Question: Solve for question D and E: On December 31, 2015, Martin Corp invested in Marlin's 5-year, $200,000 bond with a 5% interest rate for $191,575.

Solve for question D and E:

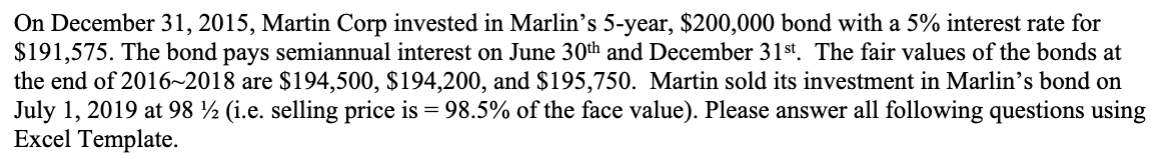

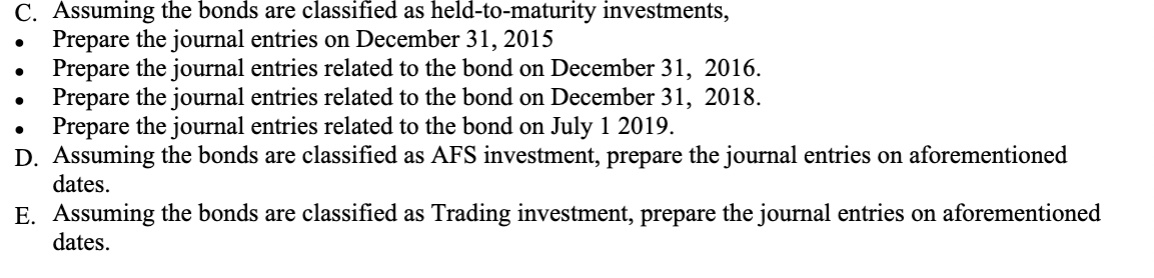

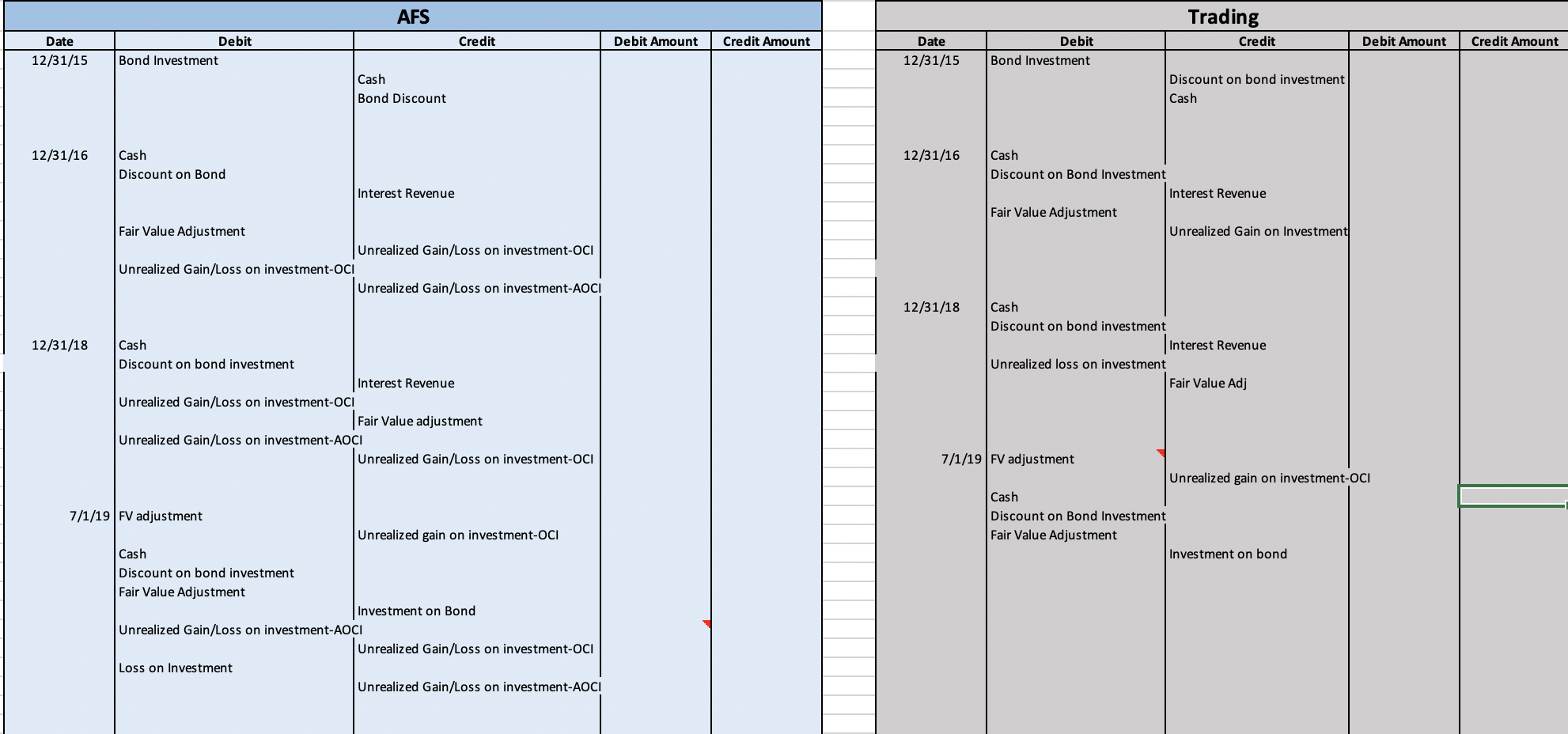

On December 31, 2015, Martin Corp invested in Marlin's 5-year, $200,000 bond with a 5% interest rate for $191,575. The bond pays semiannual interest on June 30th and December 31st. The fair values of the bonds at the end of 20162018 are $194,500, $194,200, and $195,750. Martin sold its investment in Marlin's bond on July 1, 2019 at 98 72 (i.e. selling price is = 98.5% of the face value). Please answer all following questions using Excel Template. . C. Assuming the bonds are classified as held-to-maturity investments, Prepare the journal entries on December 31, 2015 Prepare the journal entries related to the bond on December 31, 2016. Prepare the journal entries related to the bond on December 31, 2018. Prepare the journal entries related to the bond on July 1 2019. D. Assuming the bonds are classified as AFS investment, prepare the journal entries on aforementioned dates. E. Assuming the bonds are classified as Trading investment, prepare the journal entries on aforementioned dates. AFS Trading Credit Debit Amount Credit Amount Credit Debit Amount Credit Amount Date 12/31/15 Debit Bond Investment Date 12/31/15 Debit Bond Investment Cash Bond Discount Discount on bond investment Cash 12/31/16 12/31/16 Cash Discount on Bond Interest Revenue Cash Discount on Bond Investment Interest Revenue Fair Value Adjustment Unrealized Gain on Investment Fair Value Adjustment Unrealized Gain/Loss on investment-OCI Unrealized Gain/Loss on investment-OCI Unrealized Gain/Loss on investment-AOCI 12/31/18 12/31/18 Cash Discount on bond investment Interest Revenue Unrealized loss on investment Fair Value Adj Cash Discount on bond investment Interest Revenue Unrealized Gain/Loss on investment-OC! |Fair Value adjustment Unrealized Gain/Loss on investment-AOCI Unrealized Gain/Loss on investment-OCI 7/1/19 FV adjustment Unrealized gain on investment-OCI Cash Discount on Bond Investment Fair Value Adjustment Investment on bond 7/1/19 FV adjustment Unrealized gain on investment-OCI Cash Discount on bond investment Fair Value Adjustment Investment on Bond Unrealized Gain/Loss on investment-AOCI Unrealized Gain/Loss on investment-OCI Loss on Investment Unrealized Gain/Loss on investment-AOCI On December 31, 2015, Martin Corp invested in Marlin's 5-year, $200,000 bond with a 5% interest rate for $191,575. The bond pays semiannual interest on June 30th and December 31st. The fair values of the bonds at the end of 20162018 are $194,500, $194,200, and $195,750. Martin sold its investment in Marlin's bond on July 1, 2019 at 98 72 (i.e. selling price is = 98.5% of the face value). Please answer all following questions using Excel Template. . C. Assuming the bonds are classified as held-to-maturity investments, Prepare the journal entries on December 31, 2015 Prepare the journal entries related to the bond on December 31, 2016. Prepare the journal entries related to the bond on December 31, 2018. Prepare the journal entries related to the bond on July 1 2019. D. Assuming the bonds are classified as AFS investment, prepare the journal entries on aforementioned dates. E. Assuming the bonds are classified as Trading investment, prepare the journal entries on aforementioned dates. AFS Trading Credit Debit Amount Credit Amount Credit Debit Amount Credit Amount Date 12/31/15 Debit Bond Investment Date 12/31/15 Debit Bond Investment Cash Bond Discount Discount on bond investment Cash 12/31/16 12/31/16 Cash Discount on Bond Interest Revenue Cash Discount on Bond Investment Interest Revenue Fair Value Adjustment Unrealized Gain on Investment Fair Value Adjustment Unrealized Gain/Loss on investment-OCI Unrealized Gain/Loss on investment-OCI Unrealized Gain/Loss on investment-AOCI 12/31/18 12/31/18 Cash Discount on bond investment Interest Revenue Unrealized loss on investment Fair Value Adj Cash Discount on bond investment Interest Revenue Unrealized Gain/Loss on investment-OC! |Fair Value adjustment Unrealized Gain/Loss on investment-AOCI Unrealized Gain/Loss on investment-OCI 7/1/19 FV adjustment Unrealized gain on investment-OCI Cash Discount on Bond Investment Fair Value Adjustment Investment on bond 7/1/19 FV adjustment Unrealized gain on investment-OCI Cash Discount on bond investment Fair Value Adjustment Investment on Bond Unrealized Gain/Loss on investment-AOCI Unrealized Gain/Loss on investment-OCI Loss on Investment Unrealized Gain/Loss on investment-AOCI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts