Question: solve for both 1. A hedge fund with $1 billion of assets charges a management fee of 2% and an incentive fee of 20% of

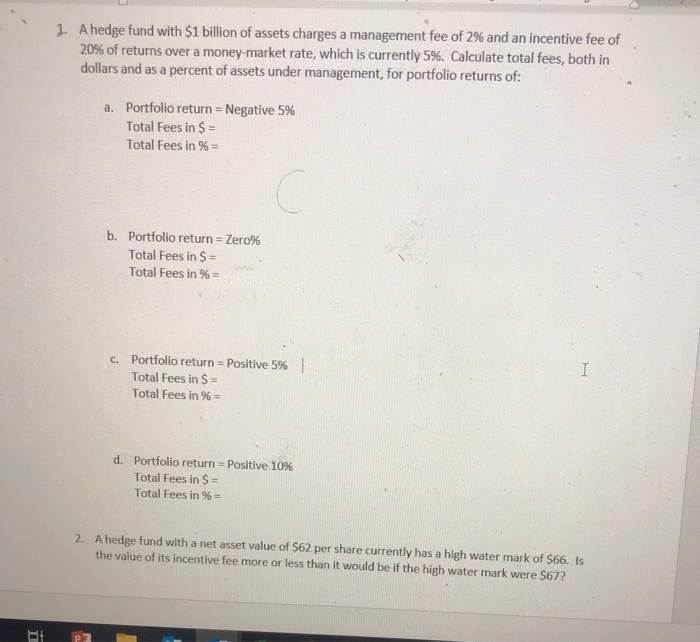

1. A hedge fund with $1 billion of assets charges a management fee of 2% and an incentive fee of 20% of returns over a money-market rate, which is currently 5%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of: a. Portfolio return = Negative 5% Total Fees in $ = Total Fees in % = b. Portfolio return = Zero% Total Fees in $ = Total Fees in %= C. Portfolio return = Positive 5% Total Fees in $ = Total Fees in % = d. Portfolio return = Positive 10% Total Fees in $ = Total Fees in % = 2. A hedge fund with a net asset value of $62 per share currently has a high water mark of $66. Is the value of its incentive fee more or less than it would be if the high water mark were $67? BA P2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts