Question: Solve in full detail with step by step How do I make an income statement and t accounts for this? During May 2021 the following

Solve in full detail with step by step

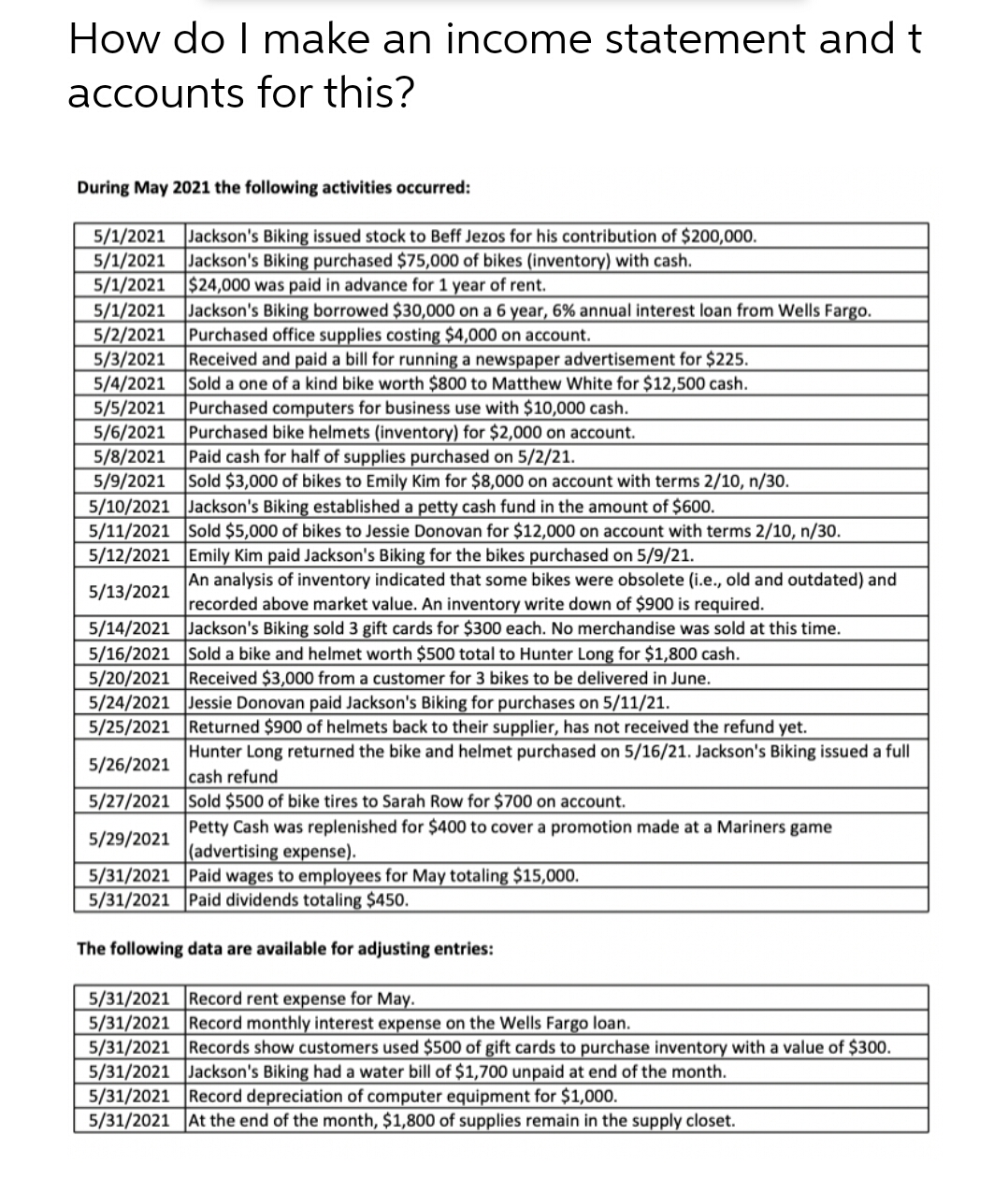

How do I make an income statement and t accounts for this? During May 2021 the following activities occurred: 5/1/2021 Jackson's Biking issued stock to Beff Jezos for his contribution of $200,000 5/1/2021 Jackson's Biking purchased $75,000 of bikes (inventory) with cash 5/1/2021 $24,000 was paid in advance for 1 year of rent. 5/1/2021 Jackson's Biking borrowed $30,000 on a 6 year, 6% annual interest loan from Wells Fargo. 5/2/2021 Purchased office supplies costing $4,000 on account 5/3/2021 Received and paid a bill for running a newspaper advertisement for $225. 5/4/2021 Sold a one of a kind bike worth $800 to Matthew White for $12,500 cash 5/5/2021 Purchased computers for business use with $10,000 cash. 5/6/2021 Purchased bike helmets (inventory) for $2,000 on account. 5/8/2021 Paid cash for half of supplies purchased on 5/2/21. 5/9/2021 Sold $3,000 of bikes to Emily Kim for $8,000 on account with terms 2/10, n/30. 5/10/2021 Jackson's Biking established a petty cash fund in the amount of $600 5/11/2021 Sold $5,000 of bikes to Jessie Donovan for $12,000 on account with terms 2/10, n/30. 5/12/2021 Emily Kim paid Jackson's Biking for the bikes purchased on 5/9/21. 5/13/2021 An analysis of inventory indicated that some bikes were obsolete (i.e., old and outdated) and recorded above market value. An inventory write down of $900 is required. 5/14/2021 Jackson's Biking sold 3 gift cards for $300 each. No merchandise was sold at this time. 5/16/2021 Sold a bike and helmet worth $500 total to Hunter Long for $1,800 cash. 5/20/2021 Received $3,000 from a customer for 3 bikes to be delivered in June 5/24/2021 Jessie Donovan paid Jackson's Biking for purchases on 5/11/21. 5/25/2021 Returned $900 of helmets back to their supplier, has not received the refund yet. 5/26/2021 Hunter Long returned the bike and helmet purchased on 5/16/21. Jackson's Biking issued a full cash refund 5/27/2021 Sold $500 of bike tires to Sarah Row for $700 on account. 5/29/2021 Petty Cash was replenished for $400 to cover a promotion made at a Mariners game advertising expense) 5/31/2021 Paid wages to employees for May totaling $15,000 5/31/2021 Paid dividends totaling $450. The following data are available for adjusting entries: 5/31/2021 Record rent expense for May. 5/31/2021 Record monthly interest expense on the Wells Fargo loan. 5/31/2021 Records show customers used $500 of gift cards to purchase inventory with a value of $300. 5/31/2021 Jackson's Biking had a water bill of $1,700 unpaid at end of the month 5/31/2021 Record depreciation of computer equipment for $1,000. 5/31/2021 At the end of the month, $1,800 of supplies remain in the supply closet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts