Question: Solve for a and b, fast answer In a two-factor APT model, easyJet has a factor beta of 1.15 on the first factor portfolio, which

Solve for a and b, fast answer

Solve for a and b, fast answer

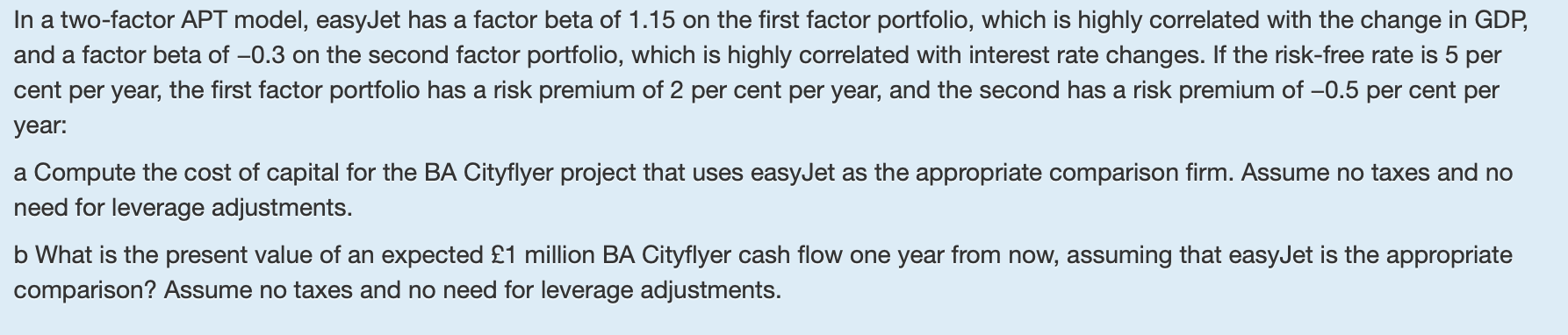

In a two-factor APT model, easyJet has a factor beta of 1.15 on the first factor portfolio, which is highly correlated with the change in GDP, and a factor beta of -0.3 on the second factor portfolio, which is highly correlated with interest rate changes. If the risk-free rate is 5 per cent per year, the first factor portfolio has a risk premium of 2 per cent per year, and the second has a risk premium of -0.5 per cent per year: a Compute the cost of capital for the BA Cityflyer project that uses easyJet as the appropriate comparison firm. Assume no taxes and no need for leverage adjustments. b What is the present value of an expected 1 million BA Cityflyer cash flow one year from now, assuming that easyJet is the appropriate comparison? Assume no taxes and no need for leverage adjustments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts