Question: solve for the missing blank, if you post a picture or a PDF please make sure if it's for a thumbs up Purchase of raw

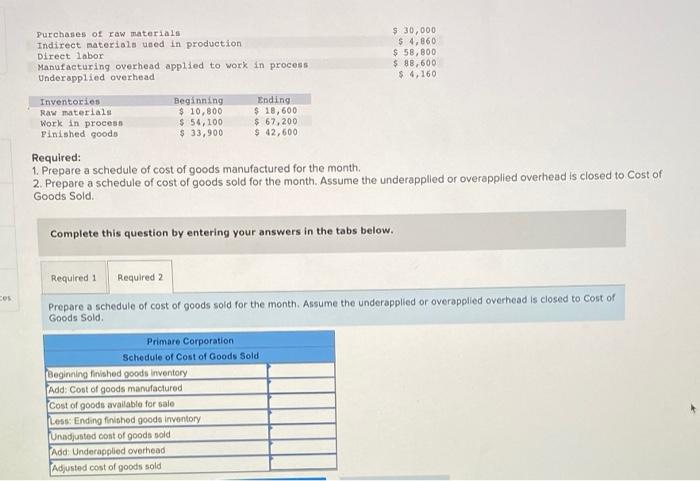

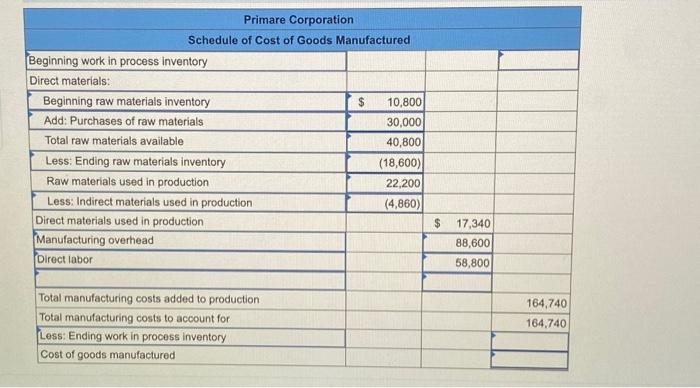

Purchase of raw materials Indirect materials used in production Direct labor Manufacturing overhead applied to work in process Underapplied overhead $ 30,000 $ 4,860 $ 58,800 $ 88,600 $ 4,160 Inventories Raw materials Work in process Finished goods Beginning $ 10,800 $ 54,100 $ 33,900 Ending $ 18,600 $ 67,200 $ 42,600 Required: 1. Prepare a schedule of cost of goods manufactured for the month. 2. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to cost of Goods Sold Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to cost of Goods Sold Primare Corporation Schedule of Cost of Goods Sold Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less Ending finished goods inventory nadjusted cost of goods sold Add: Underapplied overhead Adjusted cost of goods sold $ Primare Corporation Schedule of Cost of Goods Manufactured Beginning work in process inventory Direct materials: Beginning raw materials inventory 10.800 Add: Purchases of raw materials 30,000 Total raw materials available 40,800 Less: Ending raw materials inventory (18,600) Raw materials used in production 22,200 Less: Indirect materials used in production (4,860) Direct materials used in production Manufacturing overhead Direct labor $ 17,340 88,600 58,800 Total manufacturing costs added to production Total manufacturing costs to account for Less Ending work in process inventory Cost of goods manufactured 164,740 164,740

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts