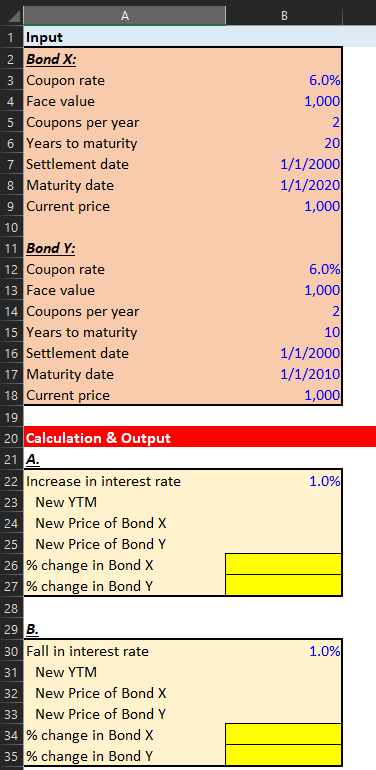

Question: Solve for missing values. SHOW FORMULAS B 6.0% 1,0001 2 201 1/1/2000 1/1/20201 1,000 1 Input 2 Bond X: 3 Coupon rate 4 Face value

Solve for missing values. SHOW FORMULAS

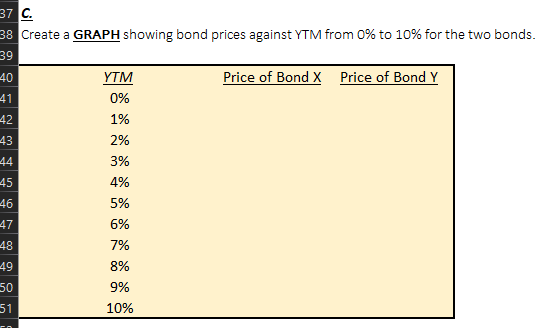

B 6.0% 1,0001 2 201 1/1/2000 1/1/20201 1,000 1 Input 2 Bond X: 3 Coupon rate 4 Face value 5 Coupons per year 6 Years to maturity 7 Settlement date 8 Maturity date 9 Current price 10 11 Bond Y: 12 Coupon rate 13 Face value 14 Coupons per year 15 Years to maturity 16 Settlement date 17 Maturity date 18 Current price 19 20 Calculation & Output 21 A. 22 Increase in interest rate 23 New YTM 24 New Price of Bond X 25 New Price of Bond Y 26 % change in Bond X 27 % change in Bond Y 28 29 B. 30 Fall in interest rate 31 New YTM 32 New Price of Bond X 33 New Price of Bond Y 34 % change in Bond X 35 % change in Bond Y 6.0% 1,000 21 101 1/1/20001 1/1/2010 1,000 1.0% 1.0%) 37 C. 38 Create a GRAPH showing bond prices against YTM from 0% to 10% for the two bonds. 39 40 Price of Bond X Price of Bond Y 41 42 43 44 45 YTM 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 46 47 48 49 50 51 B 6.0% 1,0001 2 201 1/1/2000 1/1/20201 1,000 1 Input 2 Bond X: 3 Coupon rate 4 Face value 5 Coupons per year 6 Years to maturity 7 Settlement date 8 Maturity date 9 Current price 10 11 Bond Y: 12 Coupon rate 13 Face value 14 Coupons per year 15 Years to maturity 16 Settlement date 17 Maturity date 18 Current price 19 20 Calculation & Output 21 A. 22 Increase in interest rate 23 New YTM 24 New Price of Bond X 25 New Price of Bond Y 26 % change in Bond X 27 % change in Bond Y 28 29 B. 30 Fall in interest rate 31 New YTM 32 New Price of Bond X 33 New Price of Bond Y 34 % change in Bond X 35 % change in Bond Y 6.0% 1,000 21 101 1/1/20001 1/1/2010 1,000 1.0% 1.0%) 37 C. 38 Create a GRAPH showing bond prices against YTM from 0% to 10% for the two bonds. 39 40 Price of Bond X Price of Bond Y 41 42 43 44 45 YTM 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 46 47 48 49 50 51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts