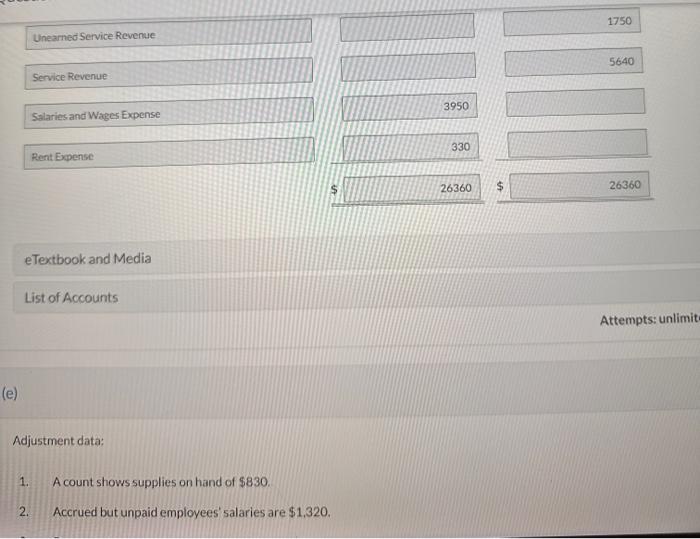

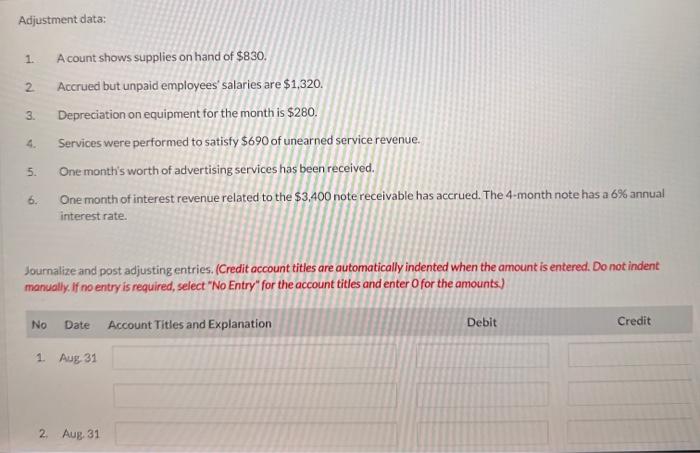

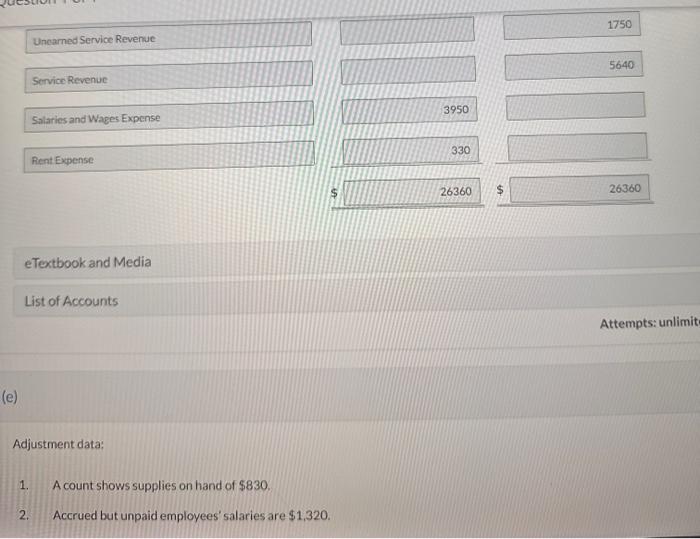

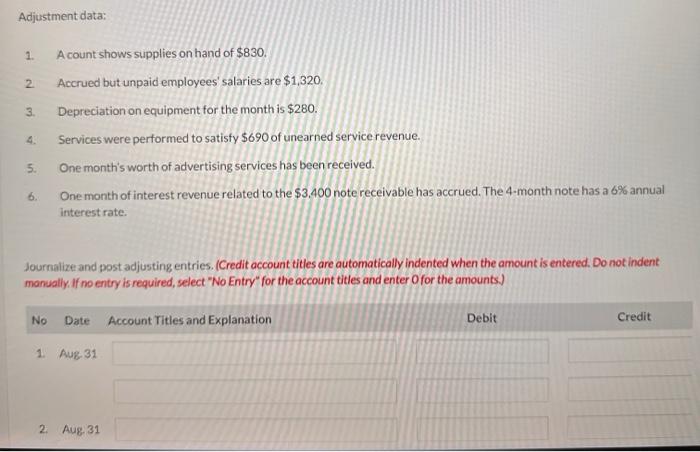

Question: solve for e) adjustment data Attempts: unlimit e) Adjustment data: 1. A count shows supplies on hand of $830. 2. Accrued but unpaid employees' salaries

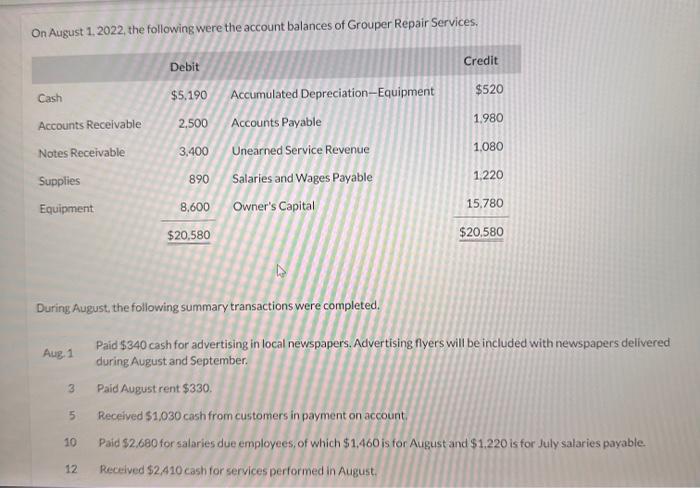

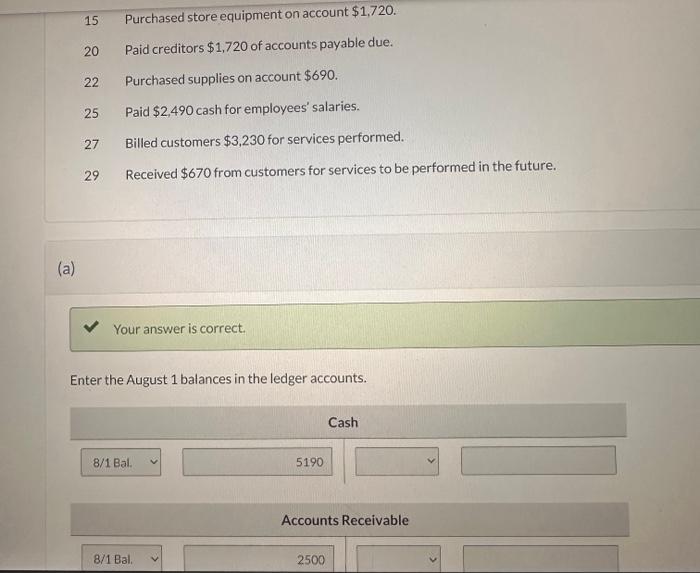

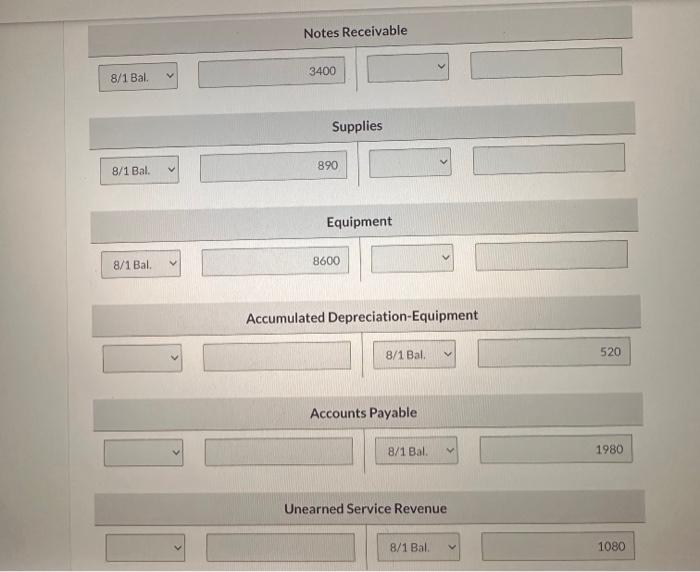

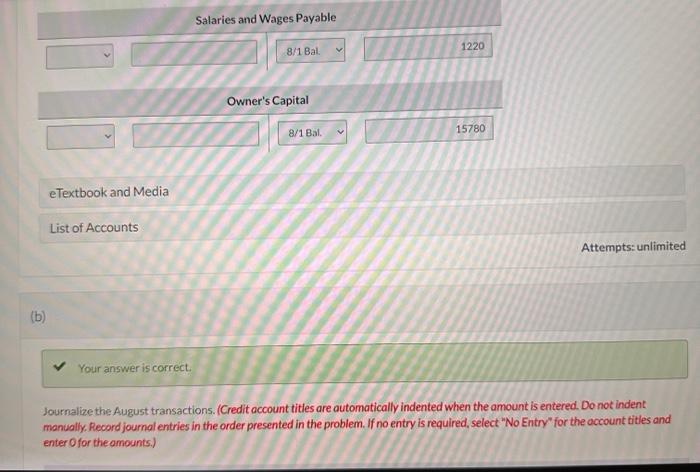

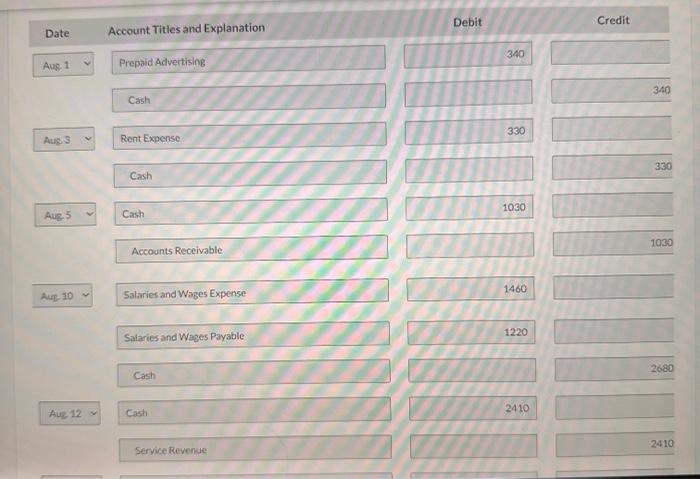

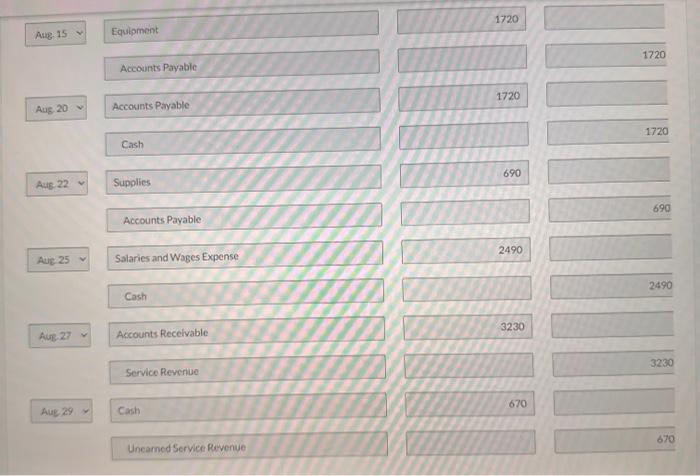

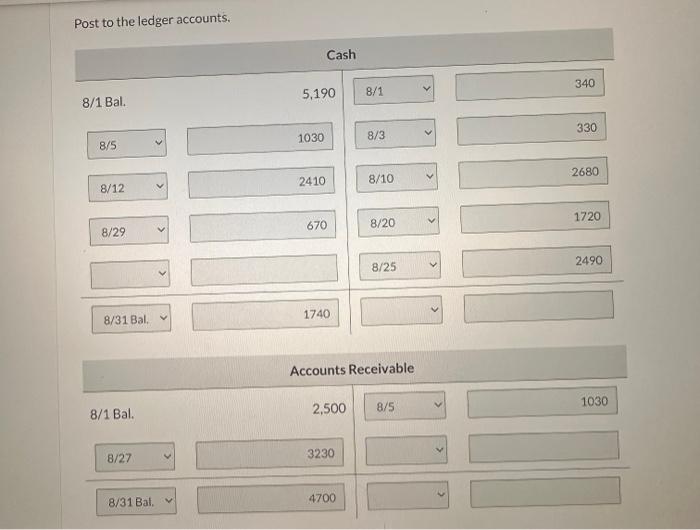

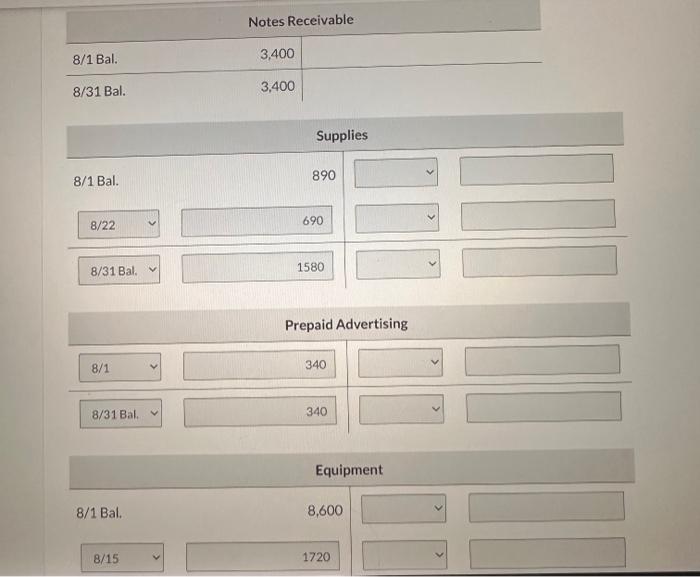

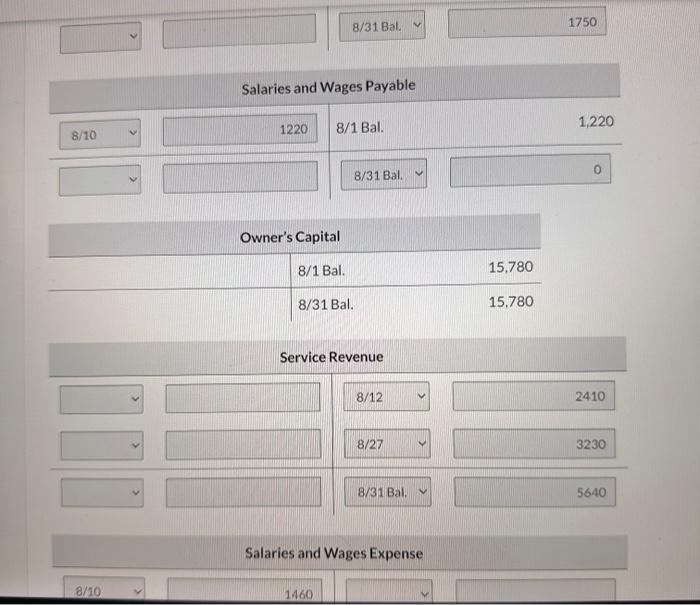

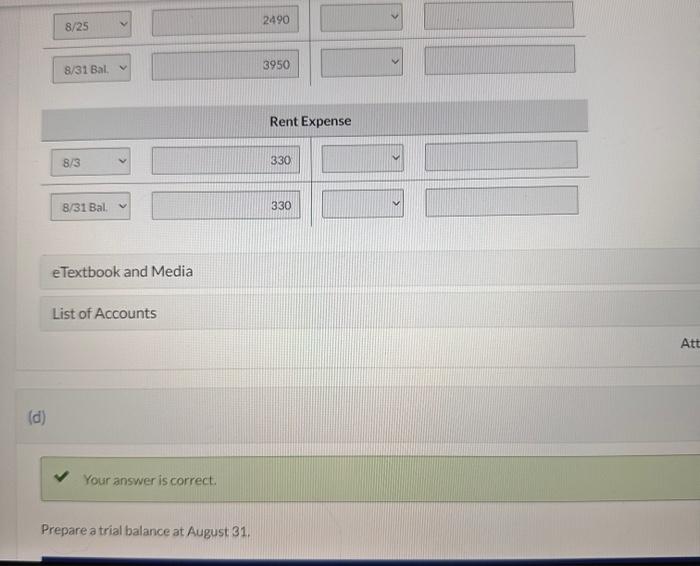

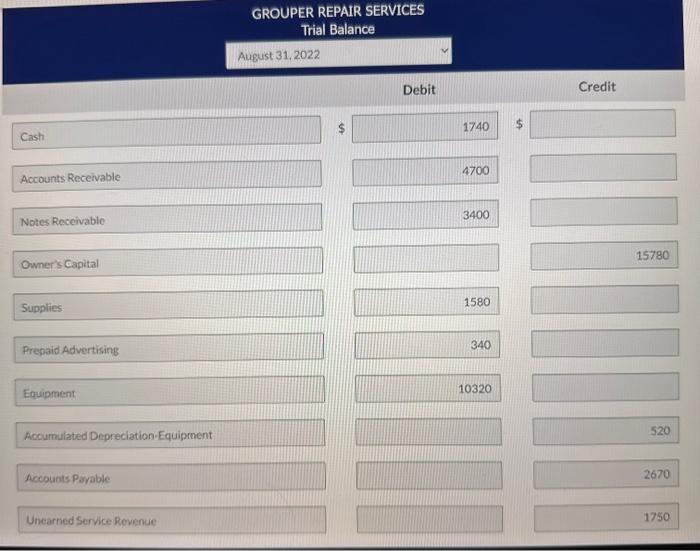

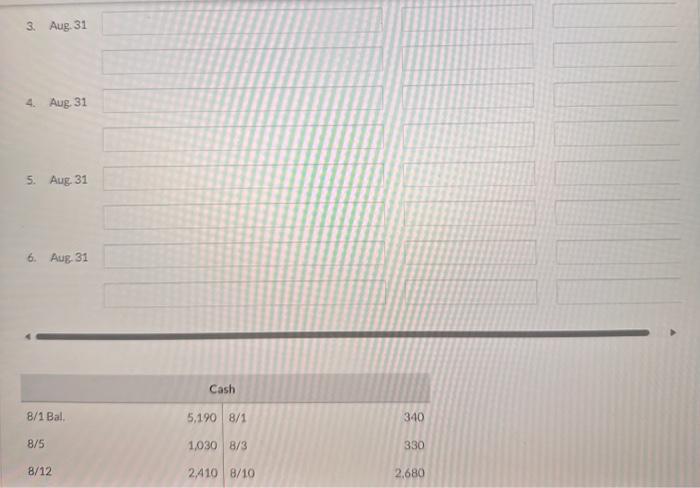

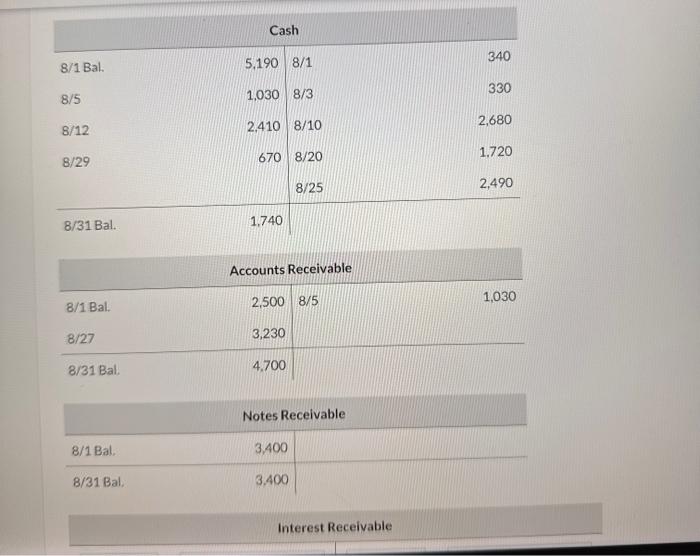

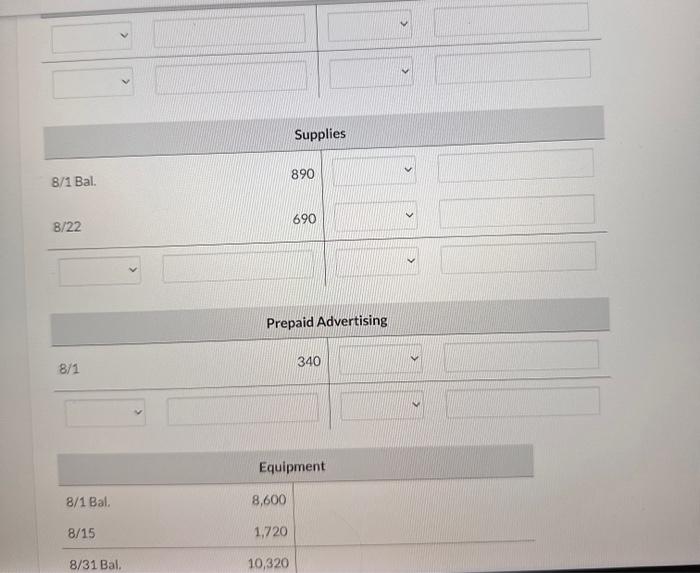

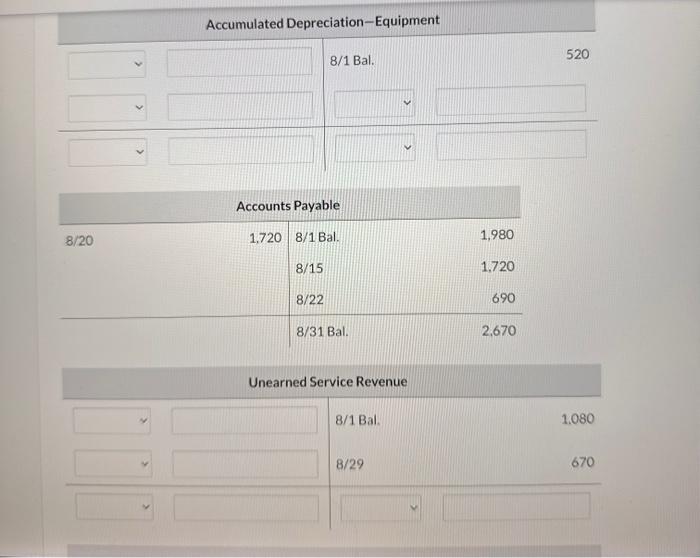

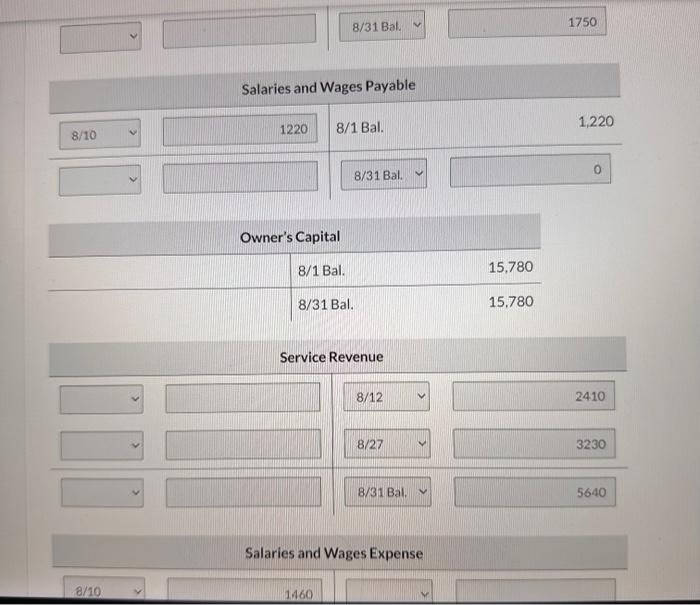

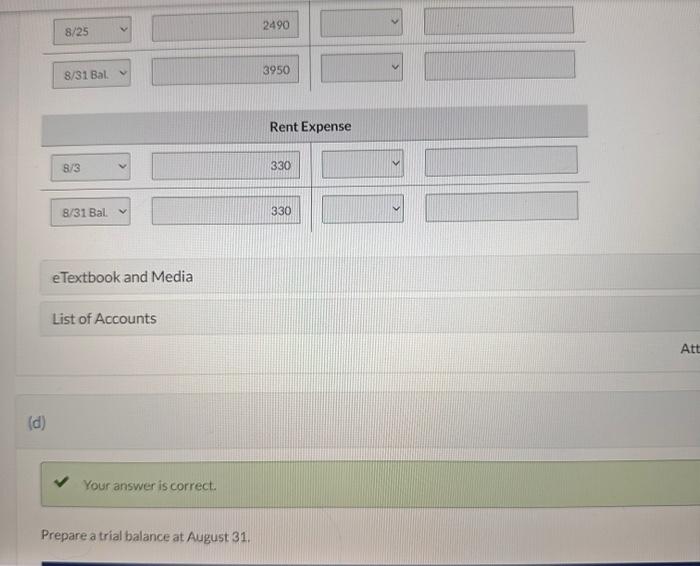

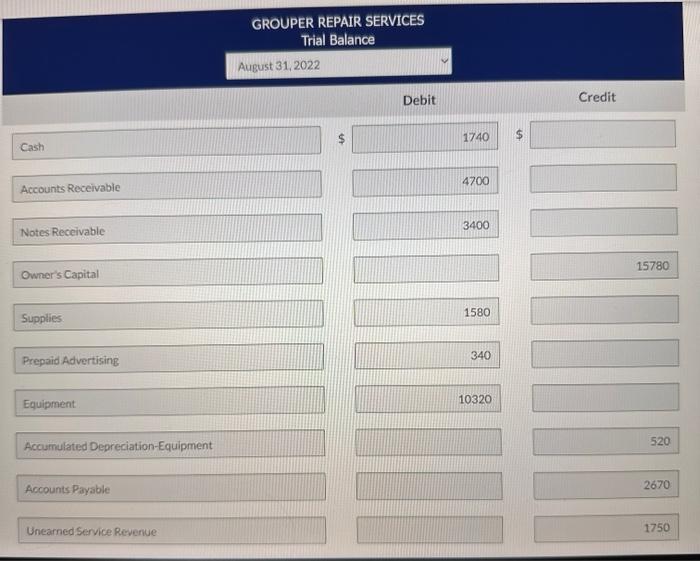

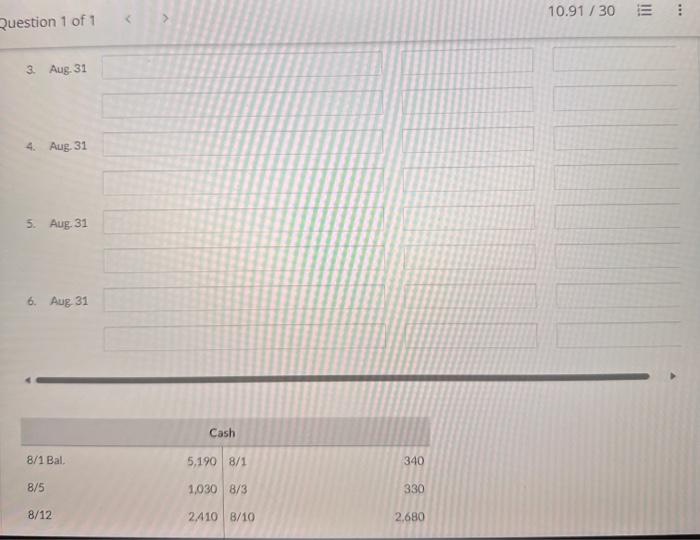

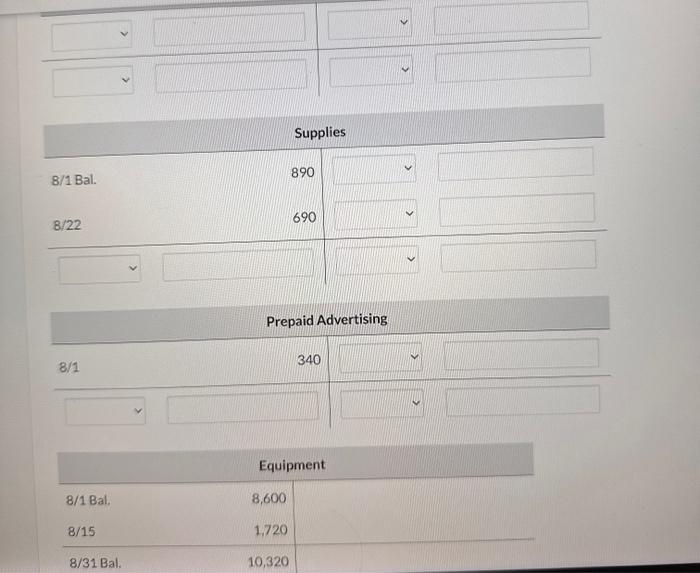

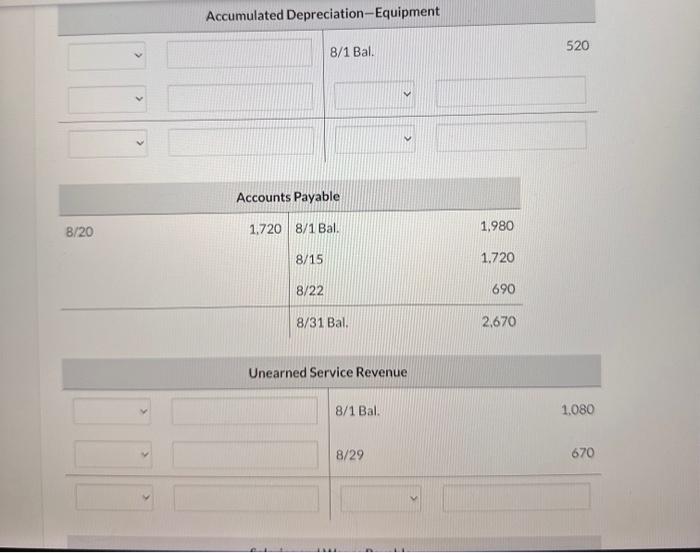

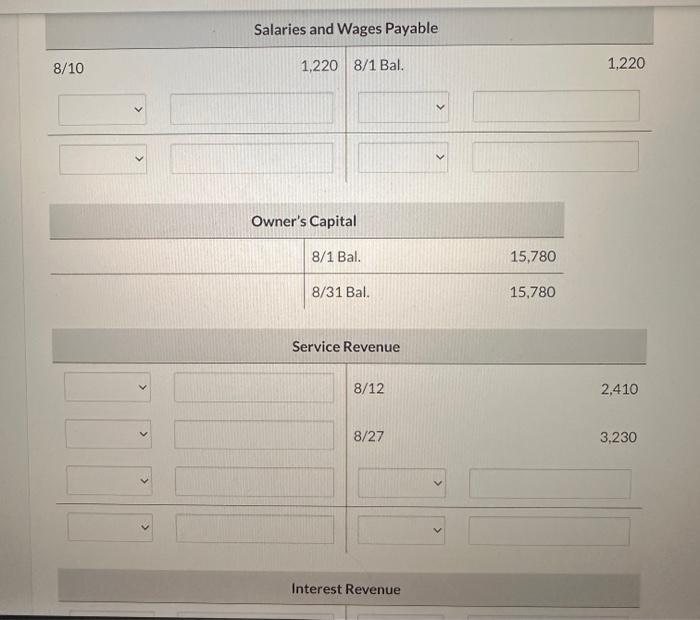

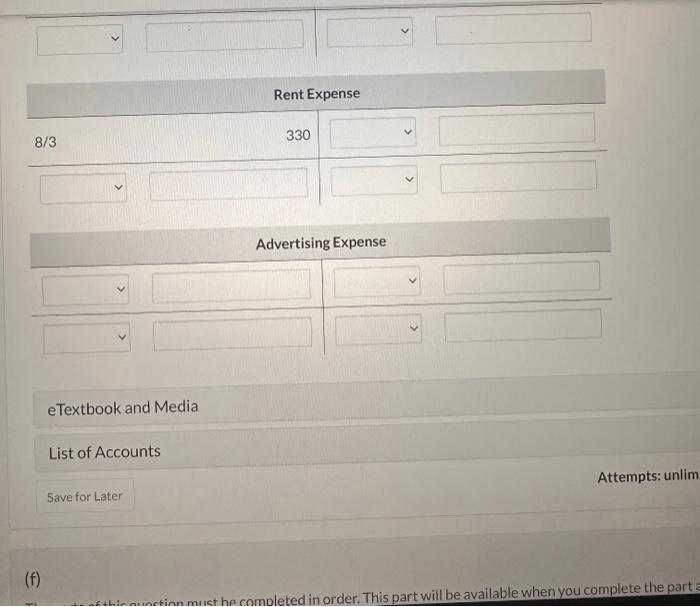

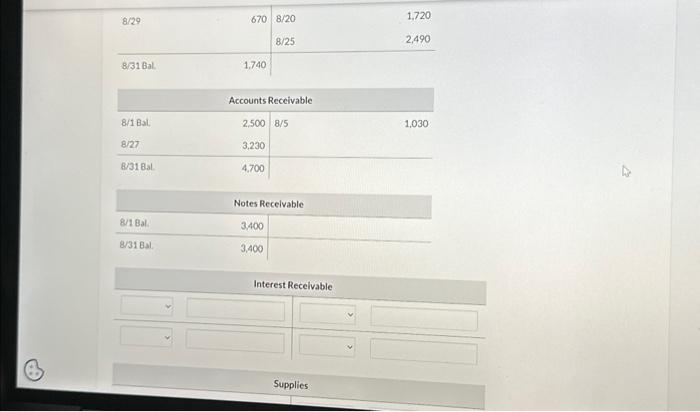

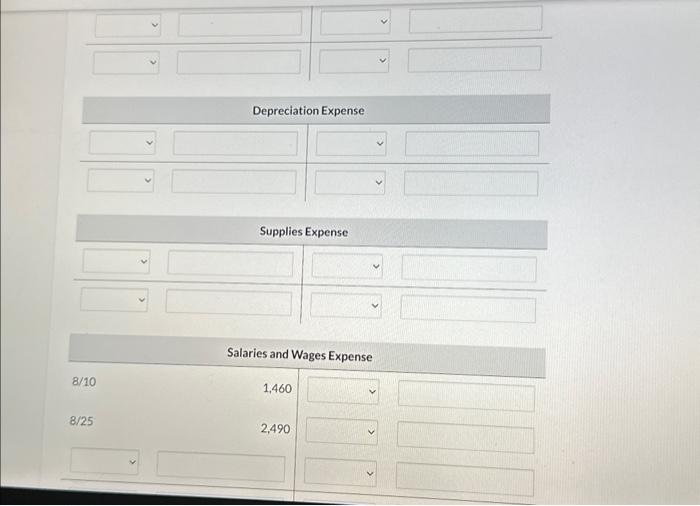

Attempts: unlimit e) Adjustment data: 1. A count shows supplies on hand of $830. 2. Accrued but unpaid employees' salaries are $1,320. Supplies 8/1 Bal. 890 8/22 690 Prepaid Advertising 8/1 340 Equipment 8/1 Bal. 8/15 8,600 1,720 8/31 Bal. 10,320 Notes Receivable 8/1 Bal. 3400 Supplies 8/1 Bal. 890 Equipment 8/1 Bal. 8600 Accumulated Depreciation-Equipment 8/1 Bal. 520 Accounts Payable 8/18al. 1980 Unearned Service Revenue 8/1Bal 1080 On August 1.2022, the following were the account balances of Grouper Repair Services. During August, the following summary transactions were completed. Aug 1 Paid $340 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. 3 Paid August rent $330. 5 Received $1,030 cash from customers in payment on account. 10 Paid $2.680 for salaries due employees, of which $1,460 is for August and $1.220 is for July salaries payable. 12 Received $2,410 cash for services performed in August. 15 Purchased store equipment on account $1,720. 20 Paid creditors $1,720 of accounts payable due. 22 Purchased supplies on account $690. 25 Paid $2,490 cash for employees' salaries. 27 Billed customers $3,230 for services performed. 29 Received $670 from customers for services to be performed in the future. (a) Your answer is correct. Enter the August 1 balances in the ledger accounts. Post to the ledger accounts. \begin{tabular}{l|ll} \multicolumn{4}{c}{ Owner's Capital } \\ \hline & 8/1 Bal. & 15,780 \\ \hline & 8/31 Bal. & 15,780 \end{tabular} Service Revenue Salaries and Wages Expense GROUPER REPAIR SERVICES Trial Balance August 31, 2022 Cash $ Accounts Receivable Debit Credit Notes Receivable Owner's Capital 15780 Supplies 1580 Prepaid Advertising 340 Equipment 10320 Accumulated Depreciation-Equipment Accounts Paysble Unearned Service Revenue \begin{tabular}{lr|lr} \multicolumn{4}{c}{ Cash } \\ \hline 8/1 Bal. & 5,190 & 8/1 & 340 \\ 8/5 & 1,030 & 8/3 & 330 \\ 8/12 & 2,410 & 8/10 & 2,680 \\ 8/29 & 670 & 8/20 & 1,720 \\ & & 8/25 & 2,490 \\ \hline 8/31 Bal. & 1,740 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Accounts Receivable } \\ \hline 8/1 Bal. & 2,500 & 8/5 & 1.030 \\ \hline 8/27 & 3,230 & & \\ \hline 8/31Bal & 4.700 & & \\ \hline \end{tabular} \begin{tabular}{|l|l|} & Notes Receivable \\ \hline 8/1 Bal. & 3,400 \\ \hline 8/31Bal. & 3,400 \\ \hline \end{tabular} Interest Receivable \begin{tabular}{ll|ll} 8/29 & 670 & 8/20 & 1.720 \\ & 8/25 & 2,490 \\ \hline 8/31 Bal. & 1,740 & & \end{tabular} \begin{tabular}{lr|ll} & \multicolumn{2}{c}{ Accounts Receivable } \\ \hline 8/1 Bal. & 2,500 & 8/5 & 1,030 \\ \hline 8/27 & 3,230 & \\ \hline B/318al & 4,700 & & \\ \hline \end{tabular} Question 1 of 1 10.91/30 3. Aug 31 4. Aug 31 5. Aug 31 6. Aug 31 \begin{tabular}{ll|ll|} \multicolumn{4}{c|}{ Cash } \\ \hline 8/1 Bal. & 5,190 & 8/1 & 340 \\ 8/5 & 1,030 & 8/3 & 330 \\ 8/12 & 2,410 & 8/10 & 2,680 \\ \hline \end{tabular} Date Account Tities and Explanation Aue 1 Prepsid Advertising Cash Aus 3 Rent Expense: Cash Aug 5 Cash Accounts Receivable Salaries and Wages Expense Salaries and Wages Paysble Cash Aus 12 Cash Service Revenue Debit 330 1030 1220 2410 Credit Depreciation Expense Salaries and Wages Expense 8/10 1,460 8/25 2,490 Journalize the August transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the omounts.) \begin{tabular}{lr|l} & Notes Receivable \\ \hline 8/1 Bal. & 3,400 & \\ \hline 8/31 Bal. & 3,400 & \end{tabular} Supplies 8/1 Bal. 890 8/22 690 8/31 Bal. 1580 Prepaid Advertising 8/1 340 8/31 Bal. 340 Equipment 8/1 Bal. 8,600 8/15 1720 \begin{tabular}{lr|} \hline \multicolumn{2}{|c|}{ Prepaid Ad } \\ \hline 8/1 & 340 \\ \hline & \\ \hline 8/1 Bal. & \\ \hline 8/15 & 8,600 \\ \hline 8/31 Bal. & 1,720 \\ \hline & 10,320 \\ \hline \end{tabular} Adjustment data: 1. A count shows supplies on hand of $830. 2. Accrued but unpaid employees' salaries are $1,320. 3. Depreciation on equipment for the month is $280. 4. Services were performed to satisfy $690 of unearned service revenue. 5. One month's worth of advertising services has been received. 6. One month of interest revenue related to the $3,400 note receivable has accrued. The 4 -month note has a 6% annual interest rate. Journalize and post adjusting entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 3. Aug 31 4. Aug 31 5. Aug 31 6. Aug. 31 Attempts: unlim (f) \begin{tabular}{l|ll} \multicolumn{4}{c}{ Owner's Capital } \\ \hline & 8/1 Bal. & 15,780 \\ \hline & 8/31 Bal. & 15,780 \end{tabular} Service Revenue Salaries and Wages Expense Accumulated Depreciation-Equipment 8/1 Bal. 520 Accounts Payable \begin{tabular}{|c|c|c|c|} \hline \multirow[t]{2}{*}{8/20} & 1,720 & 8/1Bal.8/158/22 & 1,9801,720690 \\ \hline & & 8/31Bal. & 2.670 \\ \hline \end{tabular} Unearned Service Revenue 8/1 Bal. 1.080 8/29 670 Attempts: unlimit e) Adjustment data: 1. A count shows supplies on hand of $830. 2. Accrued but unpaid employees' salaries are $1,320. \begin{tabular}{|l|ll} \multicolumn{3}{c}{ Owner's Capital } \\ \hline & 8/1 Bal. & 15,780 \\ \hline & 8/31 Bal. & 15,780 \end{tabular} Interest Revenue Prepare a trial balance at August 31. Prepare a trial balance at August 31. Adjustment data: 1. A count shows supplies on hand of $830. 2. Accrued but unpaid employees salaries are $1,320. 3. Depreciation on equipment for the month is $280. 4. Services were performed to satisfy $690 of unearned service revenue. 5. One month's worth of advertising services has been received. 6. One month of interest revenue related to the $3,400 note receivable has accrued. The 4 -month note has a 6% annual interest rate. Joumalize and post adjusting entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) GROUPER REPAIR SERVICES Trial Balance August 31,2022 Debit $ Cash Accounts Receivable Notes Receivable Owner's Capital Supplies Prepaid Advertising Equipment Accurnulated Depreciation-Equipment Accounts Payable Uncarned Service Revenue Credit 1740 $ 4700 3400 1580 340 10320 Aug 15 Equipment Accounts Payable Aus 20V Accounts Payable Cash Aus 22 Supplies Accounts Payable Aug 25 Solaries and Wages Expense Cash Aus. 27 Accounts Recelvable Service Revenue Aus 29 Cosh Unearned Service Ruvenue 1720 670

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts