Question: solve in Excel using formula text function Question 4 [based on Chapter 12} Angola Superheros, Inc. is considering launching a production of a new superhero

solve in Excel using formula text function

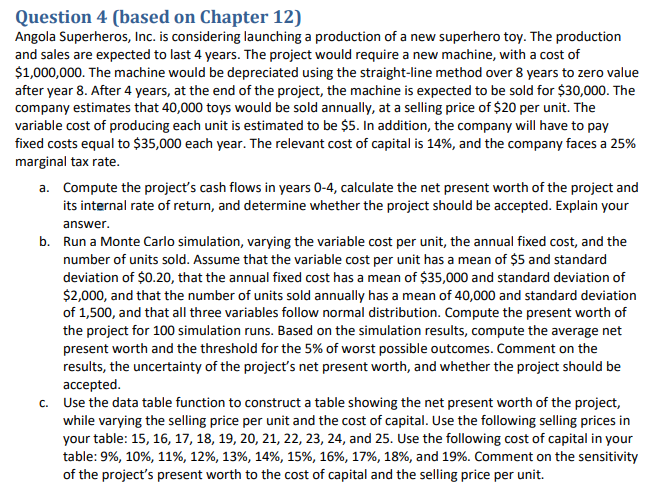

Question 4 [based on Chapter 12} Angola Superheros, Inc. is considering launching a production of a new superhero toy. The production and sales are expected to last 4 years. The project would require a new machine, with a cost of 51,0oo,ooo. The machine would he depreciated using the straightsline method over 3 years to zero value after year 3. After 4 years, at the end of the project, the machine is expected to he sold for sooooo. The company estimates that 4U,Dl} toys would he sold annually, at a selling price of $20 per unit. The varia hie cost of producing each unit is estimated to he 55. In addition, the company will have to pay xed costs equal to $35,000 each year. The relevant cost of capital is 14%, and the oornpany faces a 25% marginal tax rate. a. Compute the project's cash flows in years til-4, calculate the net present worth of the project and its intlrnal rate of return, and determine whether the project should he accepted. Explain your answer. I]. Run a Monte Carlo simulation, varying the variable cost per unit, the annual fixed cost, and the number of units sold. Assume that the variable cost per unit has a mean of $5 and standard deviation of $0.205 that the annual xed cost has a mean of $35,0DD and standard devialjon of 52,D, and that the number of units sold annually has a mean of 4D,DIII and standard deviation of 1,500, and that all three variables follow normal distribution. Compute the present worth of the project for l simulation runs. Based on the simulation results, compute the average net present worth and the threshold for the 5% of worst possible outcomes. Comment on the results, the uncertainty of the project' 5 net present worth, and whether the project should he accepted. c. Use the data table function to construct a table showing the net present worth of the project, while varying the selling price per unit and the mi of capital. Use the following selling prices in 1your table: 15, 15, 1?, 18, 19, 2D, 21, 12, 13, 24, and 25. Use the following cost of capital in your table: 9%, 1095, 1195, 12s., 1395, 14%, 15%, 16%, ms, 13%, and 1995. Comment on the sensitivity of the project's present worth to the cost of capital and the selling price per unit