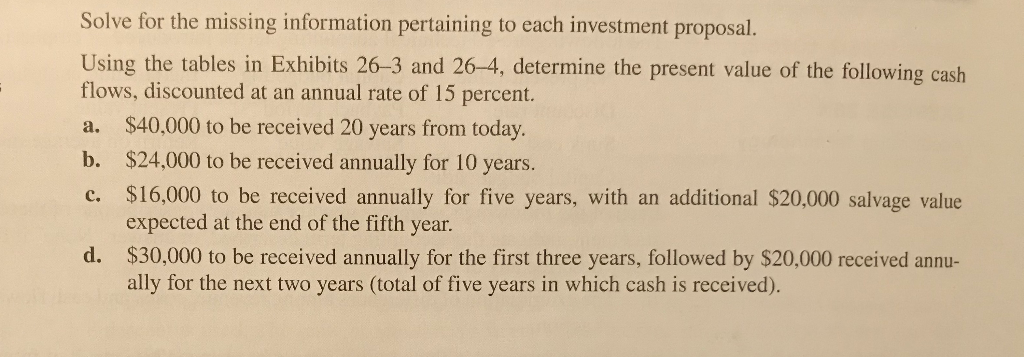

Question: Solve for the missing information pertaining to each investment proposal. Using the tables in Exhibits 263 and 26-4, determine the present value of the following

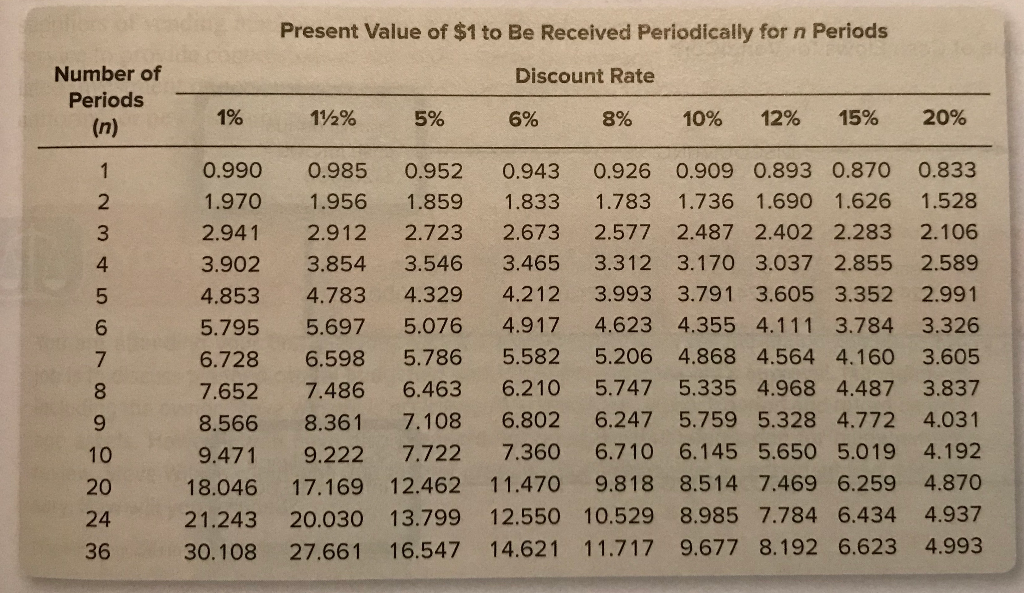

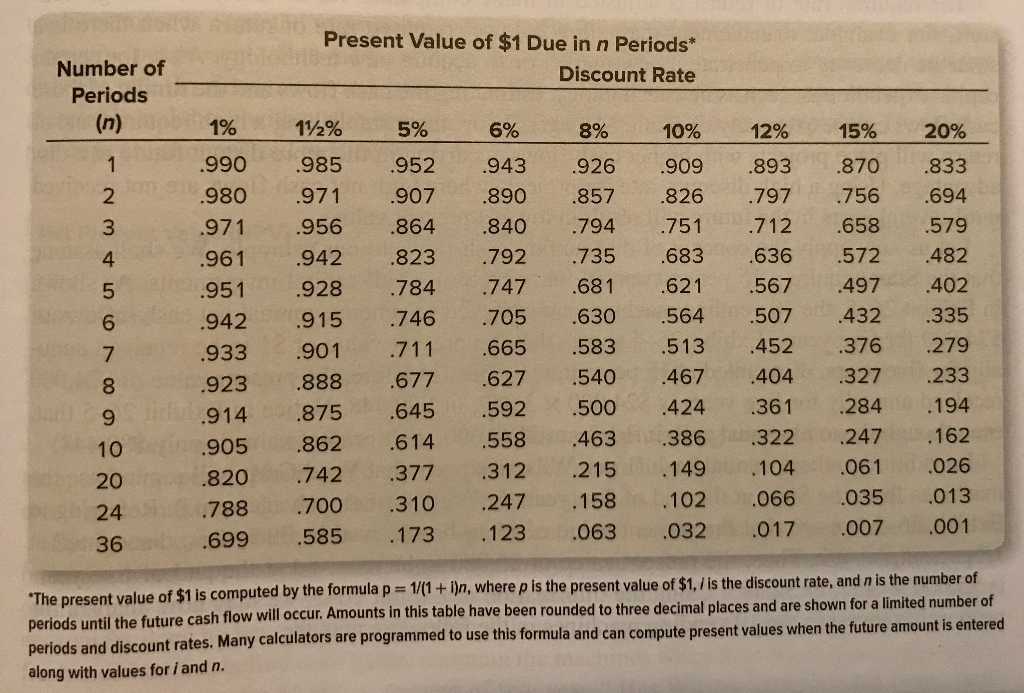

Solve for the missing information pertaining to each investment proposal. Using the tables in Exhibits 263 and 26-4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent. a. $40,000 to be received 20 years from today. b. $24,000 to be received annually for 10 years. c. $16,000 to be received annually for five years, with an additional $20,000 salvage value expected at the end of the fifth year. d. $30,000 to be received annually for the first three years, followed by $20,000 received annu- ally for the next two years (total of five years in which cash is received). Present Value of $1 to Be Received Periodically for n Periods Number of Periods Discount Rate 6% 8% 1% 192% 5% 10% 12% 15% 20% Ovou AWN 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 18.046 21.243 30.108 0.985 0.952 0.943 0.926 0.909 0.893 0.870 0.833 1.956 1.859 1.833 1.783 1.736 1.690 1.626 1.528 2.912 2.723 2.673 2.577 2.487 2.402 2.283 2.106 3.854 3.546 3.465 3.312 3.170 3.037 2.855 2.589 4.783 4.329 4.212 3.993 3.791 3.605 3.352 2.991 5.697 5.076 4.917 4.623 4.355 4.111 3.784 3.326 6.598 5.786 5.582 5.206 4.868 4.564 4.160 3.605 7.486 6.463 6.210 5.747 5.335 4.968 4.487 3.837 8.361 7.108 6.802 6.247 5.759 5.328 4.772 4.031 9.222 7.722 7.360 6.710 6.145 5.650 5.019 4.192 17.169 12.462 11.470 9.818 8.514 7.469 6.259 4.870 20.030 13.799 12.550 10.529 8.985 7.784 6.434 4.937 27.661 16.547 14.621 11.717 9.677 8.192 6.623 4.993 Present Value of $1 Due in n Periods* Discount Rate Number of Periods (n) 1% 12% .893 .797 600 OUT AWN- .990 .980 .971 .961 .951 .942 .933 .923 .914 .905 .820 788 699 112% .985 .971 .956 .942 .928 .915 .901 .888 .875 .862 .742 .700 .585 5% .952 .907 .864 .823 .784 .746 711 6% .943 .890 .840 .792 .747 .705 .665 .627 .592 .558 .312 .247 .123 8% .926 .857 .794 .735 .681 .630 .583 .540 .500 .463 .215 .158 .063 10% .909 .826 .751 .683 .621 .564 .513 .467 424 .386 149 .102 .032 15% .870 .756 .658 .572 .497 432 .376 .327 .284 .247 061 .035 .007 .712 .636 .567 .507 .452 .404 .361 .322 .104 .066 .017 20% .833 .694 .579 .482 .402 .335 .279 .233 .194 .162 026 .013 .001 .677 10 20 24 .645 .614 .377 .310 .173 36 *The present value of $1 is computed by the formula p = 1/(1+i)n, where p is the present value of $1,/ is the discount rate, and n is the number of periods until the future cash flow will occur. Amounts in this table have been rounded to three decimal places and are shown for a limited number of periods and discount rates. Many calculators are programmed to use this formula and can compute present values when the future amount is entered along with values for i and n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts