Question: solve in 35 mins i will give thumb up . 1 Problem 1 (7 marks) (14 minutes) 2 Michael Inc., a publicly accountable entity, sells

solve in 35 mins i will give thumb up

.

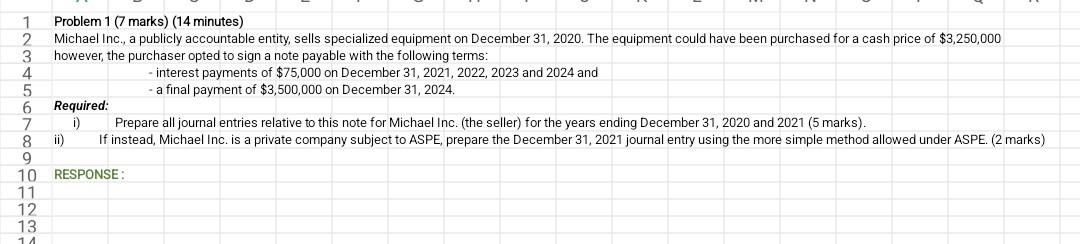

1 Problem 1 (7 marks) (14 minutes) 2 Michael Inc., a publicly accountable entity, sells specialized equipment on December 31,2020 . The equipment could have been purchased for a cash price of $3,250,000 3 however, the purchaser opted to sign a note payable with the following terms: - interest payments of $75,000 on December 31, 2021, 2022, 2023 and 2024 and - a final payment of $3,500,000 on December 31, 2024. Required: i) Prepare all journal entries relative to this note for Michael Inc. (the seller) for the years ending December 31,2020 and 2021 ( 5 marks). ii) If instead, Michael Inc. is a private company subject to ASPE, prepare the December 31,2021 journal entry using the more simple method allowed under ASPE. (2 marks) 10 RESPONSE: 11 12 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts