Question: Solve every one of the following problems using Microsoft Excel. The formula needs to be activated in every cell for the Excel sheet to be

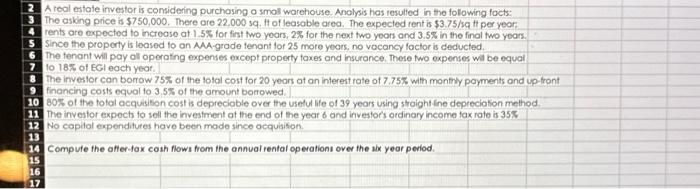

A roal estale investor is considering purchasing o smal warehouse. Anolysis has resulted in tho following focts: The asking price is $750,000. There ore 22,000sq. ft of leasoble area. The expected rent is $3.75/sqtt per year: rents ore expected to increase at 1.5% for first two years, 2% for the next two yeors and 3.5% in the final two yoars. Since the property is leased to an AM-grade tenant for 25 more yeors, no vacancy factor is deducted. The fenant will pay al operating expenses except property taxes and insurance, These two expenses wil be equal to 18% of EGl each year: The investor can borrow 75% of the folal cost for 20 years of an interest rate of 7.75% with montrly payments and up- front financing costs equal to 3.5% of the amount borrowed. bos of the tofal ocquisision cost is deprecioble over the useful life of 39 years using straight-line depreciation method. The investor expocts to sell the investment at the end of the year 6 and investors ordinary income fax rate is 35% No capilal expendifures have been modo since acquitison. Compute the affertax cash flows from the annual rental operations over the six year period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts