Question: solve in 30 mins i will give thumb up Consider the above graph that shows demand for excess reserves by the banking system as a

solve in 30 mins i will give thumb up

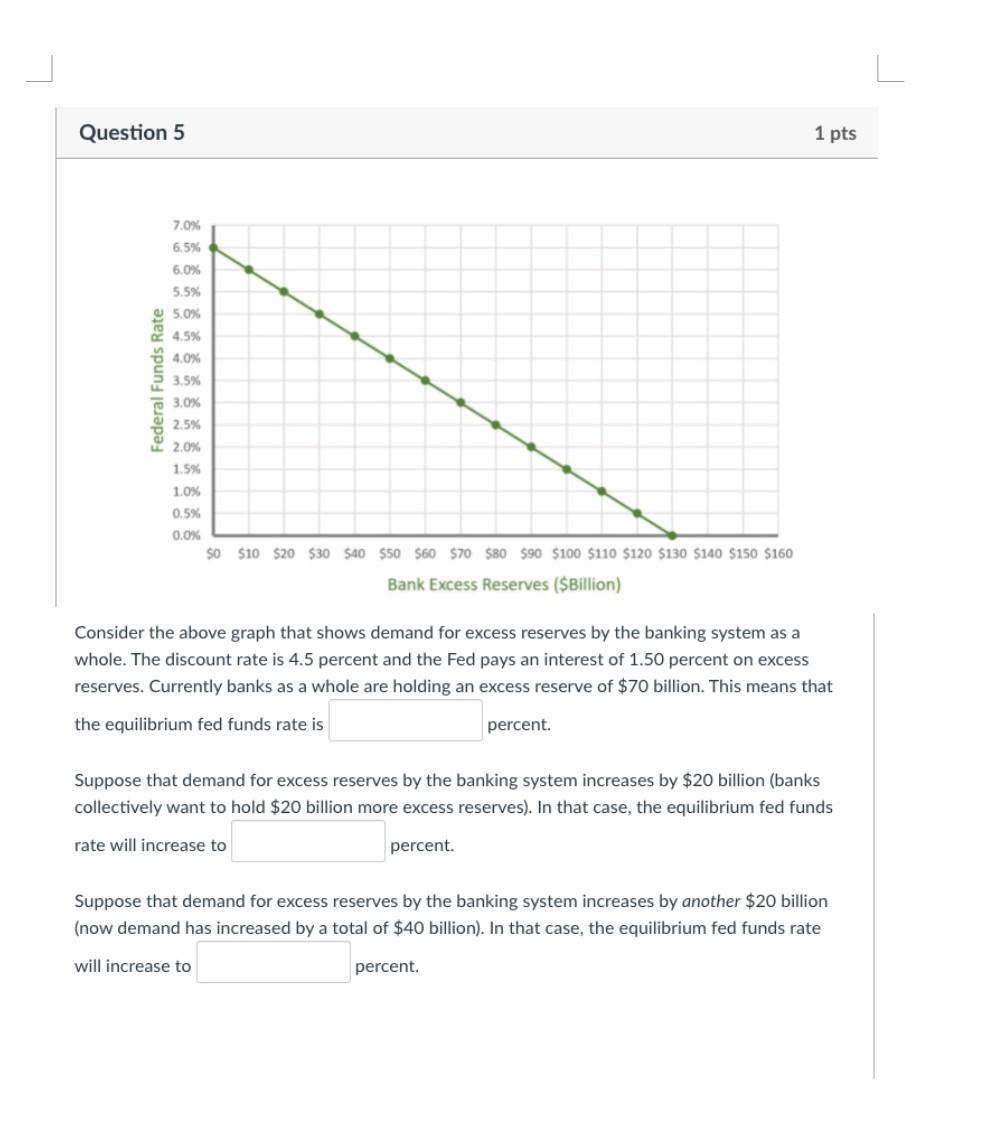

Consider the above graph that shows demand for excess reserves by the banking system as a whole. The discount rate is 4.5 percent and the Fed pays an interest of 1.50 percent on excess reserves. Currently banks as a whole are holding an excess reserve of $70 billion. This means that the equilibrium fed funds rate is percent. Suppose that demand for excess reserves by the banking system increases by $20 billion (banks collectively want to hold $20 billion more excess reserves). In that case, the equilibrium fed funds rate will increase to percent. Suppose that demand for excess reserves by the banking system increases by another $20 billion (now demand has increased by a total of $40 billion). In that case, the equilibrium fed funds rate will increase to percent. Consider the above graph that shows demand for excess reserves by the banking system as a whole. The discount rate is 4.5 percent and the Fed pays an interest of 1.50 percent on excess reserves. Currently banks as a whole are holding an excess reserve of $70 billion. This means that the equilibrium fed funds rate is percent. Suppose that demand for excess reserves by the banking system increases by $20 billion (banks collectively want to hold $20 billion more excess reserves). In that case, the equilibrium fed funds rate will increase to percent. Suppose that demand for excess reserves by the banking system increases by another $20 billion (now demand has increased by a total of $40 billion). In that case, the equilibrium fed funds rate will increase to percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts