Question: Solve for B only please. Thank you Question 35 During 2020, Rafael Corp. produced 36,800 units and sold 36,800 for $14 per unit. Suppose the

Solve for B only please.

Thank you

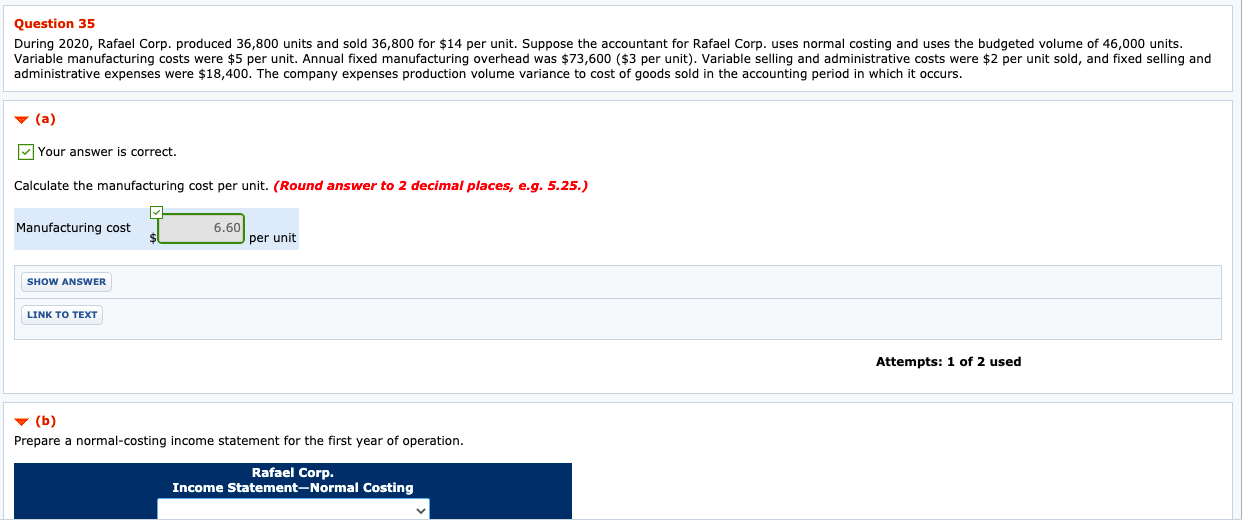

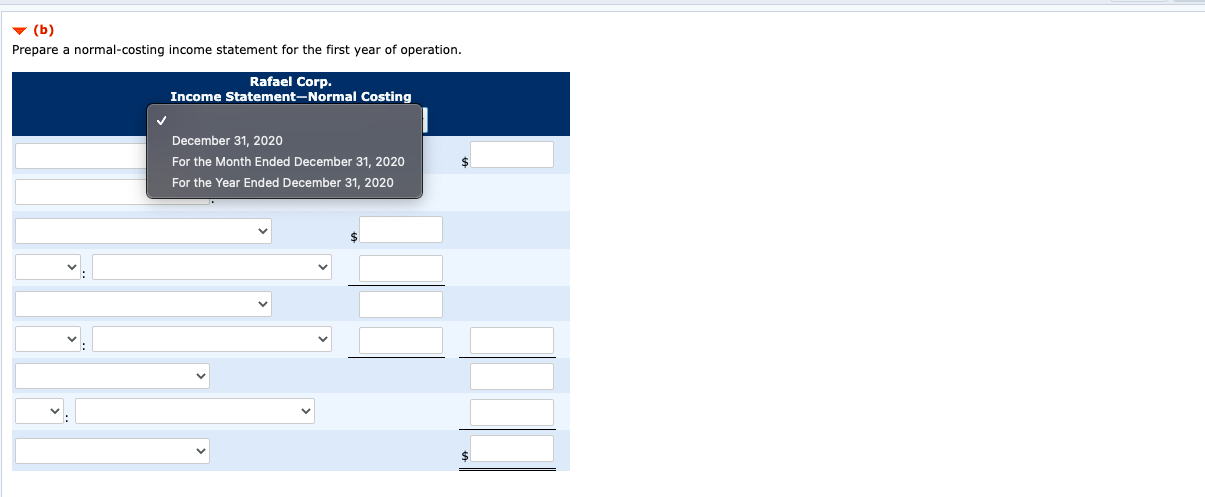

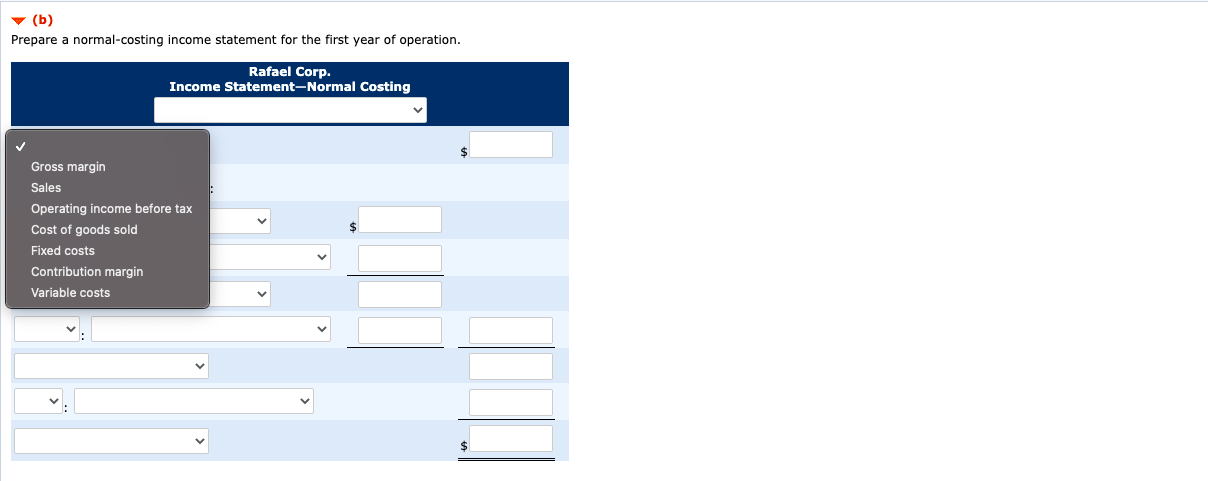

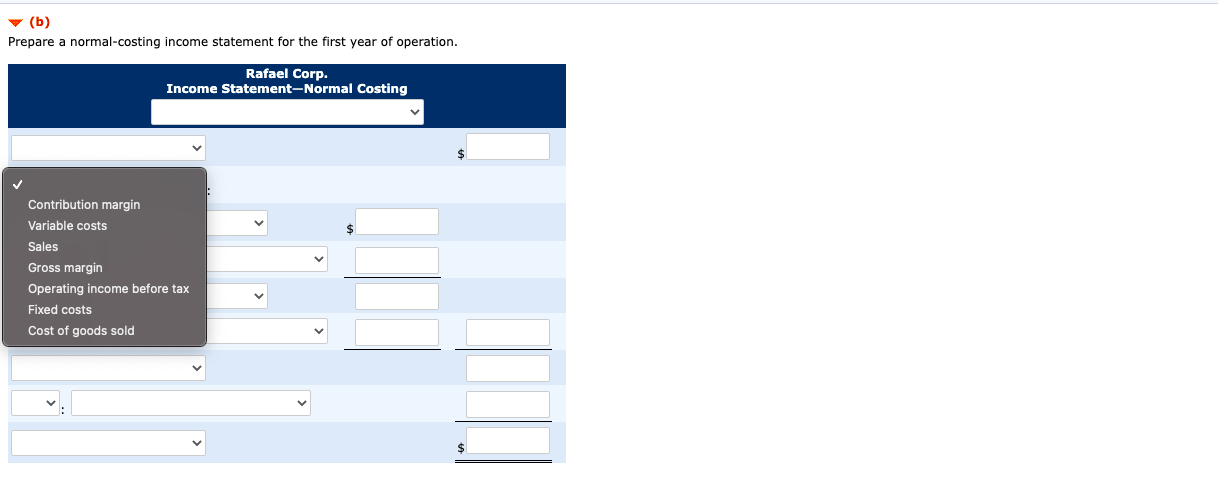

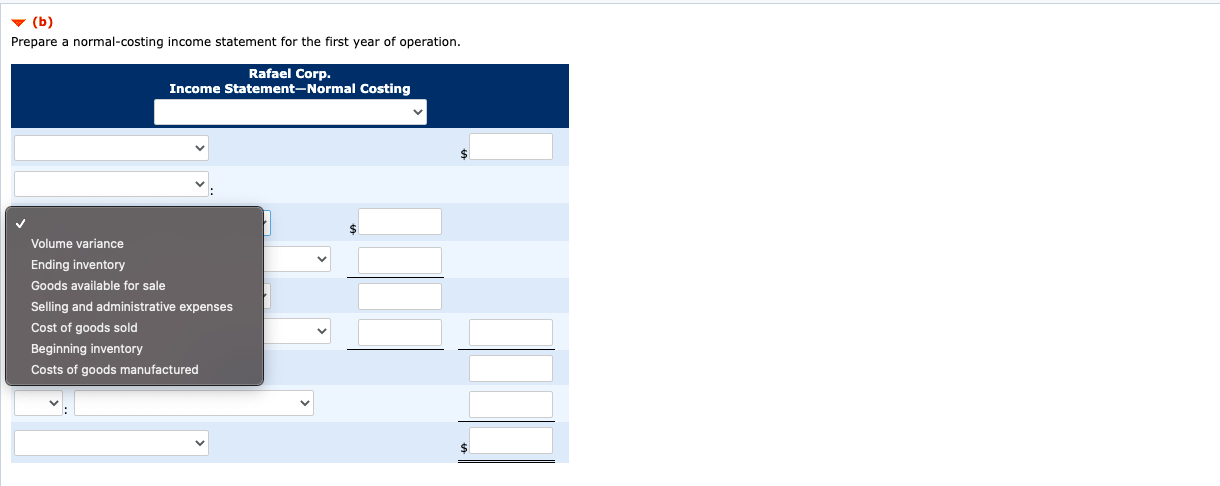

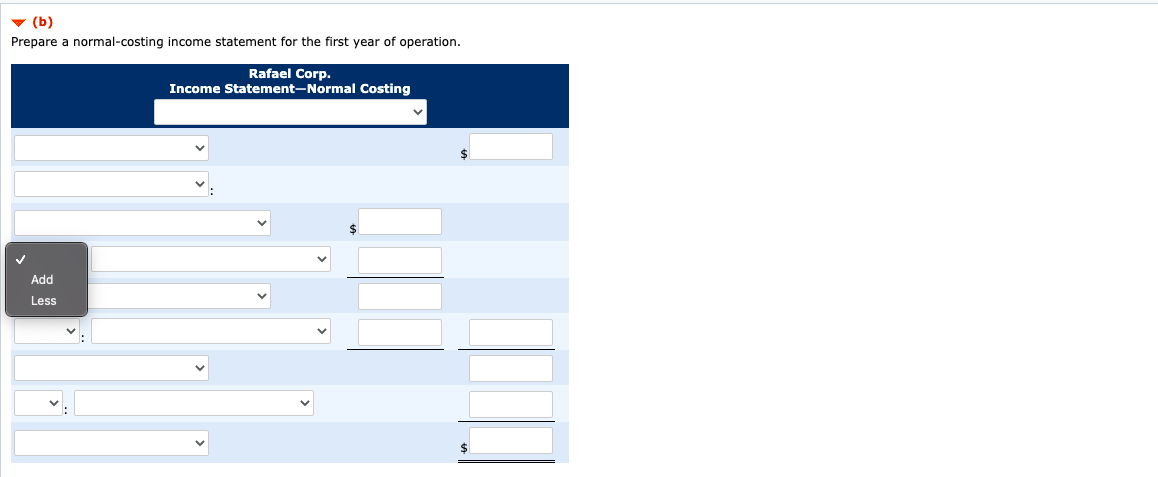

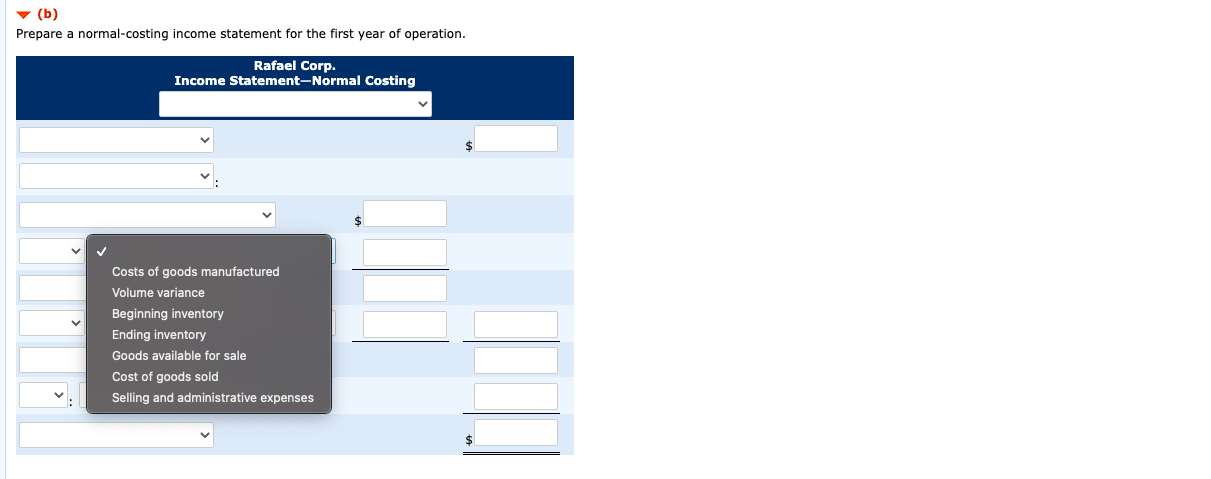

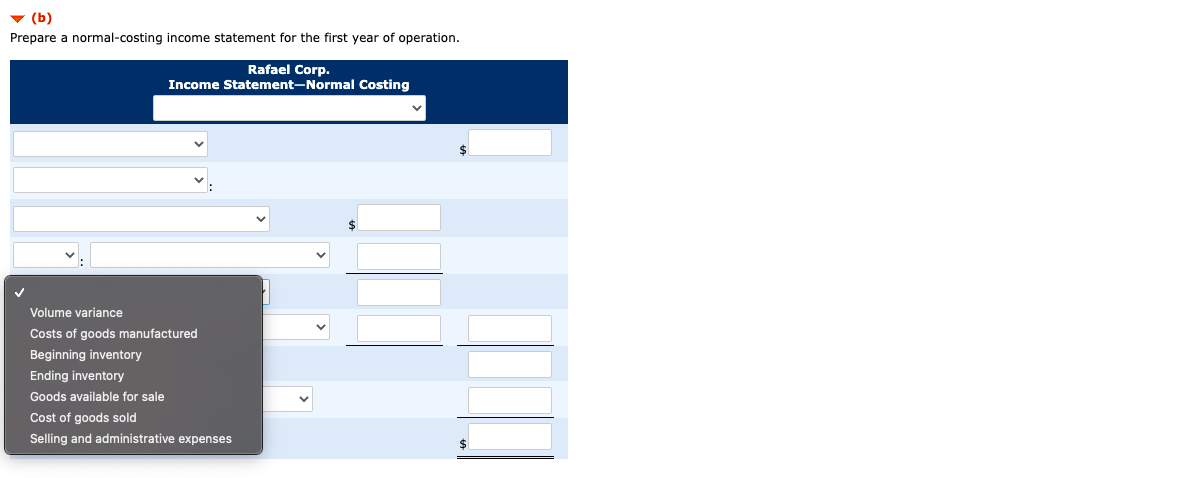

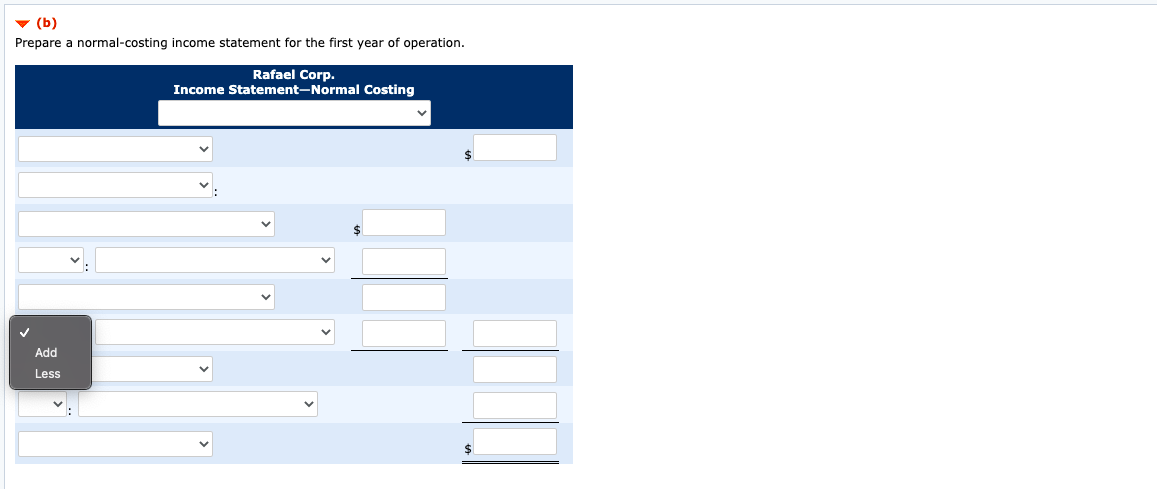

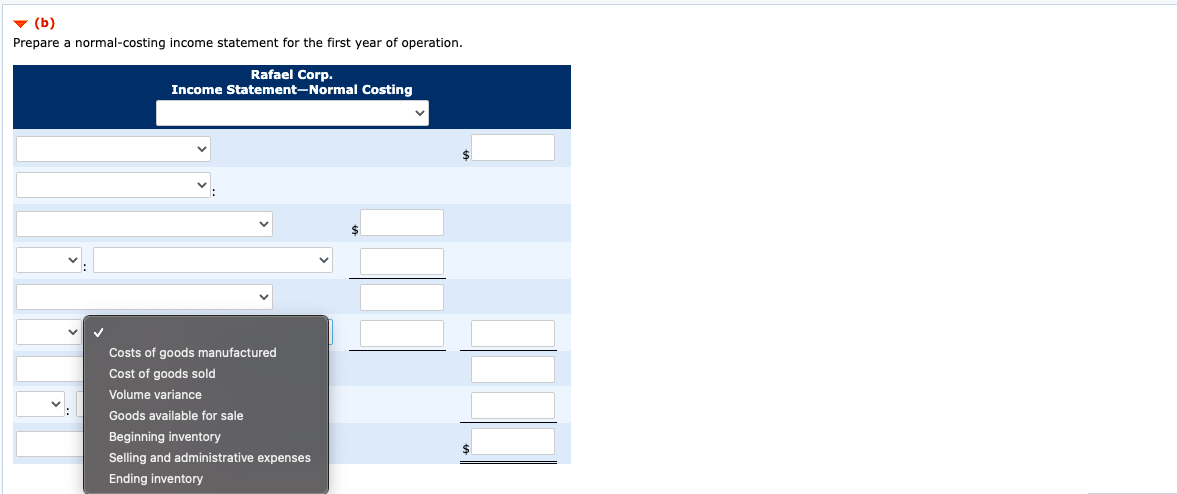

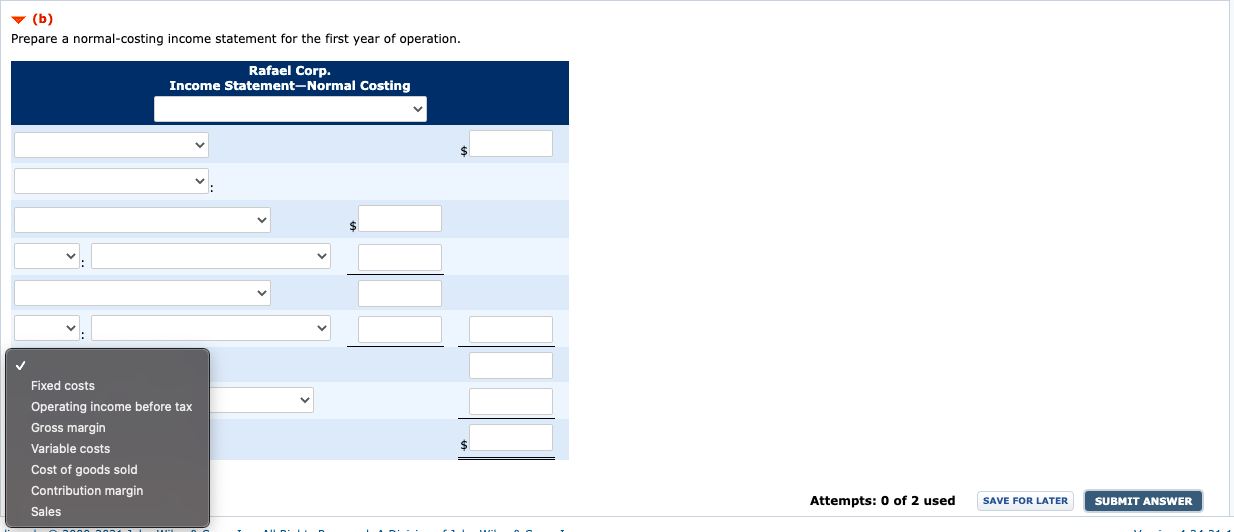

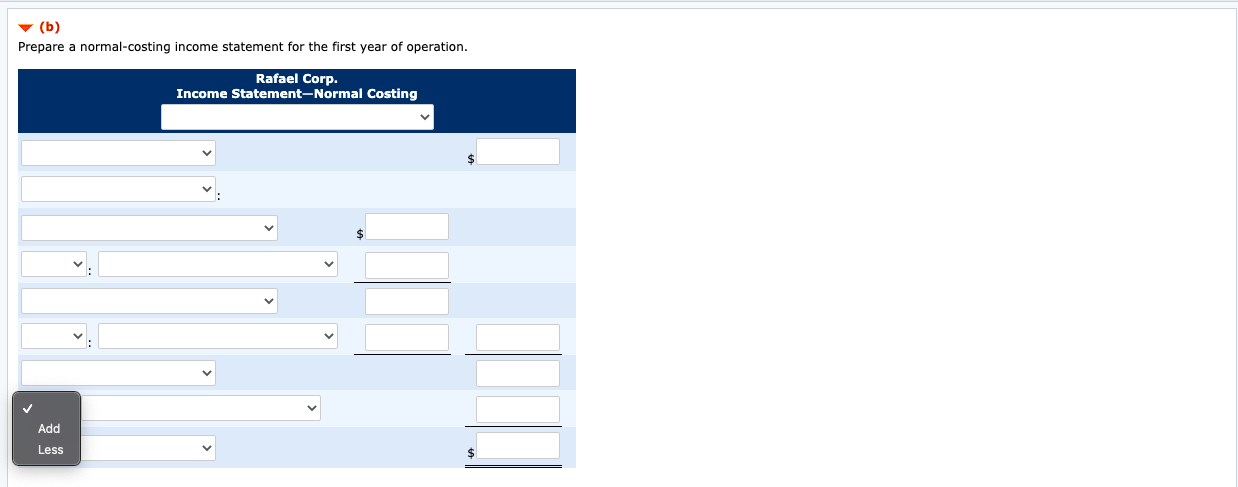

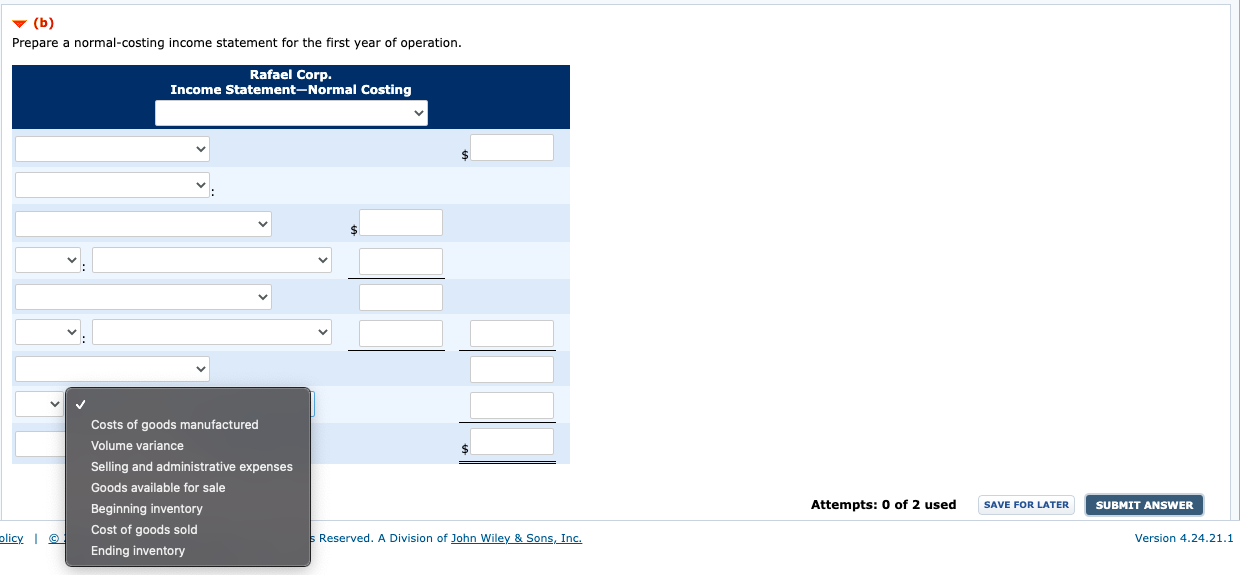

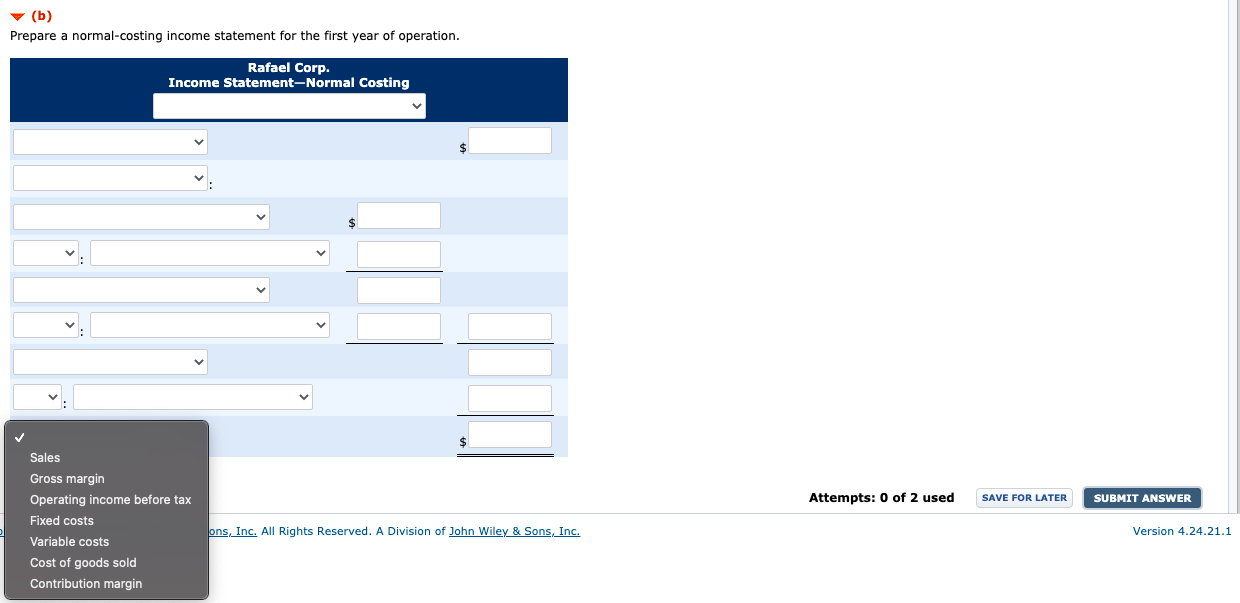

Question 35 During 2020, Rafael Corp. produced 36,800 units and sold 36,800 for $14 per unit. Suppose the accountant for Rafael Corp. uses normal costing and uses the budgeted volume of 46,000 units. Variable manufacturing costs were $5 per unit. Annual fixed manufacturing overhead was $73,600 ($3 per unit). Variable selling and administrative costs were $2 per unit sold, and fixed selling and administrative expenses were $18,400. The company expenses production volume variance to cost of goods sold in the accounting period in which it occurs. v (a) Your answer is correct. Calculate the manufacturing cost per unit. (Round answer to 2 decimal places, e.g. 5.25.) Manufacturing cost 6.60 per unit SHOW ANSWER LINK TO TEXT Attempts: 1 of 2 used (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp Income Statement-Normal Costing (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing December 31, 2020 For the Month Ended December 31, 2020 For the Year Ended December 31, 2020 (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Gross margin Sales Operating income before tax Cost of goods sold Fixed costs Contribution margin Variable costs (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Contribution margin Variable costs Sales Gross margin Operating income before tax Fixed costs Cost of goods sold (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Volume variance Ending inventory Goods available for sale Selling and administrative expenses Cost of goods sold Beginning inventory Costs of goods manufactured (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Add Less (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Costs of goods manufactured Volume variance Beginning inventory Ending inventory Goods available for sale Cost of goods sold Selling and administrative expenses (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Volume variance Costs of goods manufactured Beginning inventory Ending inventory Goods available for sale Cost of goods sold Selling and administrative expenses (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Add Less (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Costs of goods manufactured Cost of goods sold Volume variance Goods available for sale Beginning inventory Selling and administrative expenses Ending inventory (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Fixed costs Operating income before tax Gross margin Variable costs Cost of goods sold Contribution margin Sales $ Attempts: 0 of 2 used SAVE FOR LATER SUBMIT ANSWER v (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Add Less v (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing Costs of goods manufactured Volume variance Selling and administrative expenses Goods available for sale Beginning inventory Cost of goods sold Ending inventory Attempts: 0 of 2 used SAVE FOR LATER SUBMIT ANSWER olicy Reserved. A Division of John Wiley & Sons, Inc. Version 4.24.21.1 (b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing $ Attempts: 0 of 2 used SAVE FOR LATER SUBMIT ANSWER Sales Gross margin Operating income before tax Fixed costs Variable costs Cost of goods sold Contribution margin ons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. Version 4.24.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts