Question: SOLVE FOR THE IRR 06.01-PR005 WP Nu Things, Inc., is considering an investment in a business venture with the fol- lowing anticipated cash flow results:

SOLVE FOR THE IRR

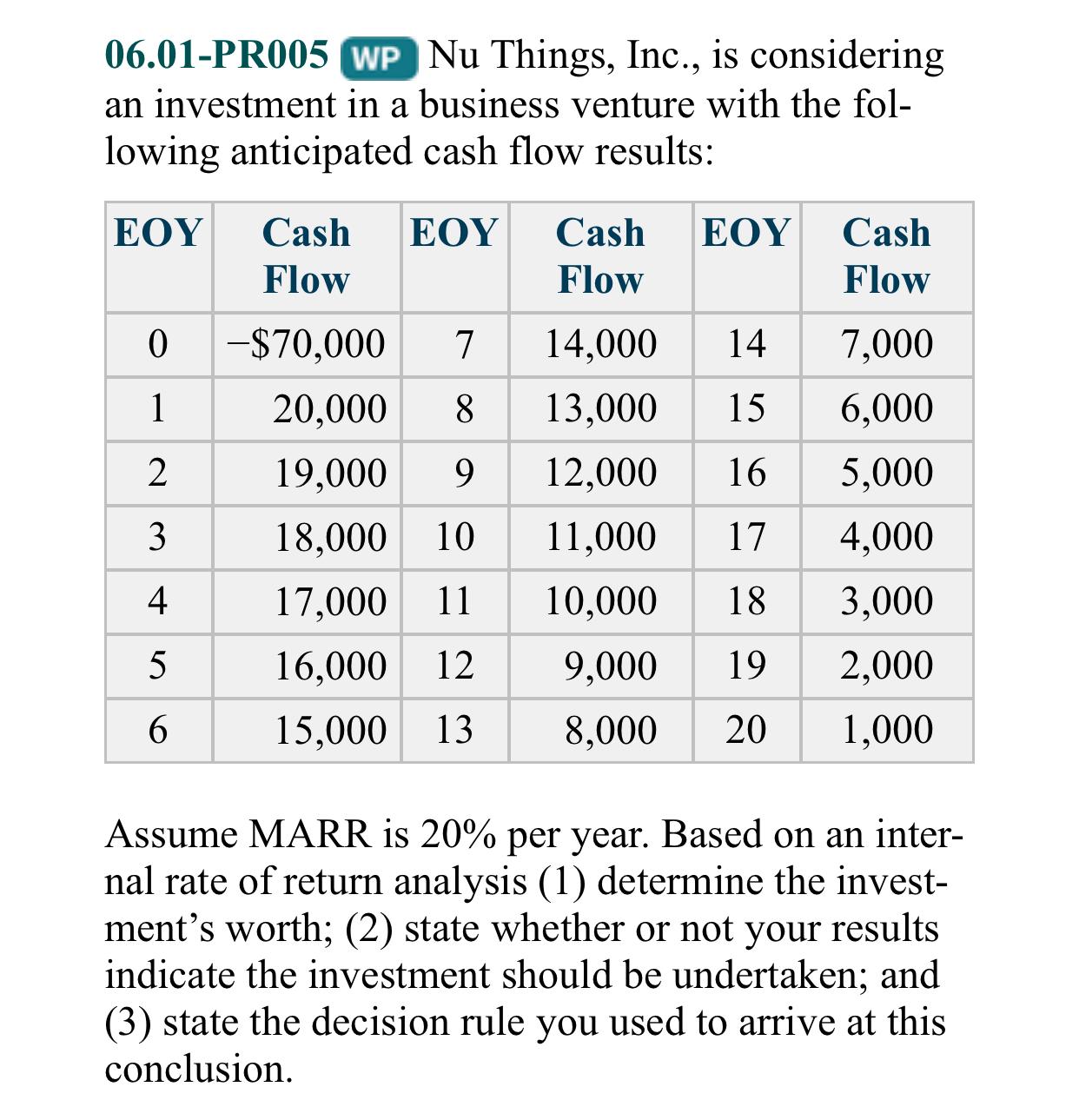

06.01-PR005 WP Nu Things, Inc., is considering an investment in a business venture with the fol- lowing anticipated cash flow results: EOY Cash EOY Cash EOY Cash Flow Flow Flow O -$70,000 7 14,000 14 7,000 20,000 8 13,000 15 6,000 2 19,000 9 12,000 16 5,000 3 18,000 10 11,000 17 4,000 4 17,000 11 10,000 18 3,000 UI 16,000 12 9,000 19 2,000 6 15,000 13 8,000 20 1,000 Assume MARR is 20% per year. Based on an inter- nal rate of return analysis (1) determine the invest- ment's worth; (2) state whether or not your results indicate the investment should be undertaken; and (3) state the decision rule you used to arrive at this conclusion.06.01-PR005 WP Nu Things, Inc., is considering an investment in a business venture with the fol- lowing anticipated cash flow results: EOY Cash EOY Cash EOY Cash Flow Flow Flow O -$70,000 7 14,000 14 7,000 20,000 8 13,000 15 6,000 2 19,000 9 12,000 16 5,000 3 18,000 10 11,000 17 4,000 4 17,000 11 10,000 18 3,000 UI 16,000 12 9,000 19 2,000 6 15,000 13 8,000 20 1,000 Assume MARR is 20% per year. Based on an inter- nal rate of return analysis (1) determine the invest- ment's worth; (2) state whether or not your results indicate the investment should be undertaken; and (3) state the decision rule you used to arrive at this conclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts