Question: solve in 20 mins I will thumb up 5 Your company aims at acquiring another company. With the limited information available, you try to do

solve in 20 mins I will thumb up

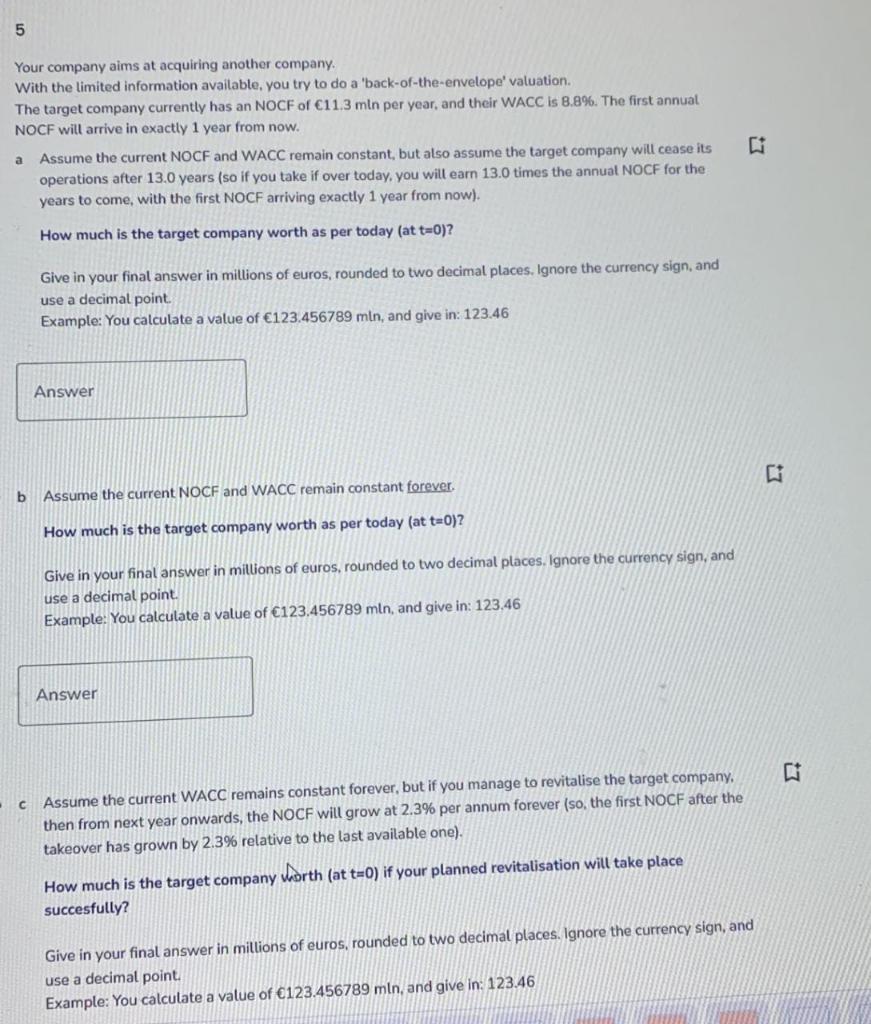

5 Your company aims at acquiring another company. With the limited information available, you try to do a 'back-of-the-envelope' valuation The target company currently has an NOCF of 11.3 min per year, and their WACC is 8.8%. The first annual NOCF will arrive in exactly 1 year from now. a Assume the current NOCF and WACC remain constant, but also assume the target company will cease its operations after 13.0 years (so if you take if over today, you will earn 13.0 times the annual NOCF for the years to come, with the first NOCF arriving exactly 1 year from now). How much is the target company worth as per today (at t=0)? Give in your final answer in millions of euros, rounded to two decimal places. Ignore the currency sign, and use a decimal point. Example: You calculate a value of 123.456789 min, and give in: 123.46 Answer 27 b Assume the current NOCF and WACC remain constant forever. How much is the target company worth as per today (at t=0)? Give in your final answer in millions of euros, rounded to two decimal places. Ignore the currency sign, and use a decimal point. Example: You calculate a value of 123.456789 mln, and give in: 123.46 Answer 27 Assume the current WACC remains constant forever, but if you manage to revitalise the target company, then from next year onwards, the NOCF will grow at 2.3% per annum forever (so, the first NOCF after the takeover has grown by 2.3% relative to the last available one). How much is the target company worth (at t=0) if your planned revitalisation will take place succesfully? Give in your final answer in millions of euros, rounded to two decimal places. Ignore the currency sign, and use a decimal point Example: You calculate a value of 123.456789 mln, and give in: 123.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts