Question: Solve for Problem 1 (complete clear work plz, also showing how did u get the numbers). A manufacturing company which is composed of 5 partners

Solve for Problem 1 (complete clear work plz, also showing how did u get the numbers).

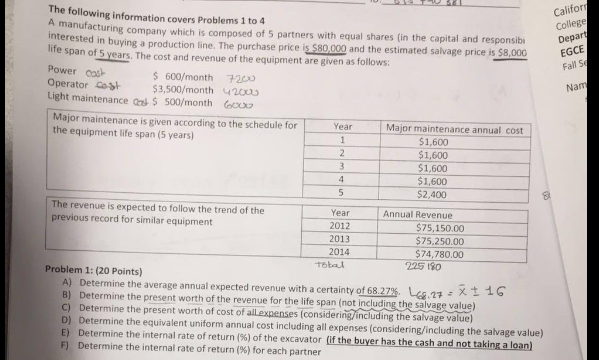

A manufacturing company which is composed of 5 partners with equal shares (in the capital and interested in buying a production line. purchase price is $80,000 and the estimated salvage price is $8,000 life span of 5 years. The cost and revenue of the equipment are given as follows: A) Determine the average annual expected revenue with a certainty of 68.27%. B) Determine the present worth of the revenue for the life span (not including the salvage value) C) Determine the present worth of cost of all expenses (consider/including the salvage value) D) Determine the equivalent uniform annual cost including all expenses (considering/including the salvage value) E) Determine the internal rate of return (%) of the excavator (if the buyer has the cash and not taking a loan) F) Determine the internal rate of return(%) for each partner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts