Question: Solve for: Problem 1-5 a.) Prepare necessary entries from January 1, 2017 to December 31, 2017 b.) What is the warranty liability on December 31,

Solve for:

Problem 1-5 a.) Prepare necessary entries from January 1, 2017 to December 31, 2017 b.) What is the warranty liability on December 31, 2017?

Problem 1-6 a.) Prepare necessary entries throughout 2017 and 2018 related to warranty. b.) On December 31, 2018, what is the estimated warranty liability balance?

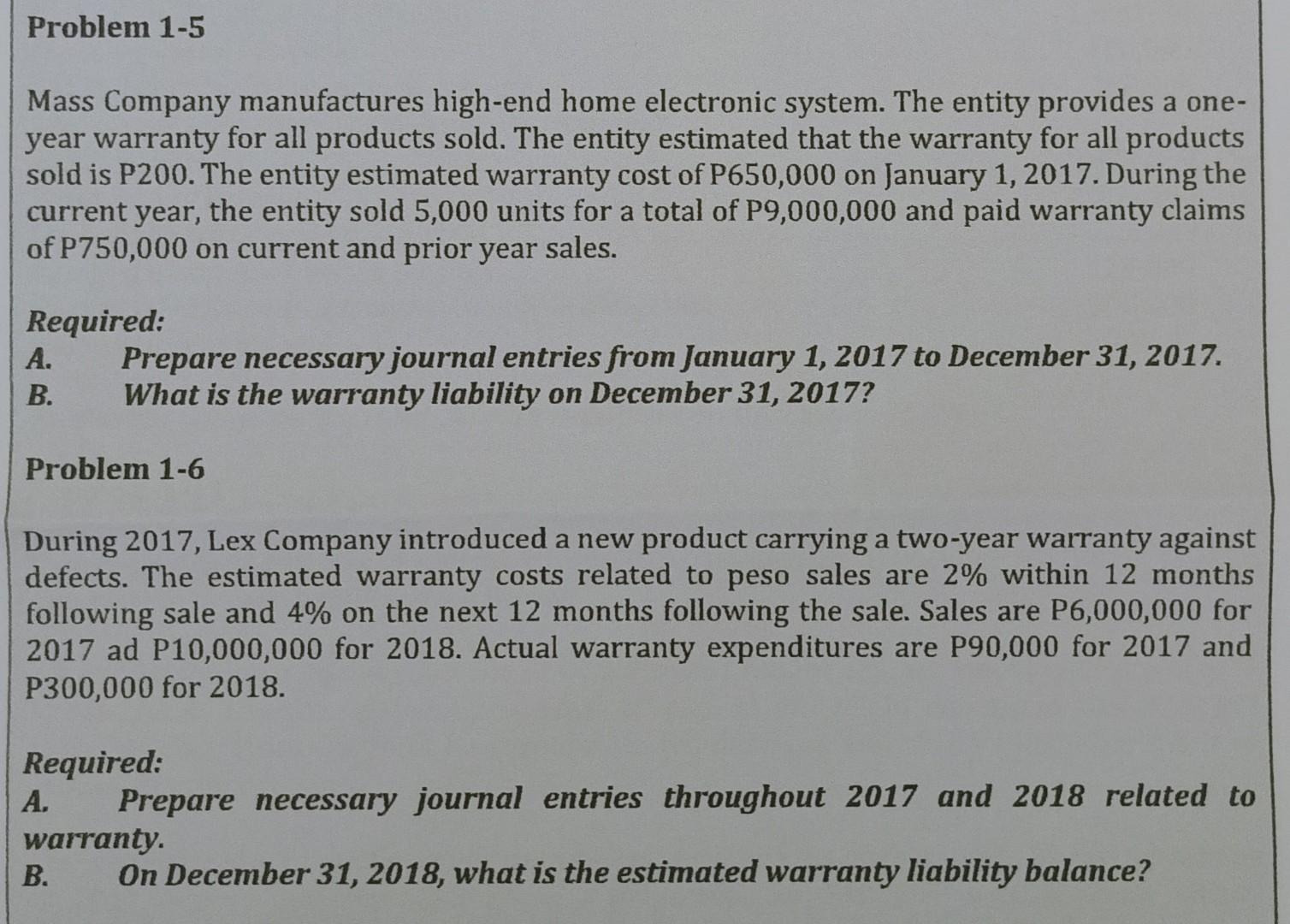

Problem 1-5 Mass Company manufactures high-end home electronic system. The entity provides a one- year warranty for all products sold. The entity estimated that the warranty for all products sold is P200. The entity estimated warranty cost of P650,000 on January 1, 2017. During the current year, the entity sold 5,000 units for a total of P9,000,000 and paid warranty claims of P750,000 on current and prior year sales. Required: A. Prepare necessary journal entries from January 1, 2017 to December 31, 2017 B. What is the warranty lia ty on December 31, 2017? Problem 1-6 During 2017, Lex Company introduced a new product carrying a two-year warranty against defects. The estimated warranty costs related to peso sales are 2% within 12 months following sale and 4% on the next 12 months following the sale. Sales are P6,000,000 for 2017 ad P10,000,000 for 2018. Actual warranty expenditures are P90,000 for 2017 and P300,000 for 2018. Required: A. Prepare necessary journal entries throughout 2017 and 2018 related to warranty. B. On December 31, 2018, what is the estimated warranty liability balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts