Question: solve it asap On Balance Sheet Items Face Value Cash 130, 600 Short-term government securities (1 year 3, 000 Standby letters of credit: Performance related

solve it asap

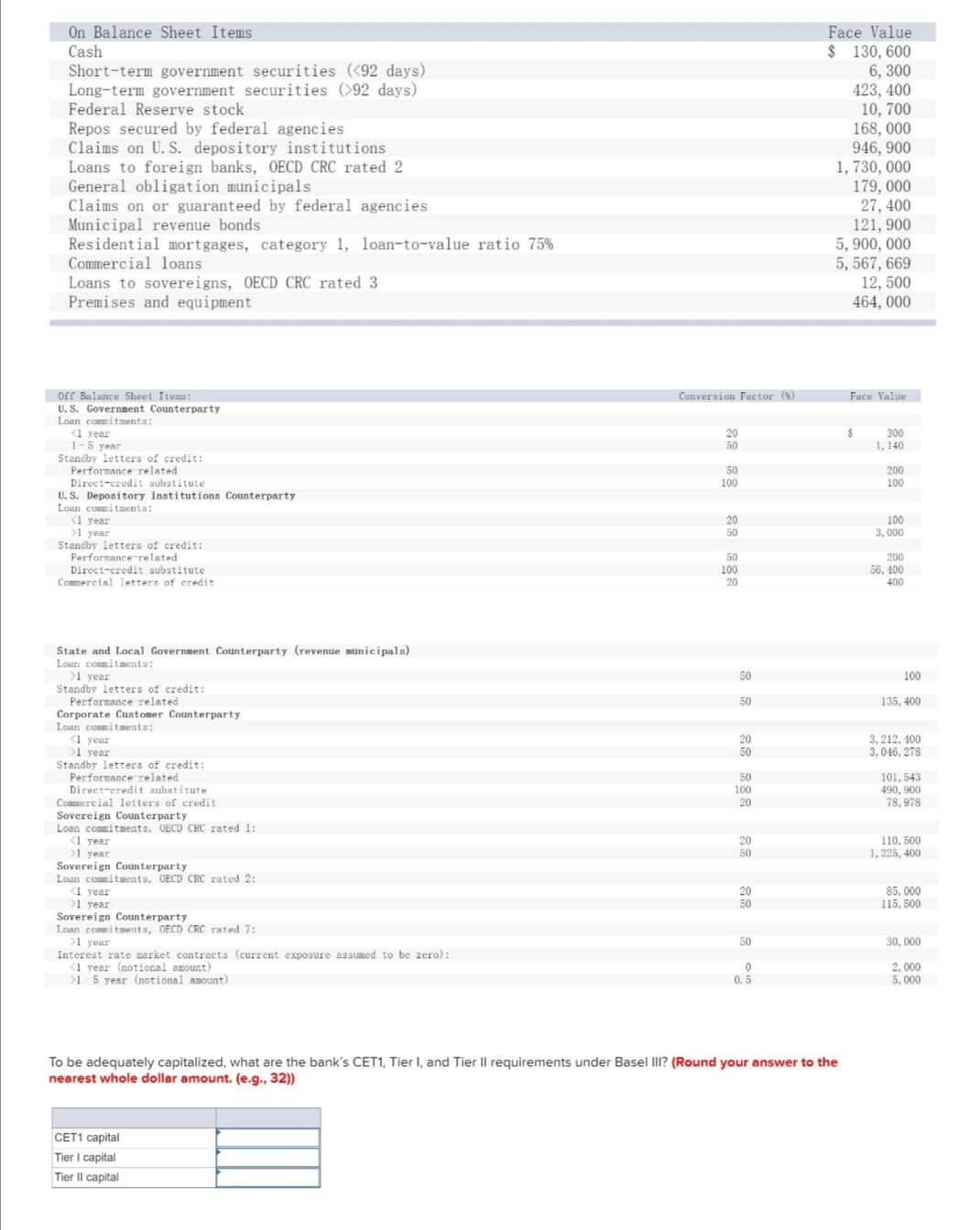

On Balance Sheet Items Face Value Cash 130, 600 Short-term government securities (1 year 3, 000 Standby letters of credit: Performance related 50 200 Direct-credit substitute 100 56, 400 commercial letters of credit 20 400 State and Local Government Counterparty (revenue municipals) Loan commitments: >1 year 50 100 Standby letters of credit: Performance related 135, 400 Corporate Customer Counterparty Loan commitments: 1 year 50 1, 225, 400 Sovereign Counterparty Loan commitments, OECD CRC rated 2: 1 year 50 115, 500 Sovereign Counterparty Loan commitments, OFCD CRC rated 7: >1 year 50 30, 000 Interest rate market contracts (current exposure assumed to be zero): 1 5 year (notional amount) 0. 5 5, 000 To be adequately capitalized, what are the bank's CET1, Tier I, and Tier II requirements under Basel III? (Round your answer to the nearest whole dollar amount. (e.g., 32)) CET1 capital Tier I capital Tier II capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts