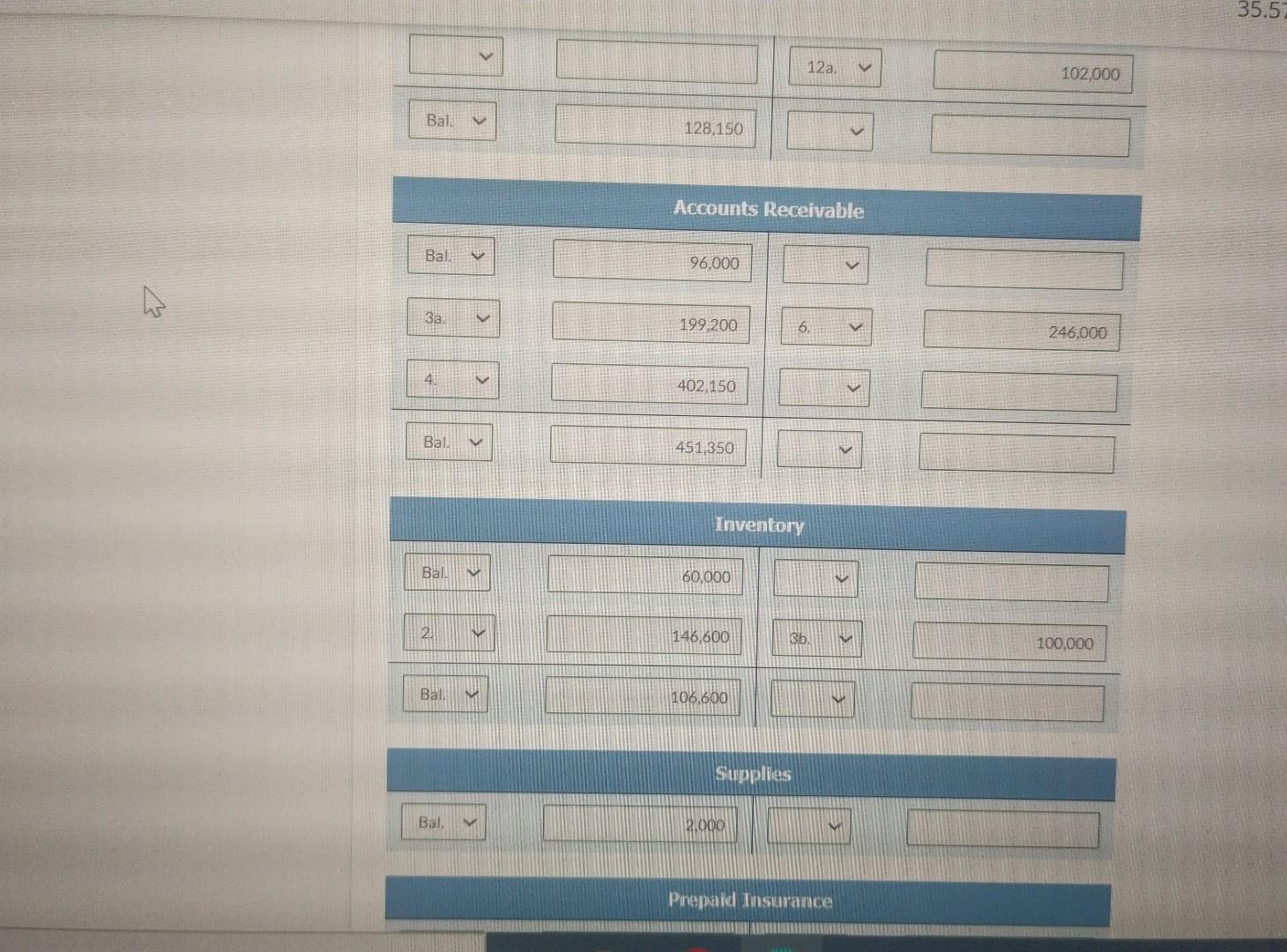

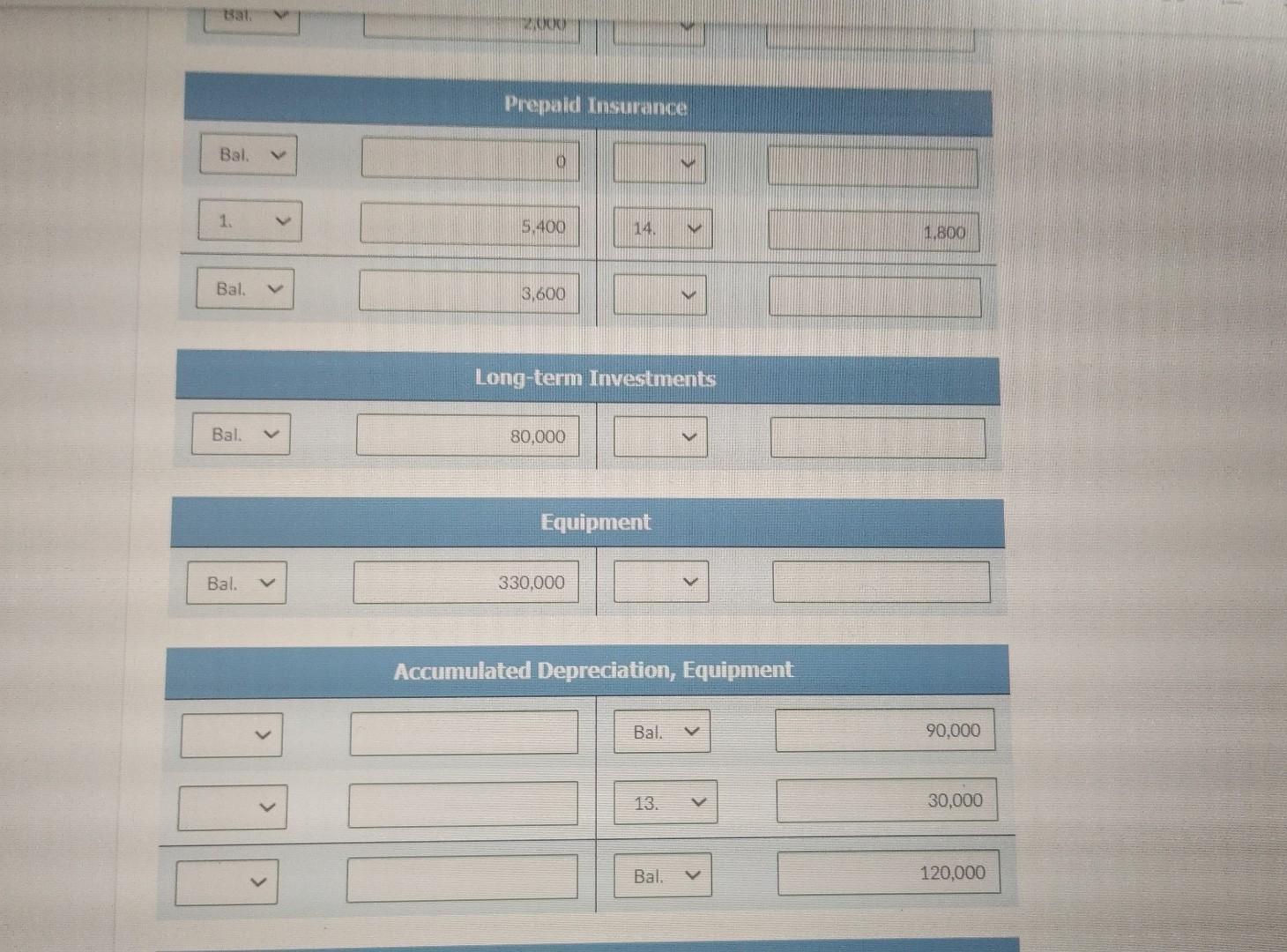

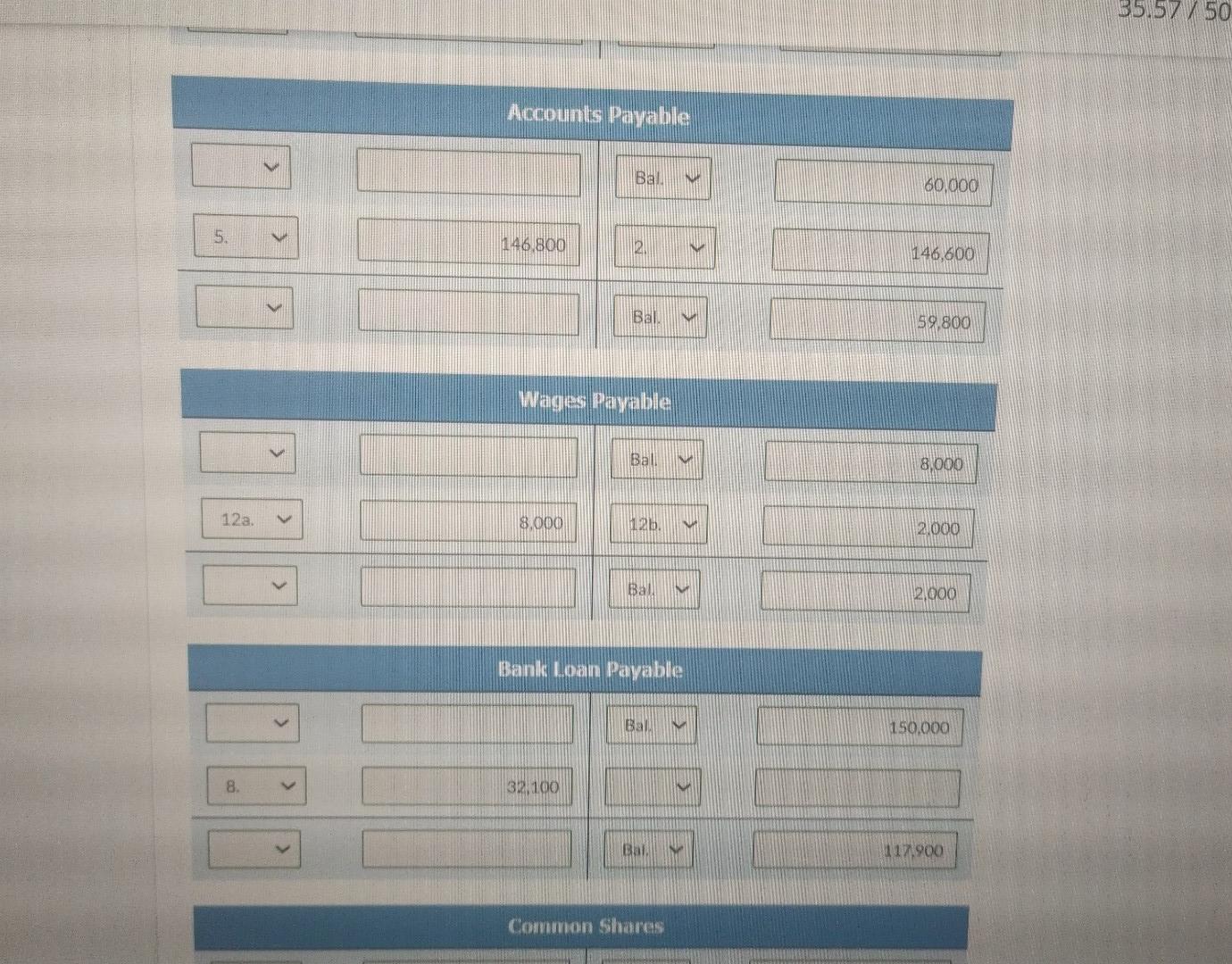

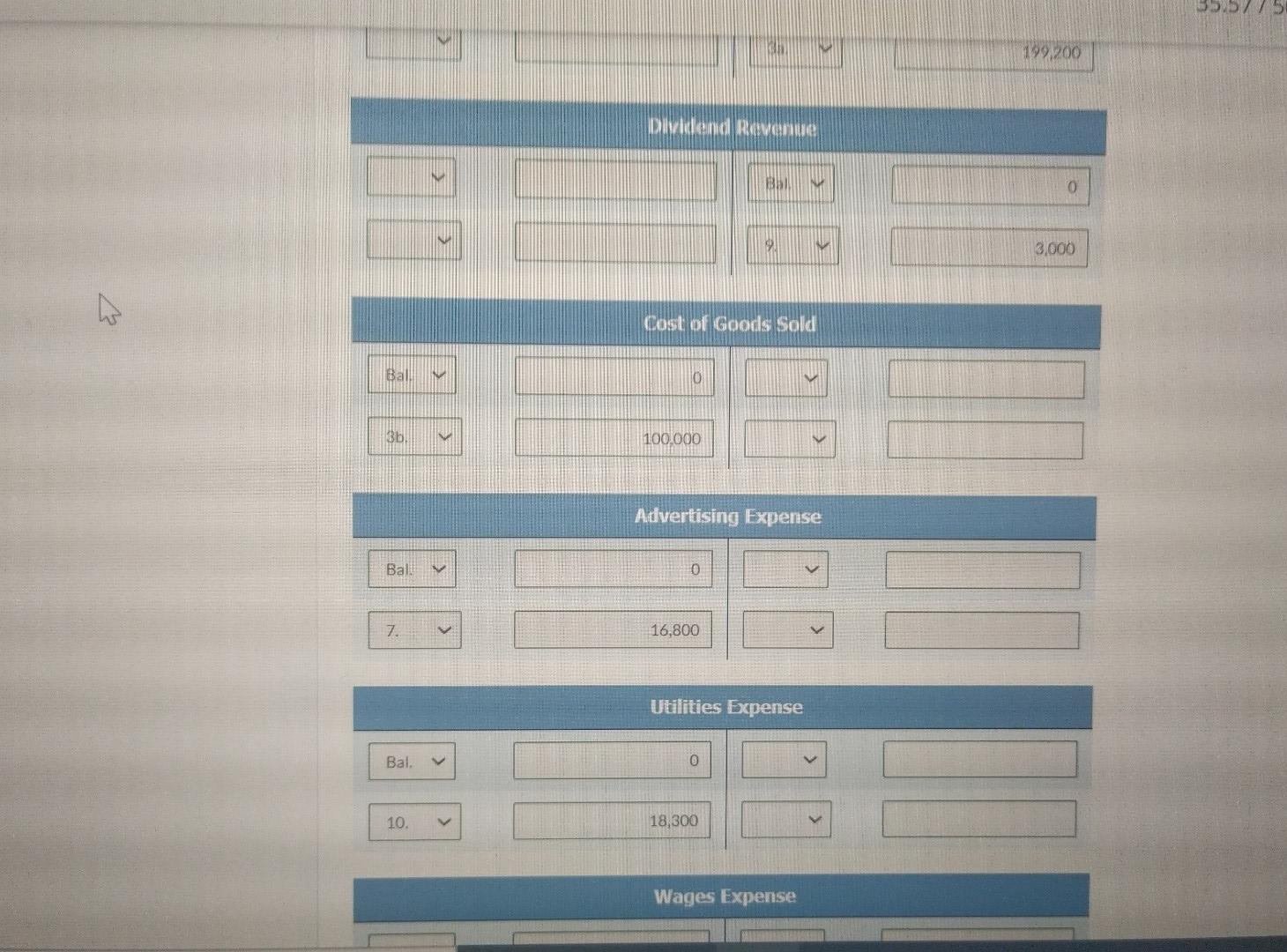

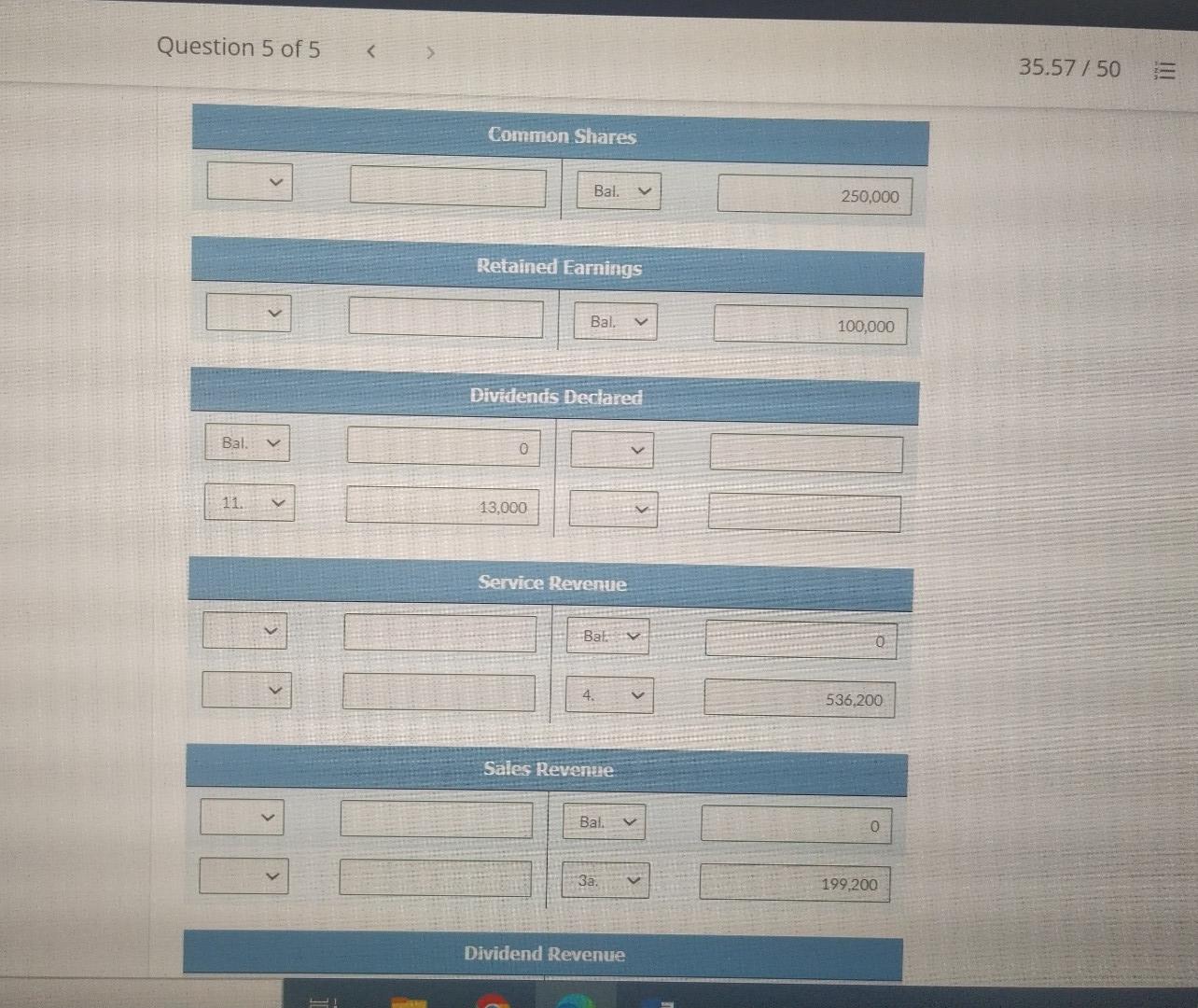

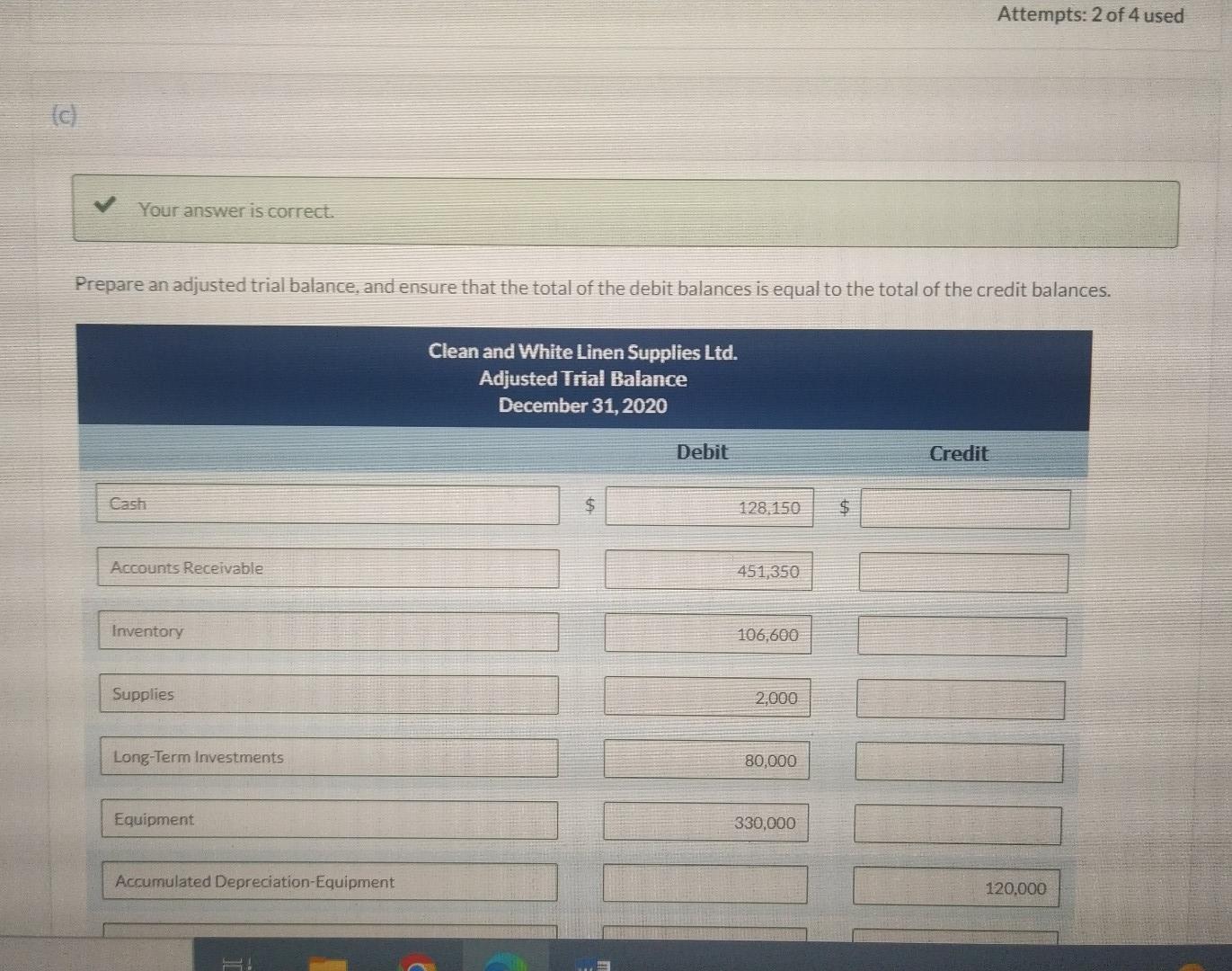

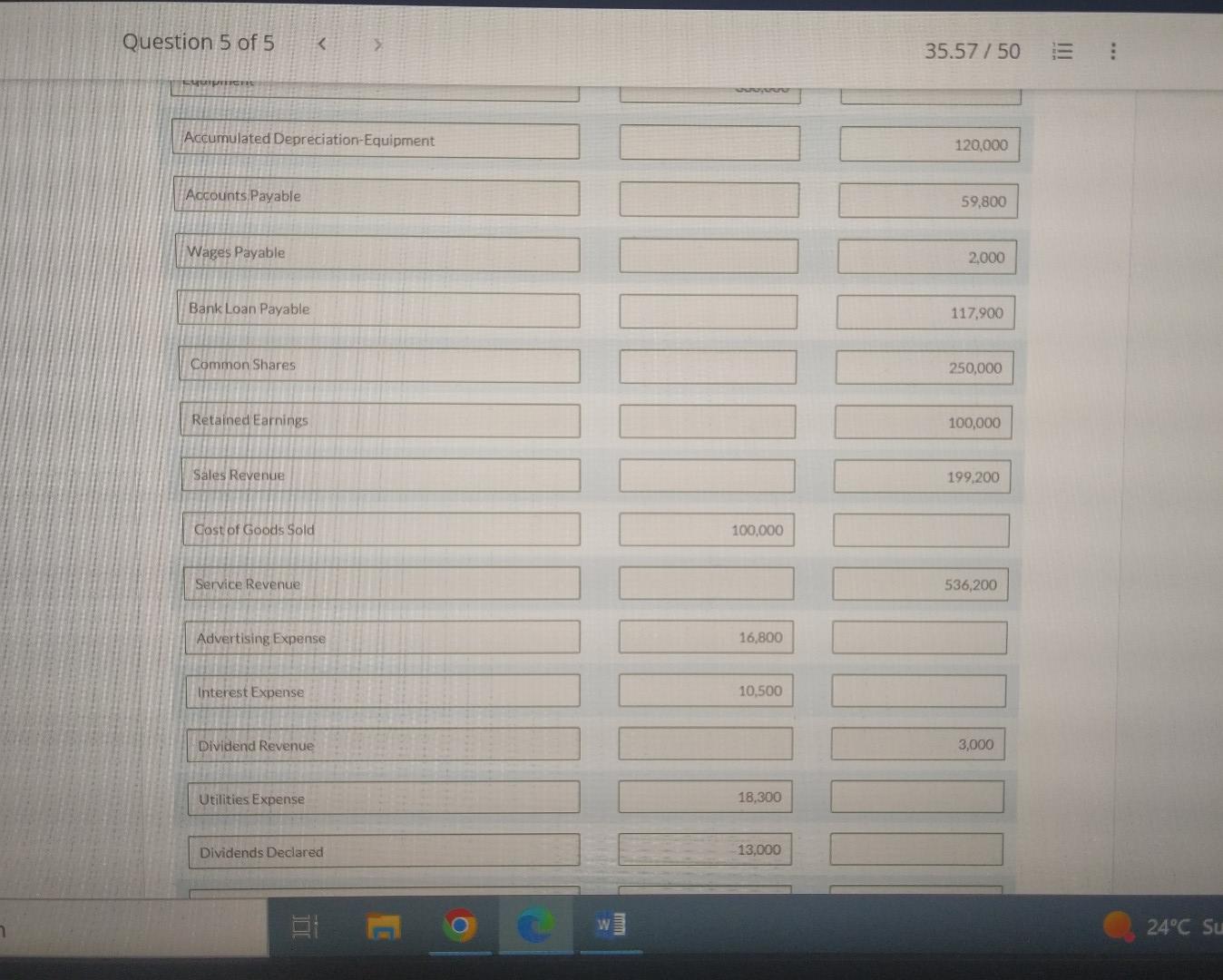

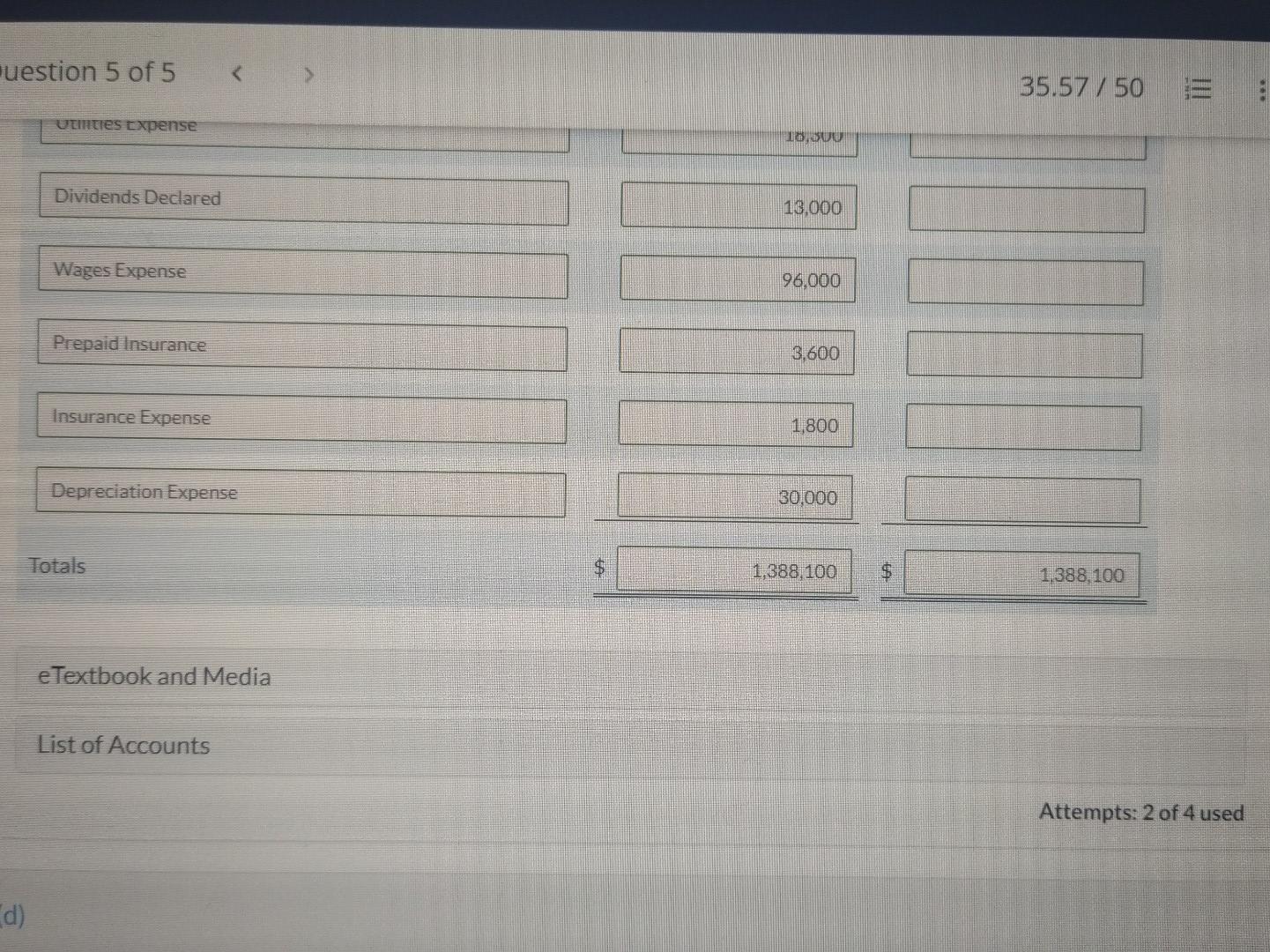

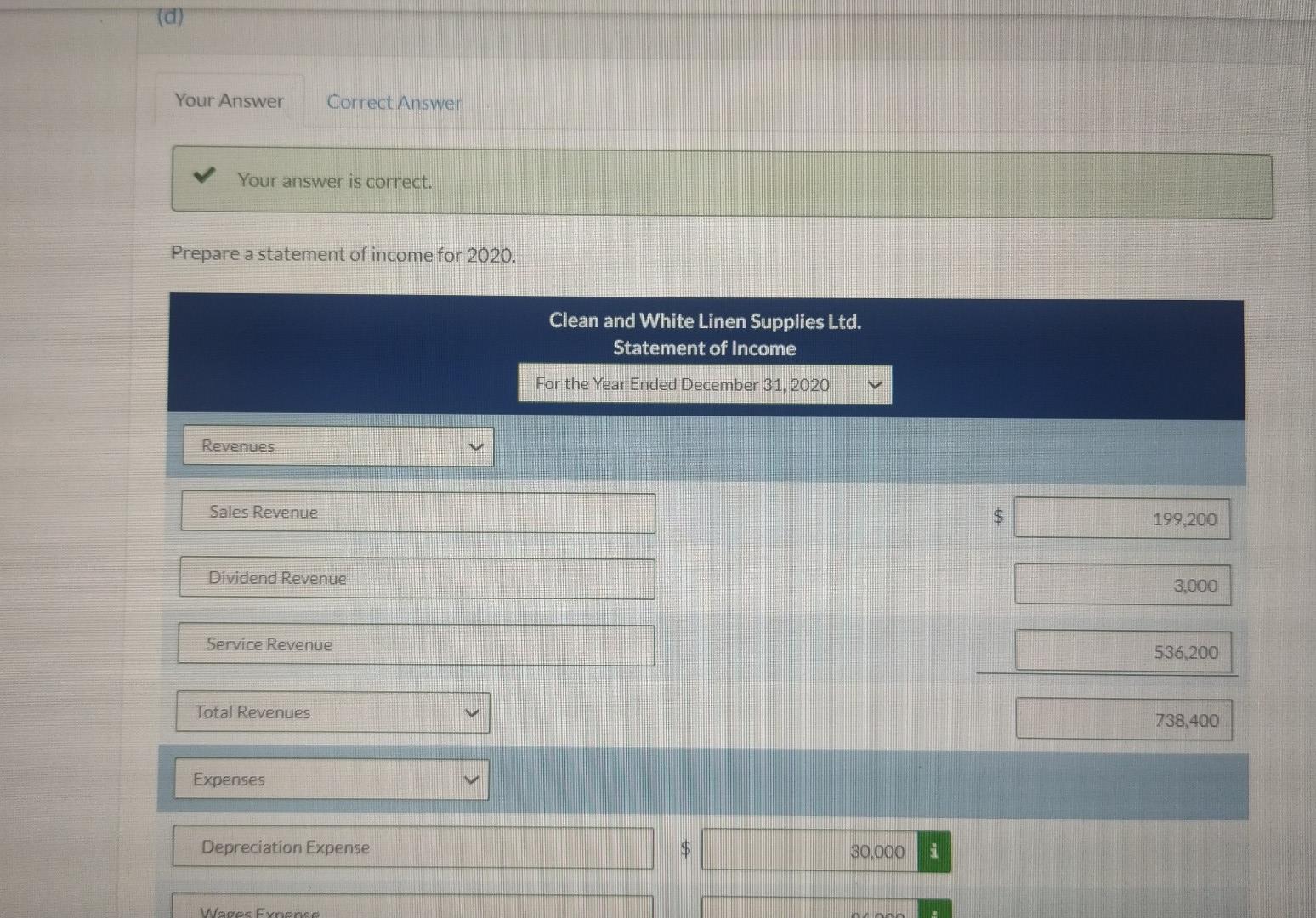

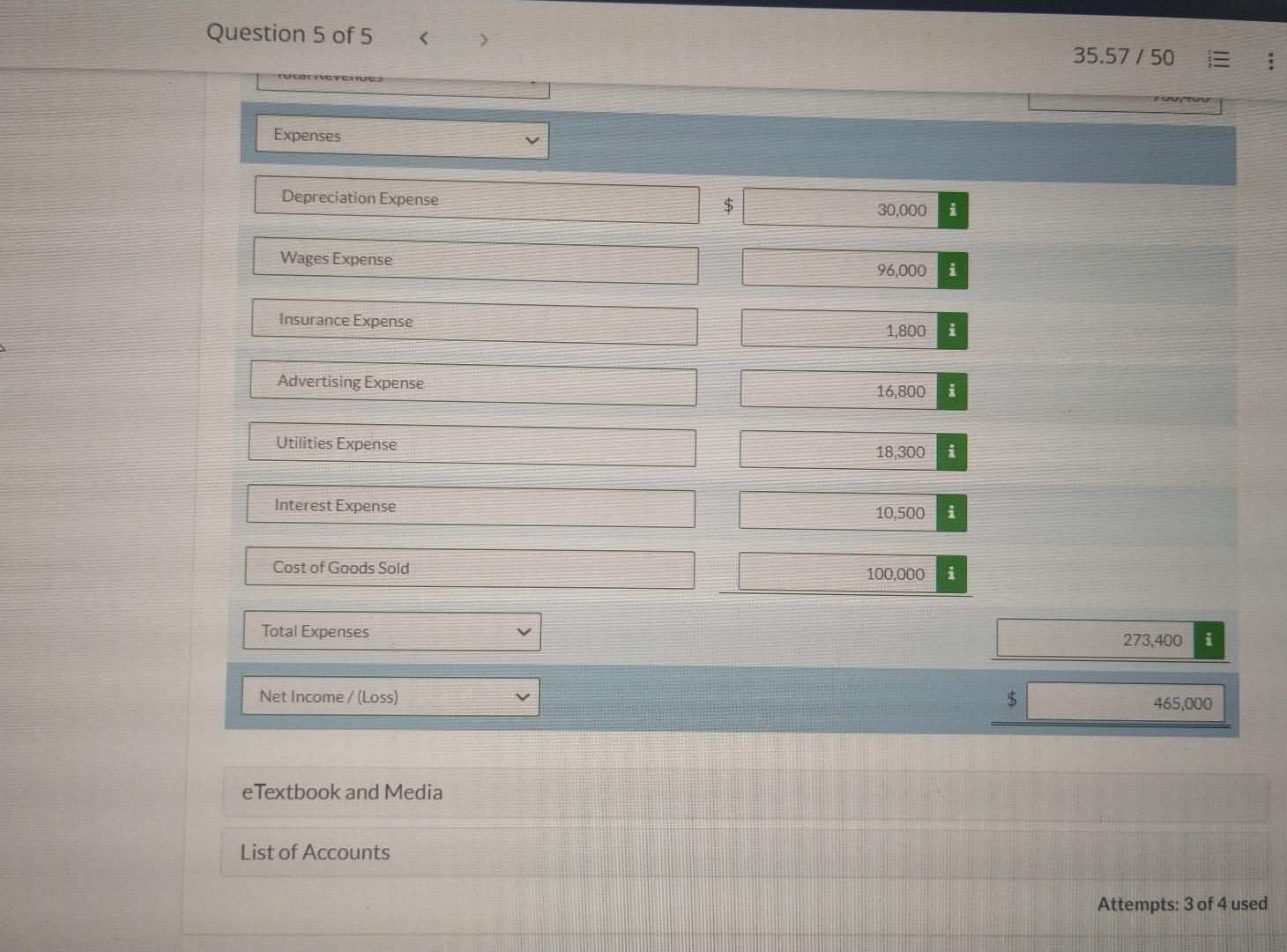

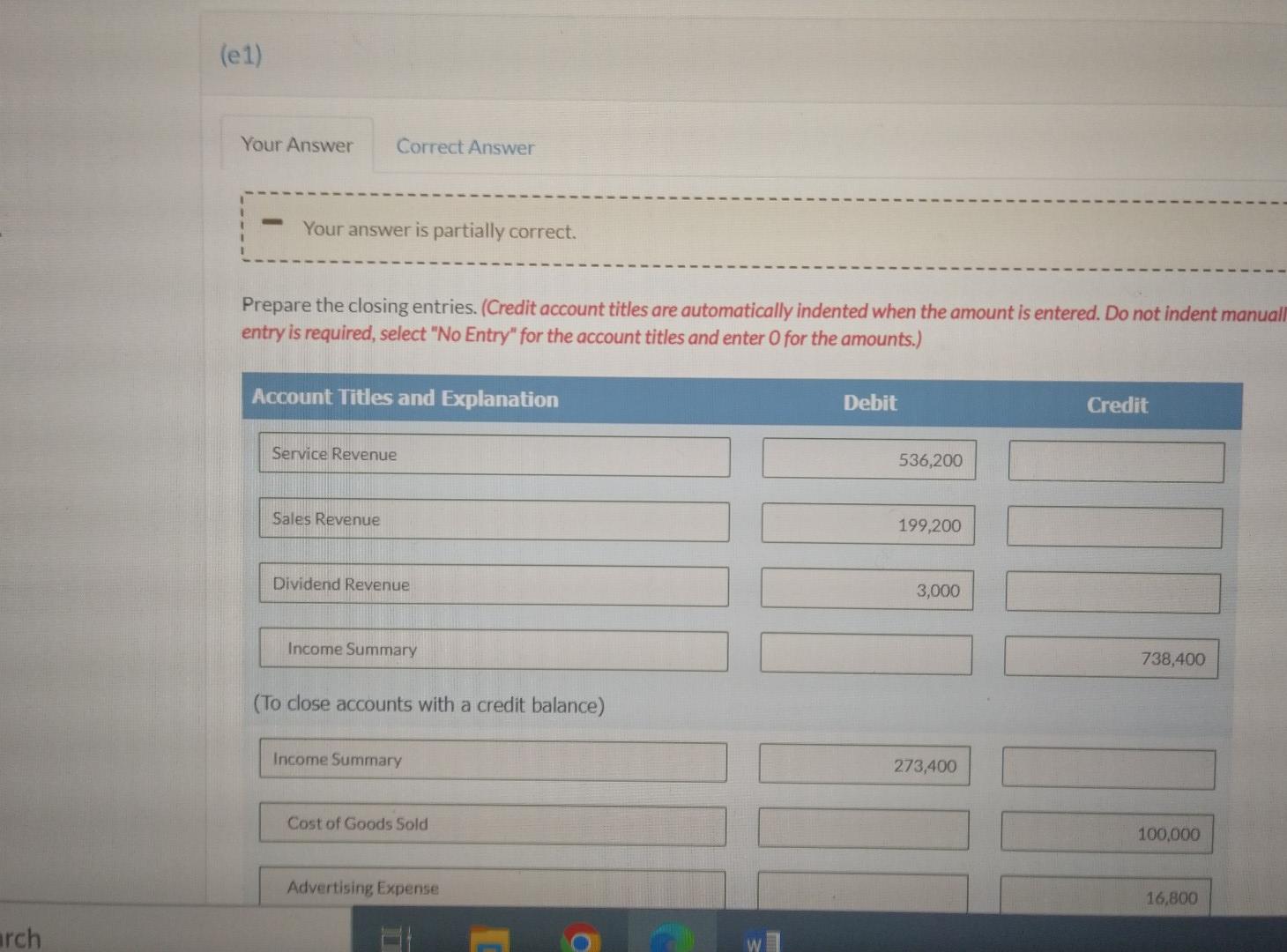

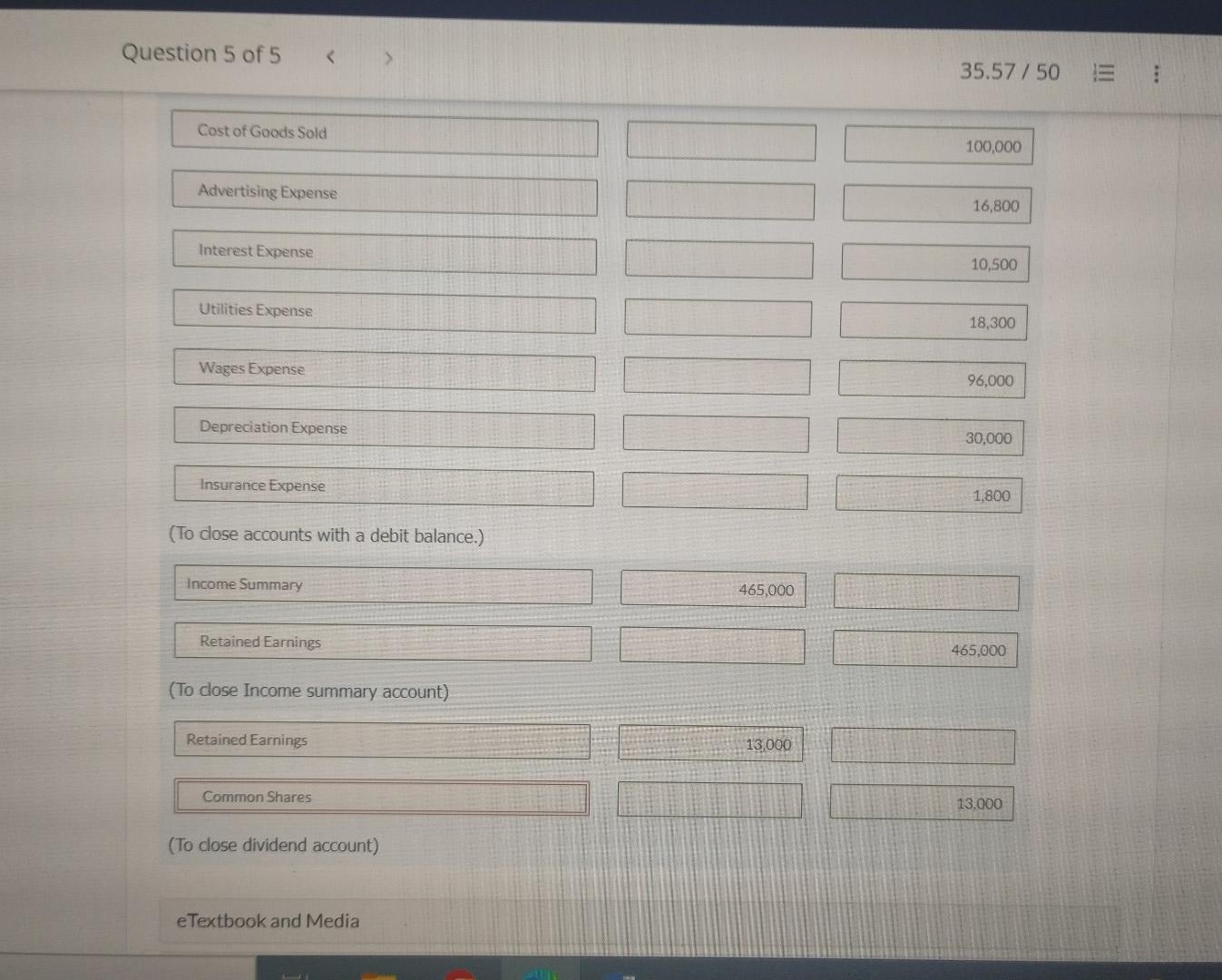

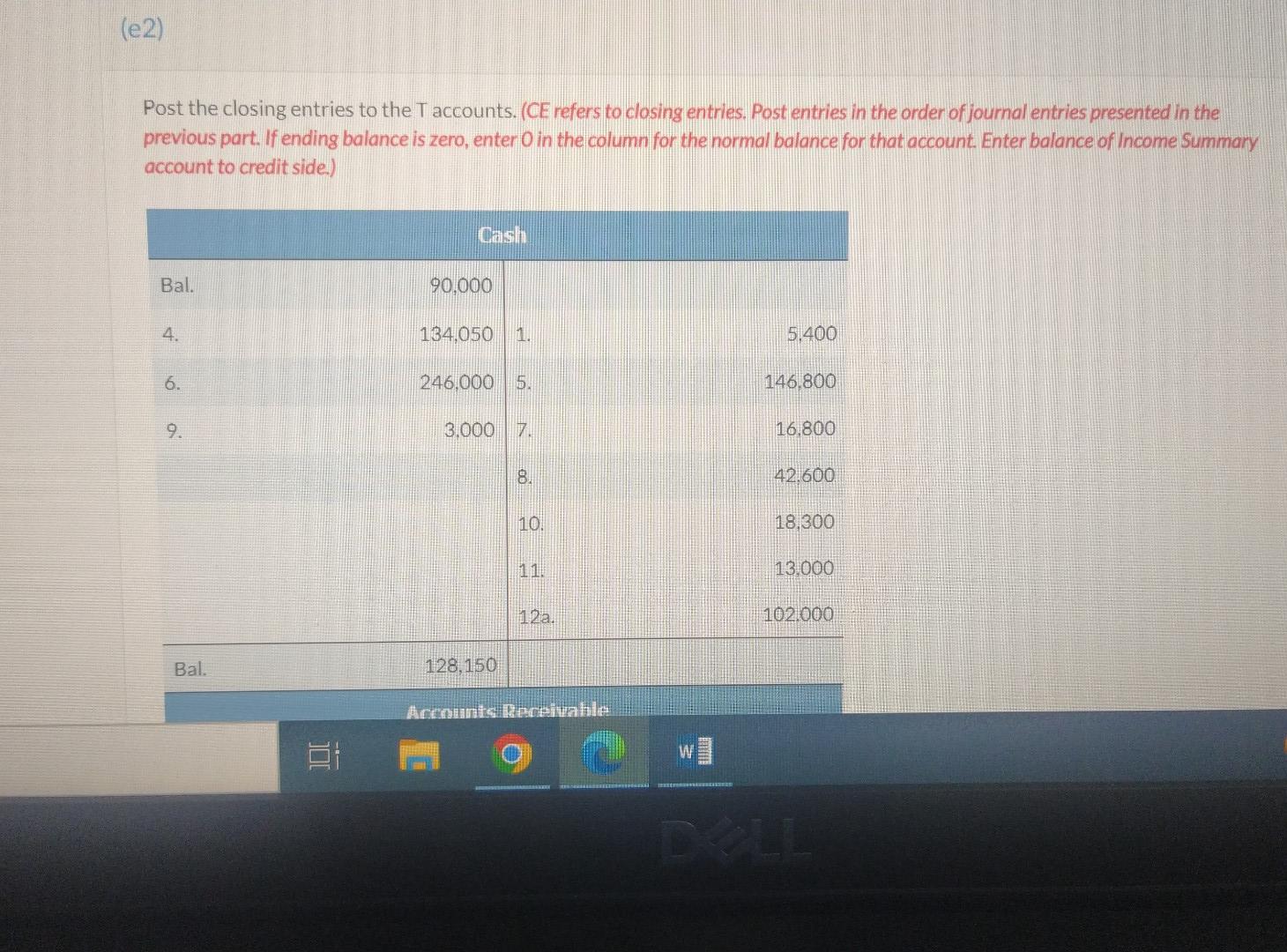

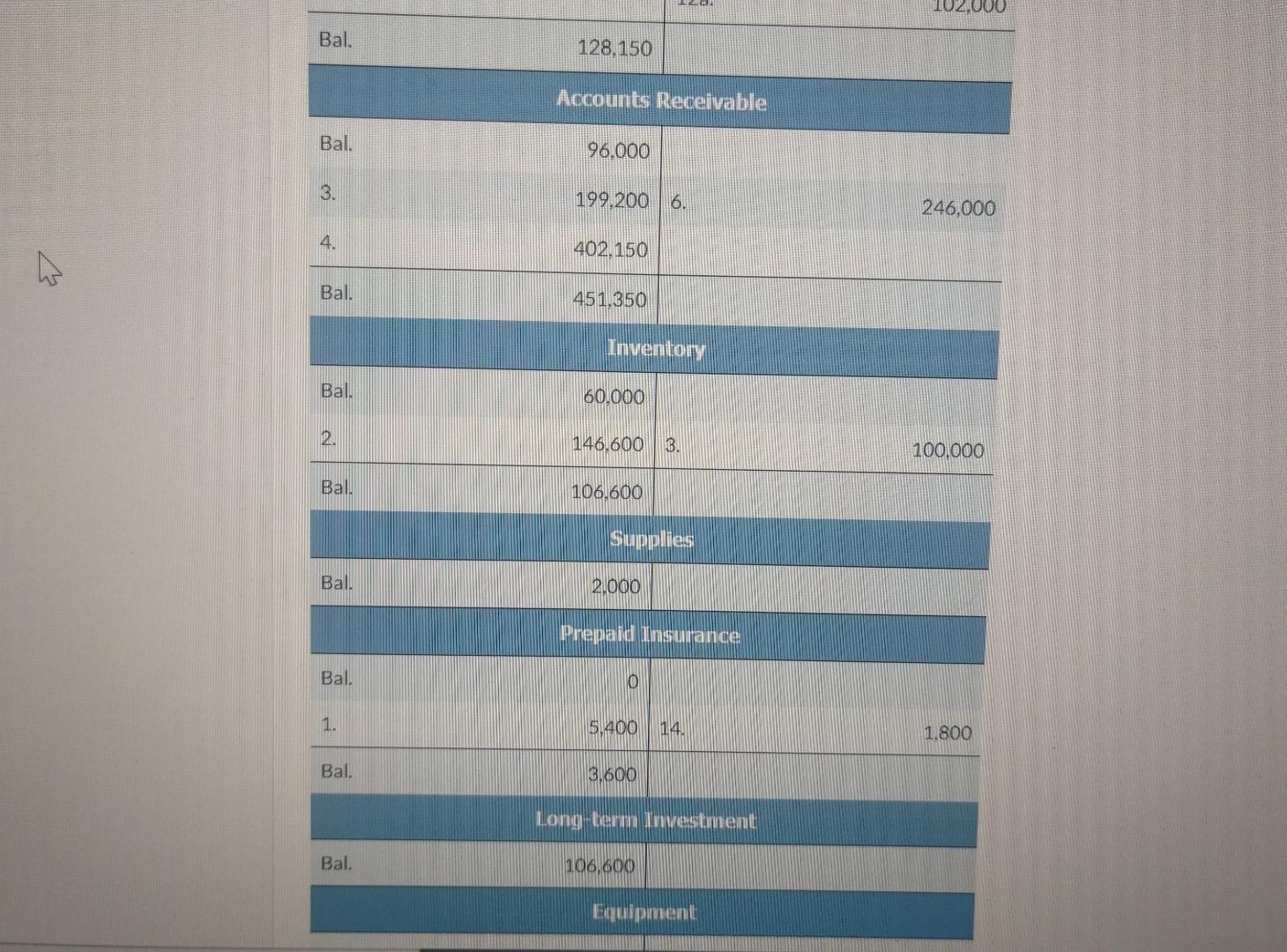

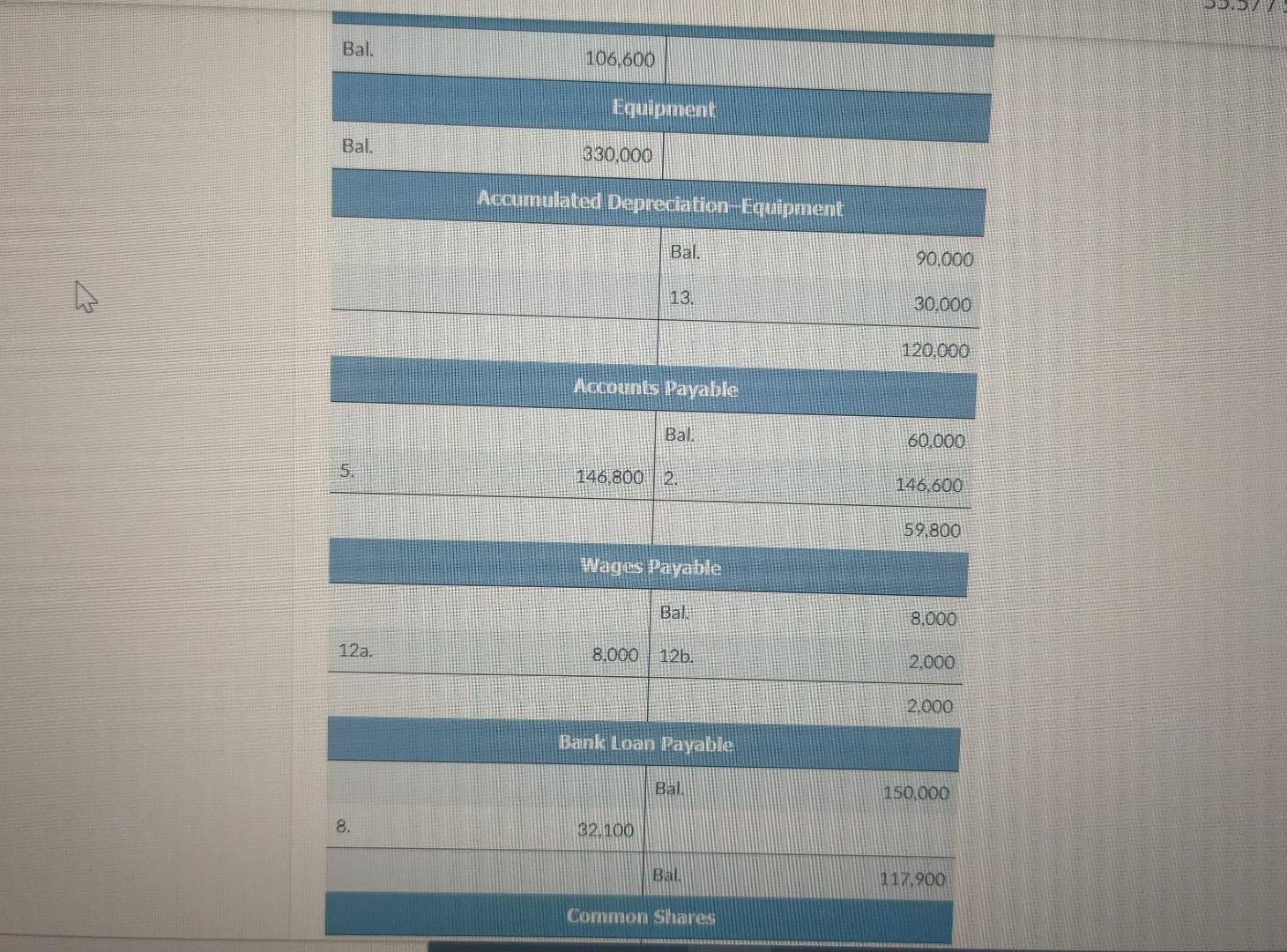

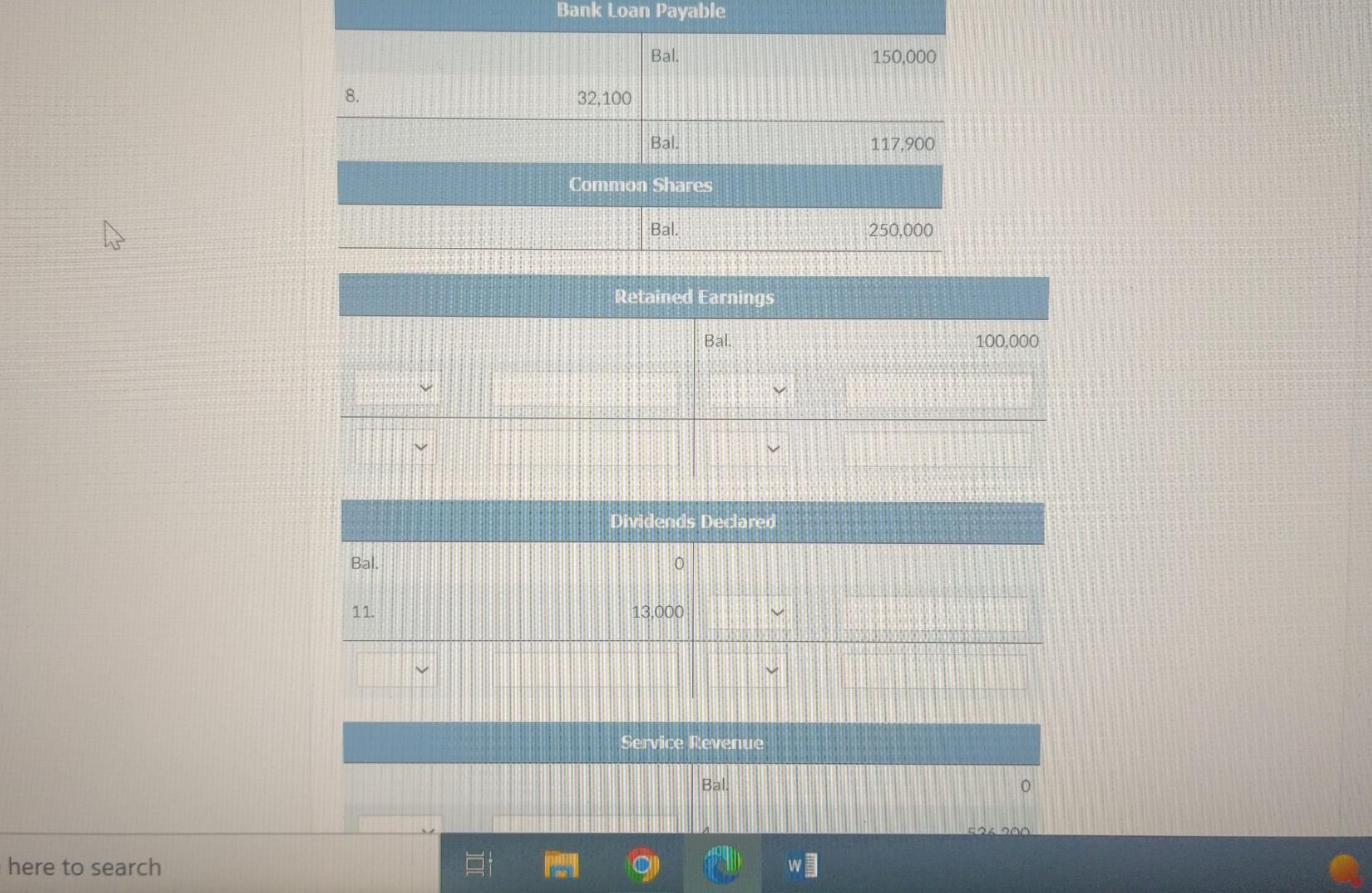

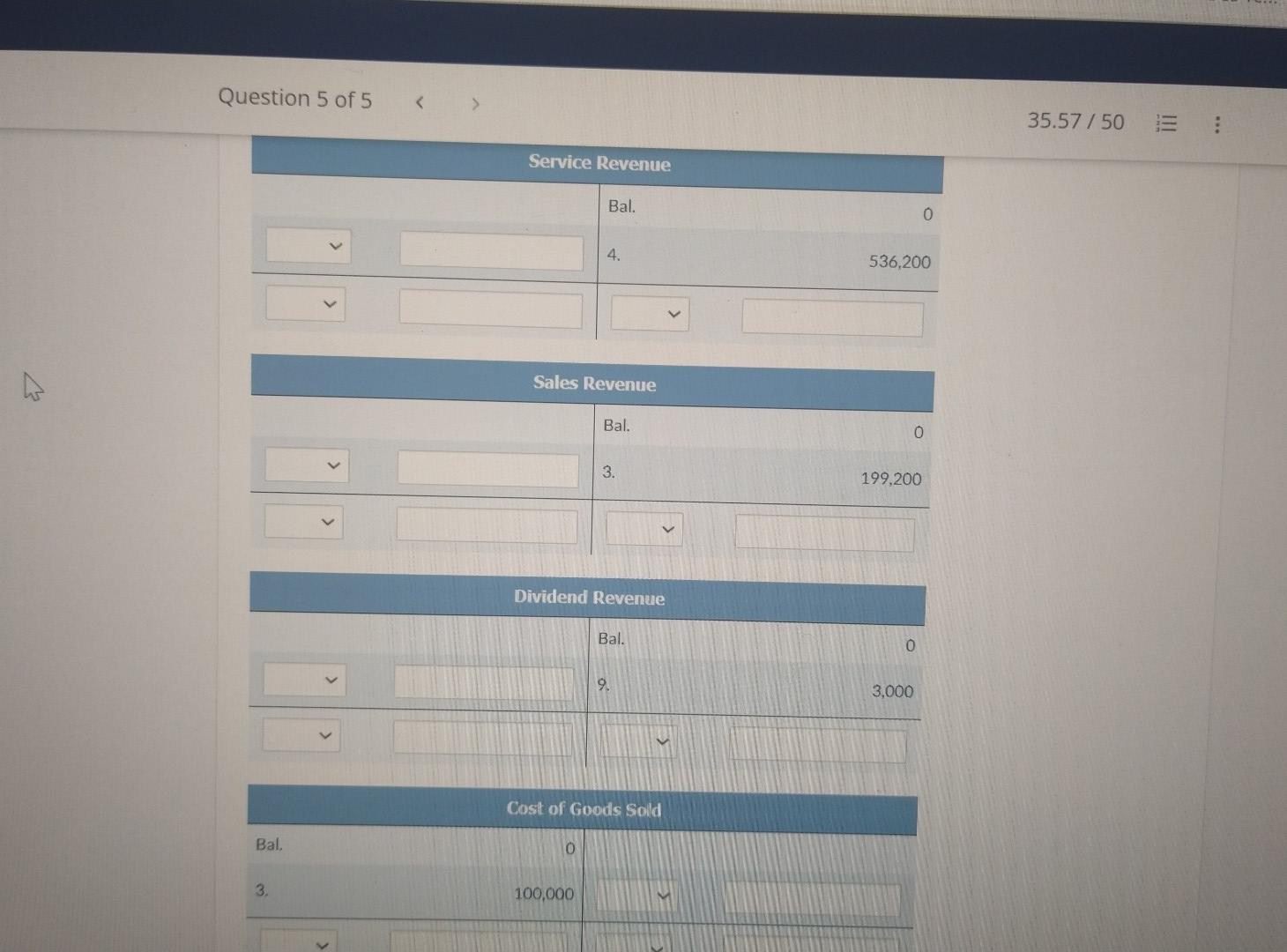

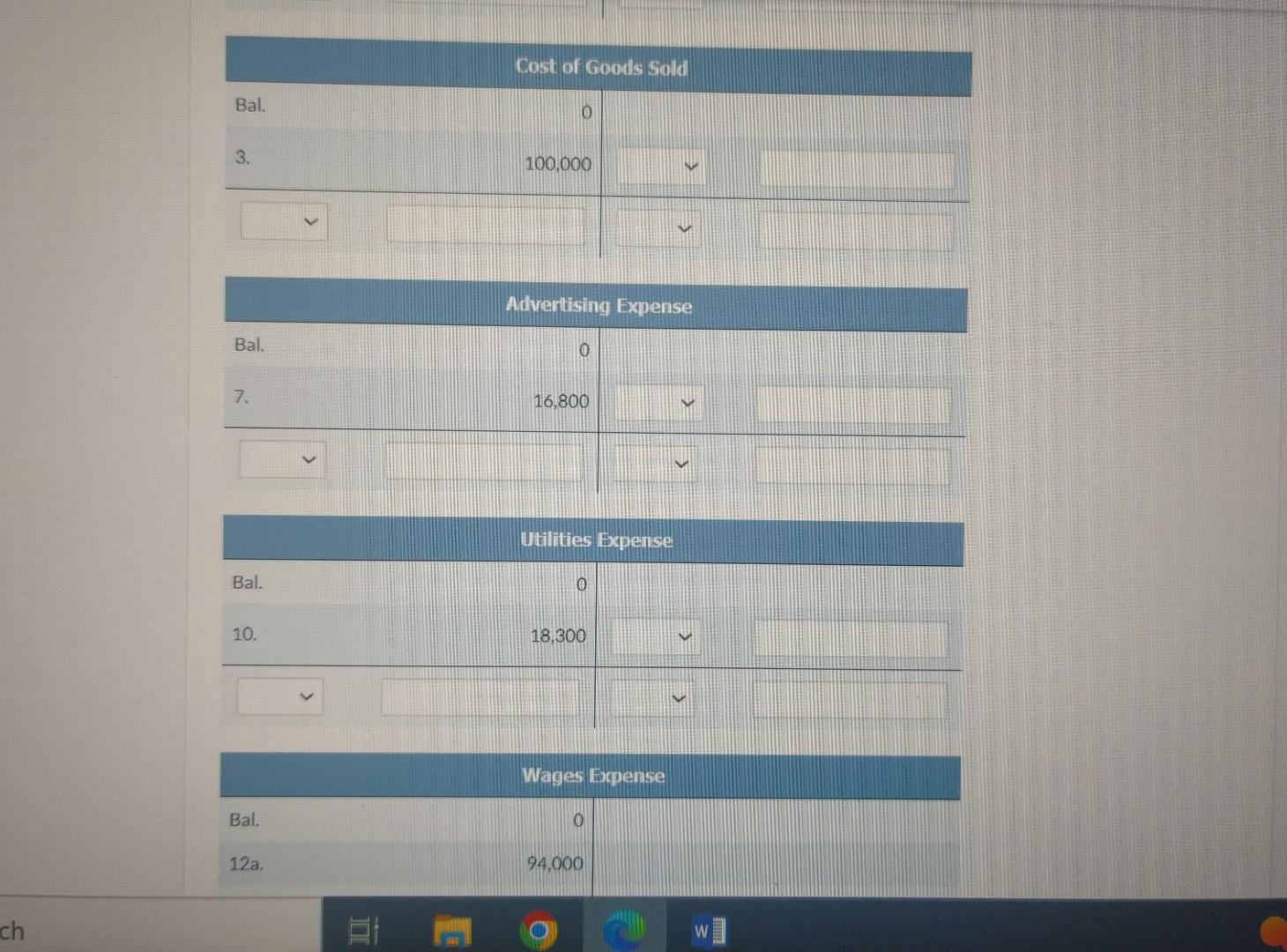

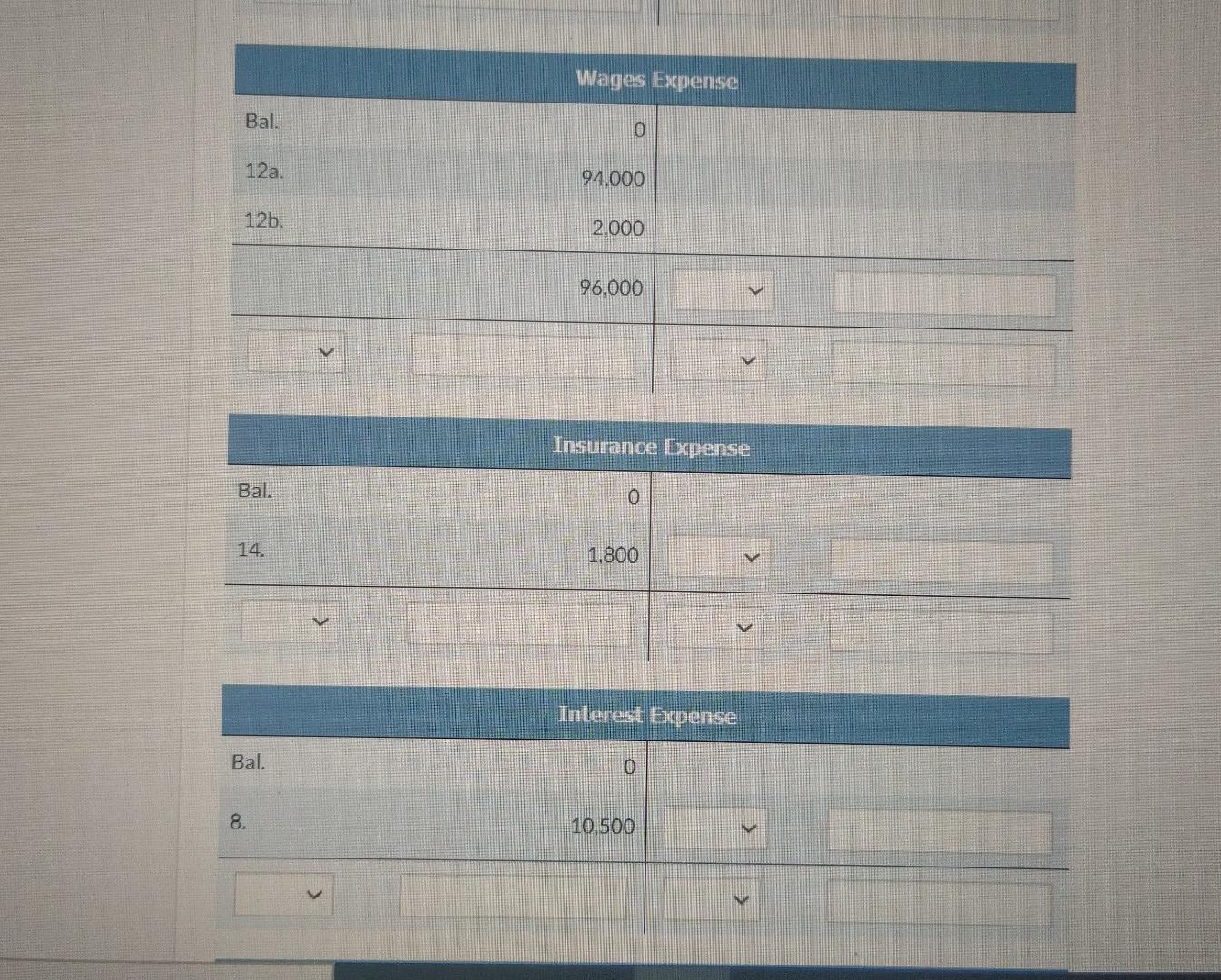

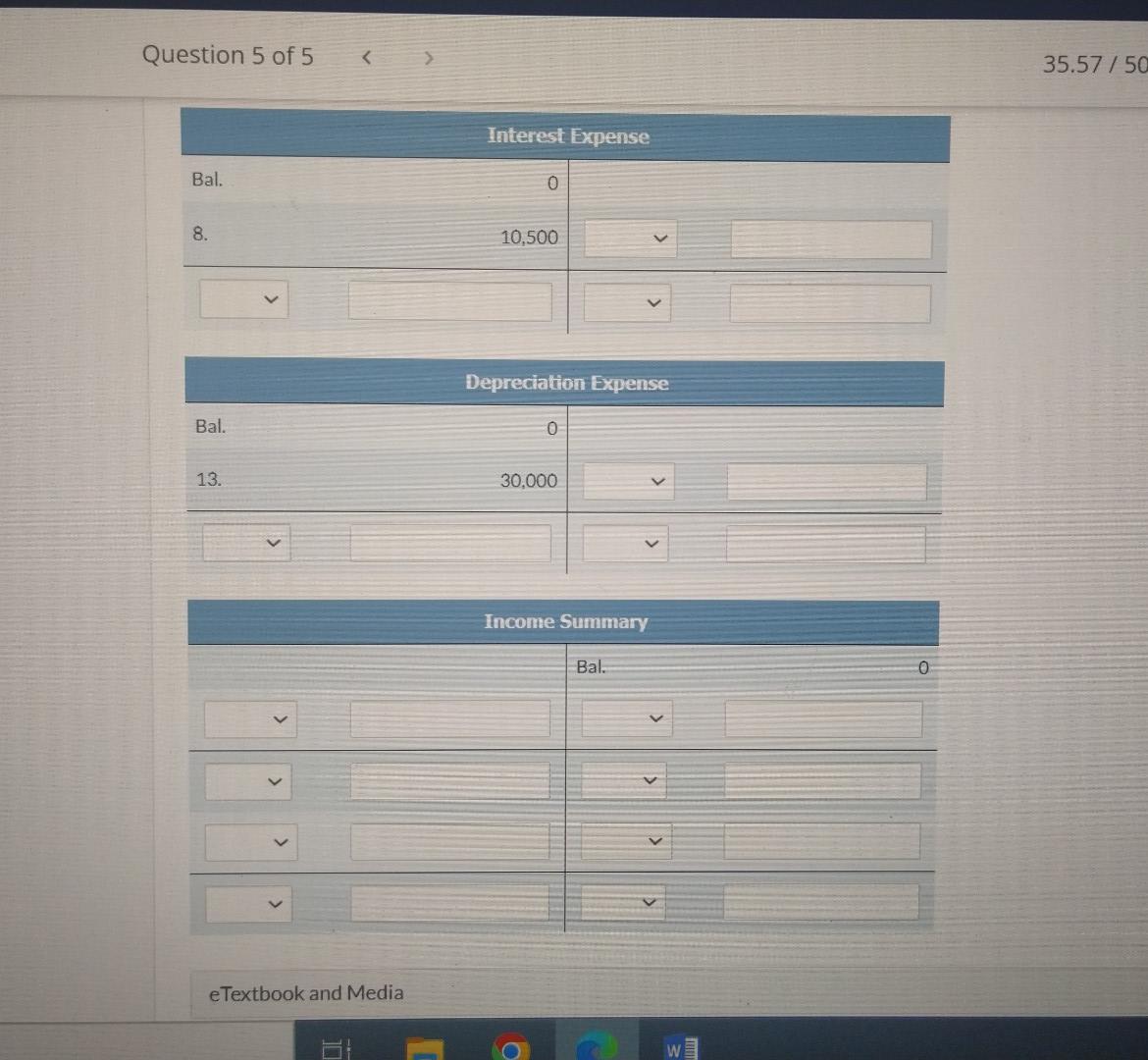

On December 31, 2019, Clean and White Linen Supplies Ltd. had the following account balances: In 2020, the following transactions occurred: 1. On January 1, paid $5,400 for a three-year fire insurance policy. 2. Purchased additional uniform inventory on credit for $146,600. 3. Sold uniforms for $199,200 on account. The inventory that was sold had been purchased for $100,000. 4. Performed cleaning services for customers for $536,200. One-quarter of this amount was paid in cash and the r was on account. 5. Paid $146,800 to suppliers to settle some of the accounts payable. 6. Received $246,000 from customers to settle amounts owed to the company. 7. Paid $16,800 for advertising. 6. Received $246,000 from customers to settle amounts owed to the company. 7. Paid $16,800 for advertising. 8. At the end of 2020 , paid the interest on the bank loan for the year at the rate of 7%, as well as $32,100 on the principal. The remaining principal balance is due in three years. 9. Received a $3,000 dividend from the long-term investment. 10. Paid $18,300 for utilities for the year. 11. Declared and paid dividends of $13,000 at the end of the year. 12. Paid $102,000 for wages during the year. At year end, the company owed another $2,000 to the employees for the last week of work in December. 13. Depreciated the equipment for the year. The company had bought its equipment at the beginning of 2017 , and it was expected to last 10 years and have a residual value of $30,000. The company depreciates its equipment using the straightline method. 14. Made an adjustment for the cost of the insurance that expired in 2020. Inventory (To record the cost) 4. Cash Accounts Receivable 134,050 Service Revenue 402,150 5. Accounts Payable 146,800 Cash 146,800 6. Cash 246,000 Accounts Receivable 246,000 7. Advertising Expense 16,800 Cash 8. Interest Expense 10,500 Bank Loan Payable 32,100 Cash 42,600 Prepare journal entries to record each of the above transactions and adjustments. (Credit account titles ore automatically indented when the amount is entered. Do not indent manuall. If ho entry is required select "No En try for the account titles and enter ofor the amounts.) Cash 9. Cash 42,600 Dividend Revenue 3.000 10. Utilities Expense 3,000 Cash 11. Dividends Declared 18,300 Cash 13,000 18,300 12a. Wages Payable 13,000 Wages Expense ,94,000 Cash (To record payment of wages during the year) 12b. Wages Expense 102,000 8,000 (To record accrued wages) (To record payment of wages during the year) 12b. Wages Expense 2,000 Wages Payable (To record accrued wages) 13. Depreciation Expense 2,000 Accumulated Depreciation-Equipment: 14. Insurance Expense 1,800 Prepaid Insurance 1,800 eTextbook and Media List of Accounts Attempts: 1 of 4 used (b) (b) Your answer is correct. Enter the beginning balances from 2019 , post the 2020 journal entries, and determine the ending balances for 2020 . (Post entries In the order of journal entries presented in the previous part. If beginning balance is zero, enter 0 in the column for the normal balance for that account.] Question 5 of 5 \begin{tabular}{|} \hline Dividend \\ \hline 0 \\ \hline 13,000 \\ \hline \end{tabular} Sales Revenue Dividend Revenue Prepare an adjusted trial balance, and ensure that the total of the debit balances is equal to the total of the credit balances. Question 5 of 5 Accumulated Depreciation-Equipment 35.57/50120,000 Accounts Payable Wages Payable BankLoan Payable Common Shares Retained Earnings Sales Revenue Cost of Goods Sold 100,000 Service Revenue 536,200 Advertising Expense 16,800 Interest Expense 10,500 Dividend Revenue Utilities Expense 18,300 3,000 Dividends Declared List of Accounts Prepare a statement of income for 2020. Question 5 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts