Question: Solve independently and using excel. Also, answer the question being asked too. Question 19) Orange Company is considering introducing a new music player. The company's

Solve independently and using excel. Also, answer the question being asked too.

Solve independently and using excel. Also, answer the question being asked too.

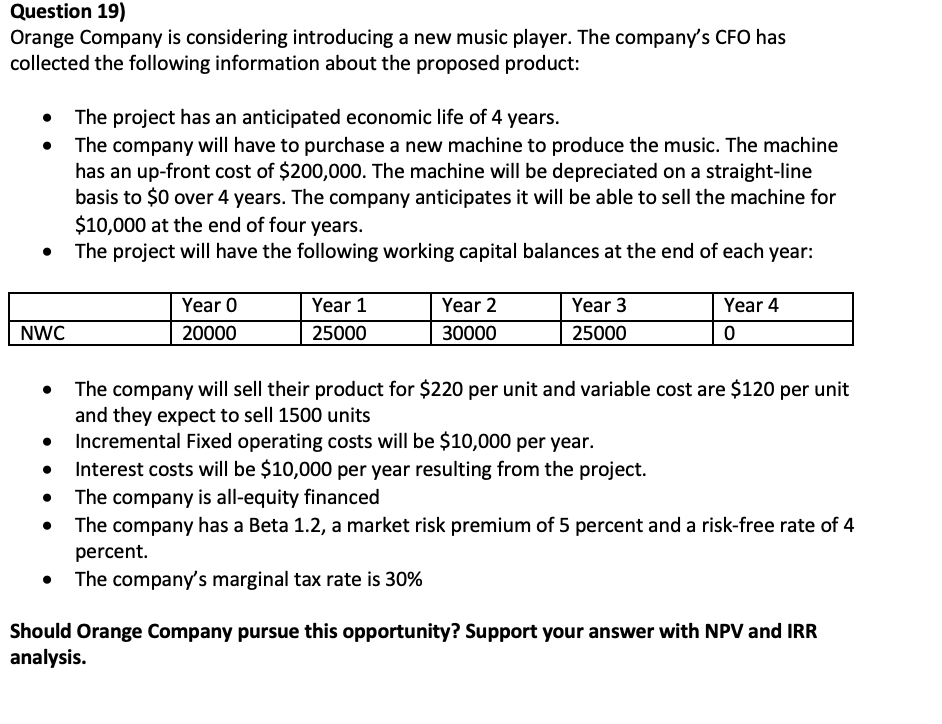

Question 19) Orange Company is considering introducing a new music player. The company's CFO has collected the following information about the proposed product: The project has an anticipated economic life of 4 years. The company will have to purchase a new machine to produce the music. The machine has an up-front cost of $200,000. The machine will be depreciated on a straight-line basis to $0 over 4 years. The company anticipates it will be able to sell the machine for $10,000 at the end of four years. The project will have the following working capital balances at the end of each year: . Year o 20000 Year 1 25000 Year 2 30000 Year 3 25000 Year 4 0 NWC . . The company will sell their product for $220 per unit and variable cost are $120 per unit and they expect to sell 1500 units Incremental Fixed operating costs will be $10,000 per year. Interest costs will be $10,000 per year resulting from the project. The company is all-equity financed The company has a Beta 1.2, a market risk premium of 5 percent and a risk-free rate of 4 percent. The company's marginal tax rate is 30% Should Orange Company pursue this opportunity? Support your answer with NPV and IRR analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts