Question: Solve it as it is do not change the order make it CLEAR! Sedona Company set the following standard costs for one unit of its

Solve it as it is do not change the order make it CLEAR!

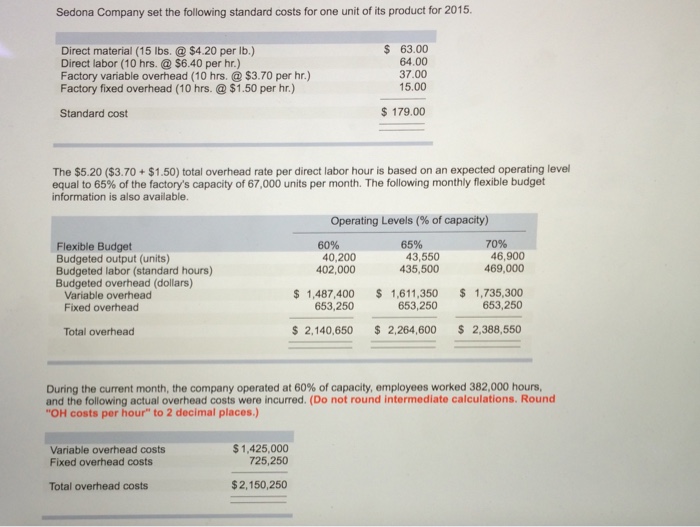

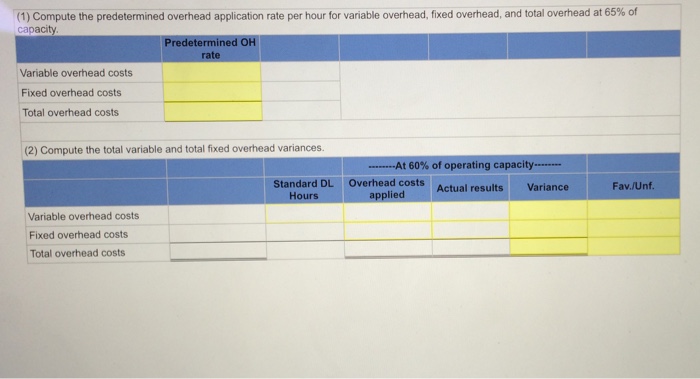

Solve it as it is do not change the order make it CLEAR! Sedona Company set the following standard costs for one unit of its product for 2015. Direct material (15 lbs.@$4.20 per lb.) Direct labor (10 hrs. $6.40 per hr.) Factory variable overhead (10 hrs.@$3.70 per hr.) Factory fixed overhead (10 hrs.@ $1.50 per hr.) 63.00 64.00 37.00 15.00 Standard cost $ 179.00 The $5.20 ($3.70+$1.50) total overhead rate per direct labor hour is based on an expected operating level equal to65% of the factory's capacity of 67,000 units per month. The following monthly flexible budget information is also available. Operating Levels (% of capacity) 60% 65% 70% Flexible Budget Budgeted output (units) Budgeted labor (standard hours) Budgeted overhead (dollars) 40,200 402,000 43,550 435,500 46,900 469,000 Variable overhead Fixed overhead 1,487,400 1,611,350 1,735,300 653,250 653,250 653,250 Total overhead 2,140,650 2,264,600 2,388,550 During the current month, the company operated at 60% of capacity, employees worked 382,000 hours, and the following actual overhead costs were incurred. (Do not round intermediate calculations.Round "OH costs per hour" to 2 decimal places) Variable overhead costs Fixed overhead costs $1,425,000 725,250 Total overhead costs $2,150,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts