Question: solve in 40 mins I will give you thumb up - Market value of di bt: 3000 milion - Number of shares issued: 100 million

solve in 40 mins I will give you thumb up

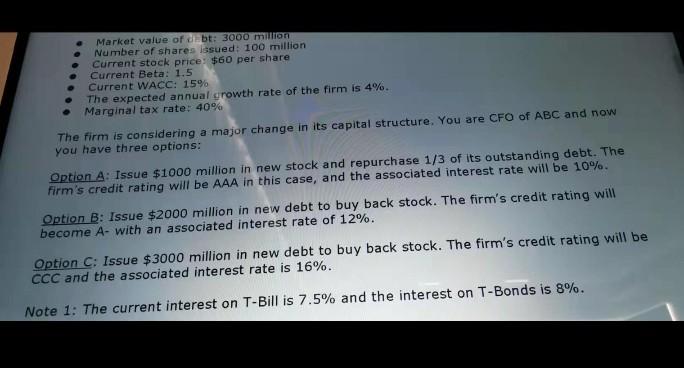

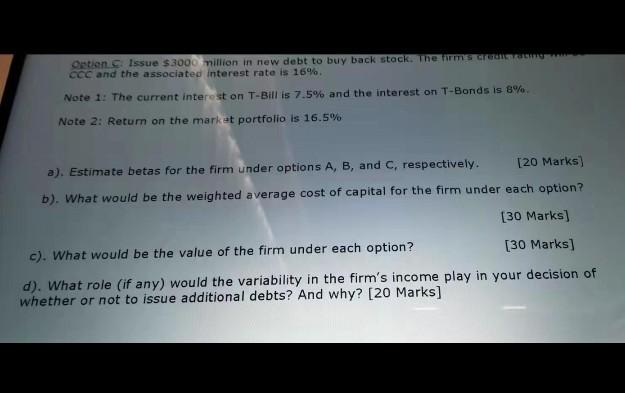

- Market value of di bt: 3000 milion - Number of shares issued: 100 million - Current stock price: $60 per share - Current Beta: 1.5 - Current WACC: 15% - The expected annual growth rate of the firm is 4%. - Marginal tax rate: 40% The firm is considering a major change in its capital structure. You are CFO of ABC and now you have three options: Option A: Issue $1000 million in new stock and repurchase 1/3 of its outstanding debt. The firm's credit rating will be AAA in this case, and the associated interest rate will be 10%. Option B: Issue $2000 million in new debt to buy back stock. The firm's credit rating will become A - with an associated interest rate of 12%. Option C: Issue $3000 million in new debt to buy back stock. The firm's credit rating will be CCC and the associated interest rate is 16% Vote 1: The current interest on T-Bill is 7.5% and the interest on T-Bonds is 8%. crc and the associated interest rate is 16%. Note 1: The current interest on T-Bil is 7.5% and the interest-on T-Bonds is 8% Note 2: Return on the market portfolio is 16.5% a). Estimate betas for the firm under options A,B, and C, respectively. [20 Marks] b). What would be the weighted average cost of capital for the firm under each option? [30 Marks] c). What would be the value of the firm under each option? [30 Marks] d). What role (if any) would the variability in the firm's income play in your decision of whether or not to issue additional debts? And why? [20 Marks] - Market value of di bt: 3000 milion - Number of shares issued: 100 million - Current stock price: $60 per share - Current Beta: 1.5 - Current WACC: 15% - The expected annual growth rate of the firm is 4%. - Marginal tax rate: 40% The firm is considering a major change in its capital structure. You are CFO of ABC and now you have three options: Option A: Issue $1000 million in new stock and repurchase 1/3 of its outstanding debt. The firm's credit rating will be AAA in this case, and the associated interest rate will be 10%. Option B: Issue $2000 million in new debt to buy back stock. The firm's credit rating will become A - with an associated interest rate of 12%. Option C: Issue $3000 million in new debt to buy back stock. The firm's credit rating will be CCC and the associated interest rate is 16% Vote 1: The current interest on T-Bill is 7.5% and the interest on T-Bonds is 8%. crc and the associated interest rate is 16%. Note 1: The current interest on T-Bil is 7.5% and the interest-on T-Bonds is 8% Note 2: Return on the market portfolio is 16.5% a). Estimate betas for the firm under options A,B, and C, respectively. [20 Marks] b). What would be the weighted average cost of capital for the firm under each option? [30 Marks] c). What would be the value of the firm under each option? [30 Marks] d). What role (if any) would the variability in the firm's income play in your decision of whether or not to issue additional debts? And why? [20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts