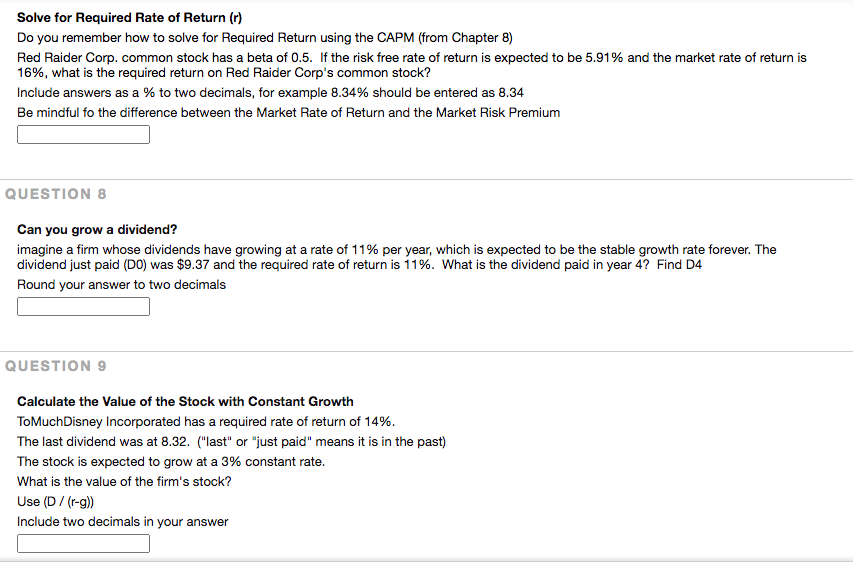

Question: Solve for Required Rate of Return (r) Do you remember how to solve for Required Return using the CAPM (from Chapter 8) Red Raider Corp.

Solve for Required Rate of Return (r) Do you remember how to solve for Required Return using the CAPM (from Chapter 8) Red Raider Corp. common stock has a beta of 0.5. If the risk free rate of return is expected to be 5.91% and the market rate of return is 16%, what is the required return on Red Raider Corp's common stock? Include answers as a % to two decimals, for example 8.34% should be entered as 8.34 Be mindful fo the difference between the Market Rate of Return and the Market Risk Premium QUESTION 8 Can you grow a dividend? imagine a firm whose dividends have growing at a rate of 11% per year, which is expected to be the stable growth rate forever. The dividend just paid (DO) was $9.37 and the required rate of return is 11%. What is the dividend paid in year 4? Find D4 Round your answer to two decimals QUESTION 9 Calculate the value of the Stock with Constant Growth To Much Disney Incorporated has a required rate of return of 14%. The last dividend was at 8.32. ("last" or "just paid" means it is in the past) The stock is expected to grow at a 3% constant rate. What is the value of the firm's stock? Use (D/(r-9)) Include two decimals in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts