Question: solve in detailed explaination using the solution posted with the question 38 An aggressive stockbroker claims an ability to consistently earn 12% per year on

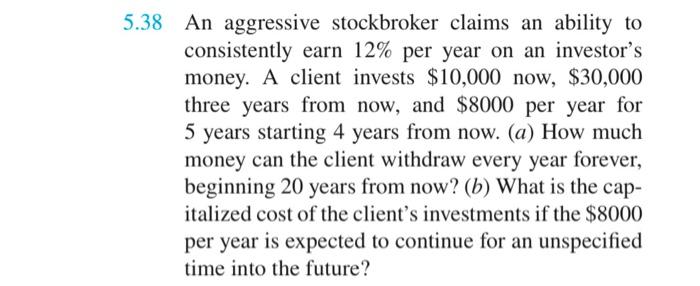

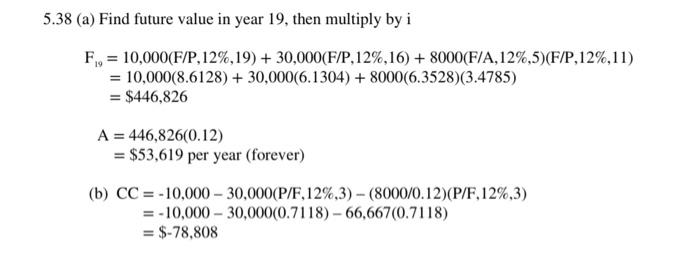

38 An aggressive stockbroker claims an ability to consistently earn 12% per year on an investor's money. A client invests $10,000 now, $30,000 three years from now, and $8000 per year for 5 years starting 4 years from now. (a) How much money can the client withdraw every year forever, beginning 20 years from now? (b) What is the capitalized cost of the client's investments if the $8000 per year is expected to continue for an unspecified time into the future? 38 (a) Find future value in year 19 , then multiply by i F19A=10,000(F/P,12%,19)+30,000(F/P,12%,16)+8000(F/A,12%,5)(F/P,12%,11)=10,000(8.6128)+30,000(6.1304)+8000(6.3528)(3.4785)=$446,826=446,826(0.12)=$53,619peryear(forever) (b) CC=10,00030,000(P/F,12%,3)(8000/0.12)(P/F,12%,3)=10,00030,000(0.7118)66,667(0.7118)=$78,808

Step by Step Solution

There are 3 Steps involved in it

To solve the problem we need to calculate two things the annual withdrawal that can be made forever ... View full answer

Get step-by-step solutions from verified subject matter experts