Question: Solve for everything like the example Help me solve this All parts showing BestSystems manufactures an optical switch that it uses in its final product.

Solve for everything like the example

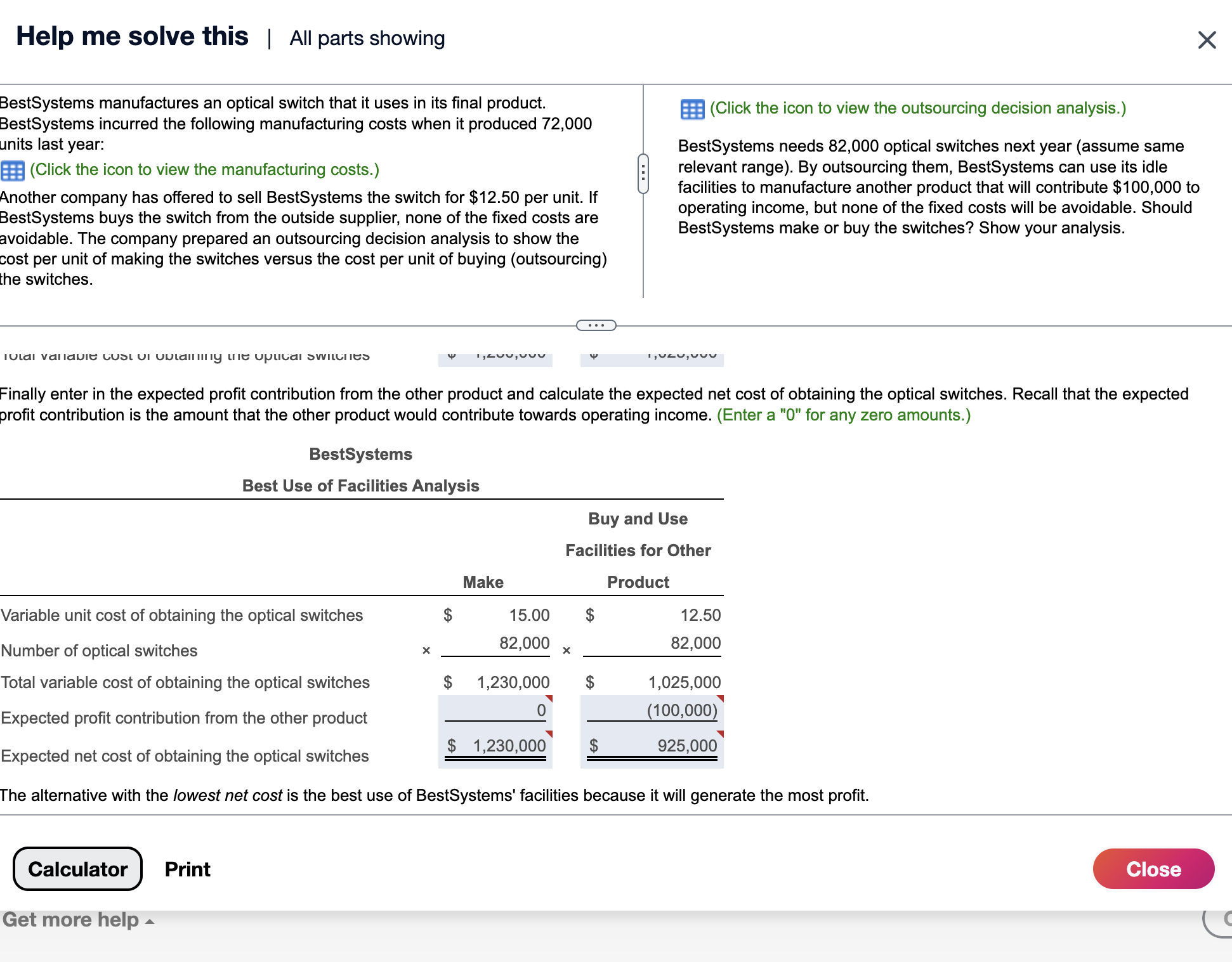

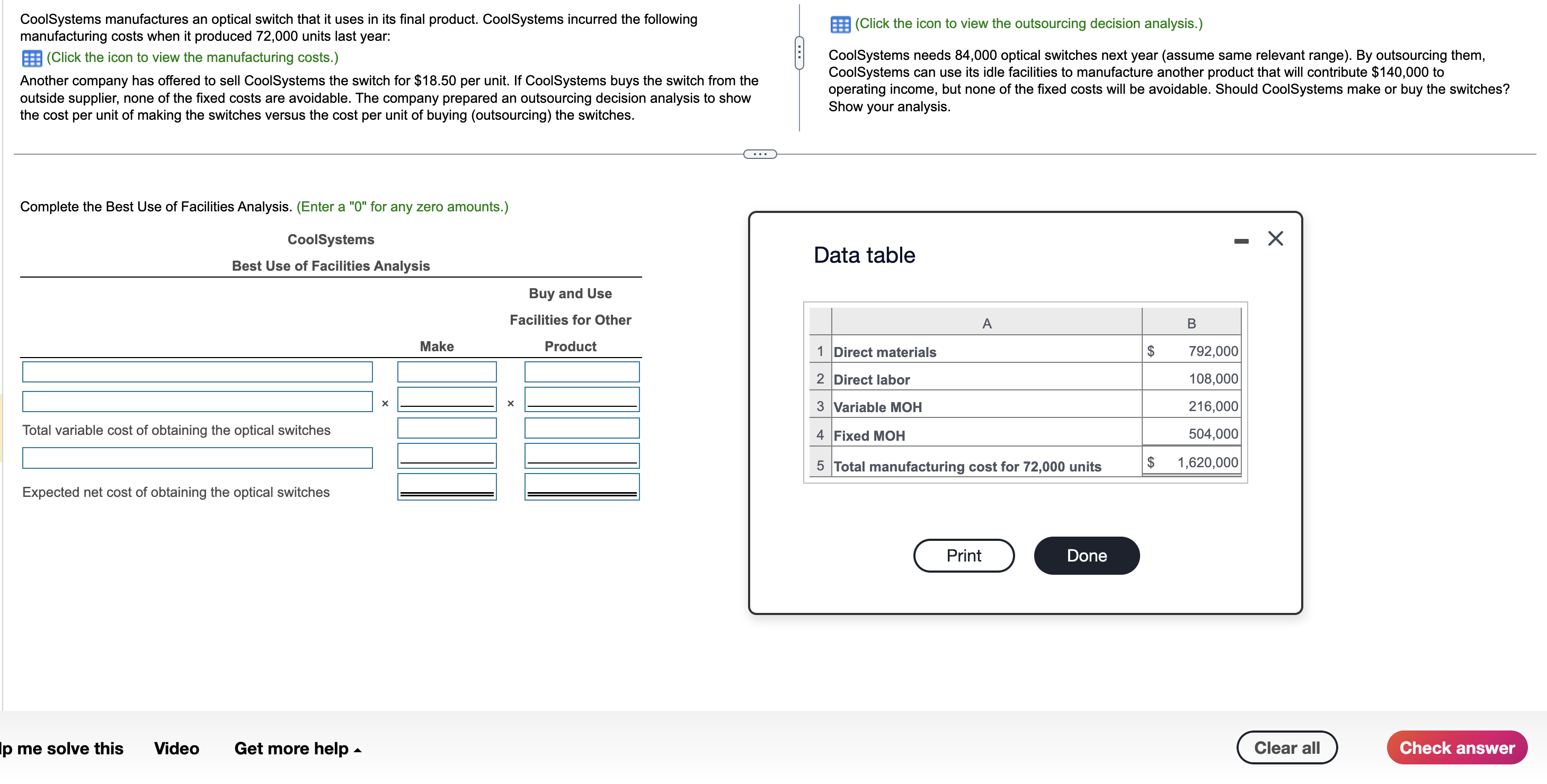

Help me solve this All parts showing BestSystems manufactures an optical switch that it uses in its final product. BestSystems incurred the following manufacturing costs when it produced 72,000 units last year: (Click the icon to view the manufacturing costs.) Another company has offered to sell BestSystems the switch for $12.50 per unit. If BestSystems buys the switch from the outside supplier, none of the fixed costs are avoidable. The company prepared an outsourcing decision analysis to show the cost per unit of making the switches versus the cost per unit of buying (outsourcing) the switches. (Click the icon to view the outsourcing decision analysis.) BestSystems needs 82,000 optical switches next year (assume same relevant range). By outsourcing them, BestSystems can use its idle facilities to manufacture another product that will contribute $100,000 to operating income, but none of the fixed costs will be avoidable. Should BestSystems make or buy the switches? Show your analysis. Finally enter in the expected profit contribution from the other product and calculate the expected net cost of obtaining the optical switches. Recall that the expected profit contribution is the amount that the other product would contribute towards operating income. (Enter a "0" for any zero amounts.) CoolSystems manufactures an optical switch that it uses in its final product. CoolSystems incurred the following manufacturing costs when it produced 72,000 units last year: (Click the icon to view the manufacturing costs.) Another company has offered to sell CoolSystems the switch for $18.50 per unit. If CoolSystems buys the switch from the outside supplier, none of the fixed costs are avoidable. The company prepared an outsourcing decision analysis to show the cost per unit of making the switches versus the cost per unit of buying (outsourcing) the switches. (Click the icon to view the outsourcing decision analysis.) CoolSystems needs 84,000 optical switches next year (assume same relevant range). By outsourcing them, CoolSystems can use its idle facilities to manufacture another product that will contribute $140,000 to operating income, but none of the fixed costs will be avoidable. Should CoolSystems make or buy the switches? Show your analysis. Complete the Best Use of Facilities Analysis. (Enter a "0" for any zero amounts.) Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts