Question: Solve it asap with other quarters as well Construct a short-term financial plan for Whistler Snowboards based on its expansion opportunity described in the following

Solve it asap with other quarters as well

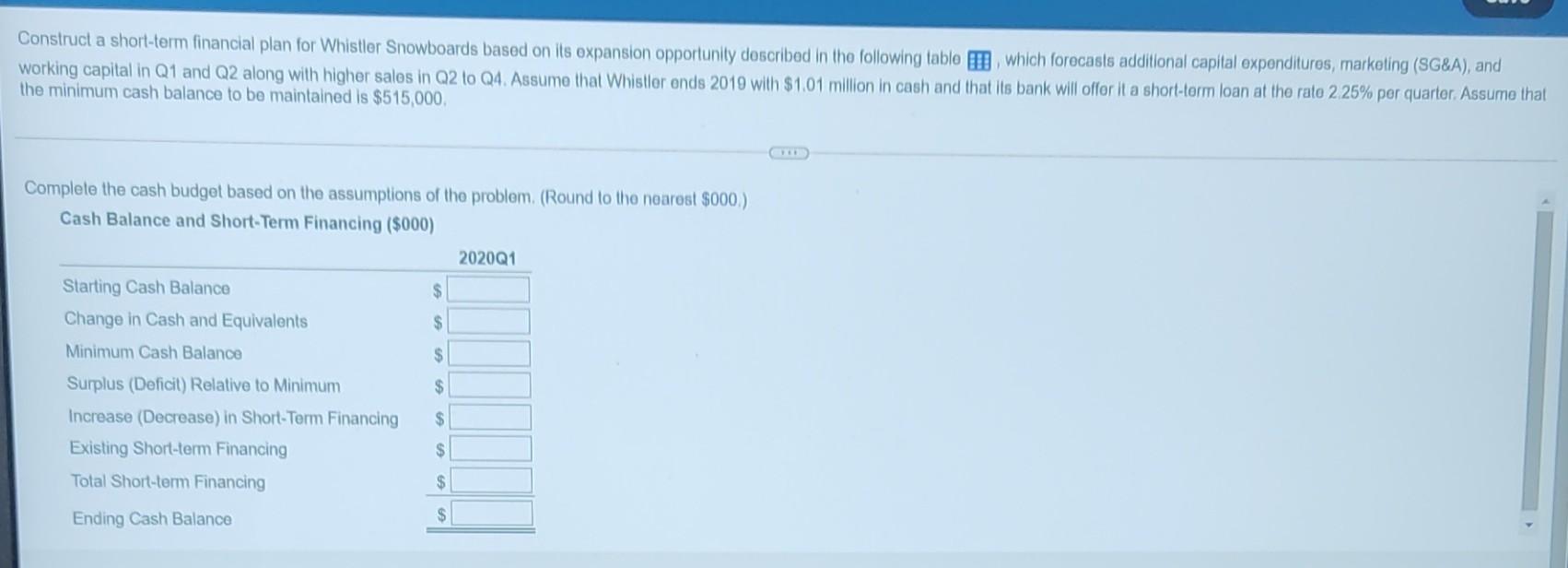

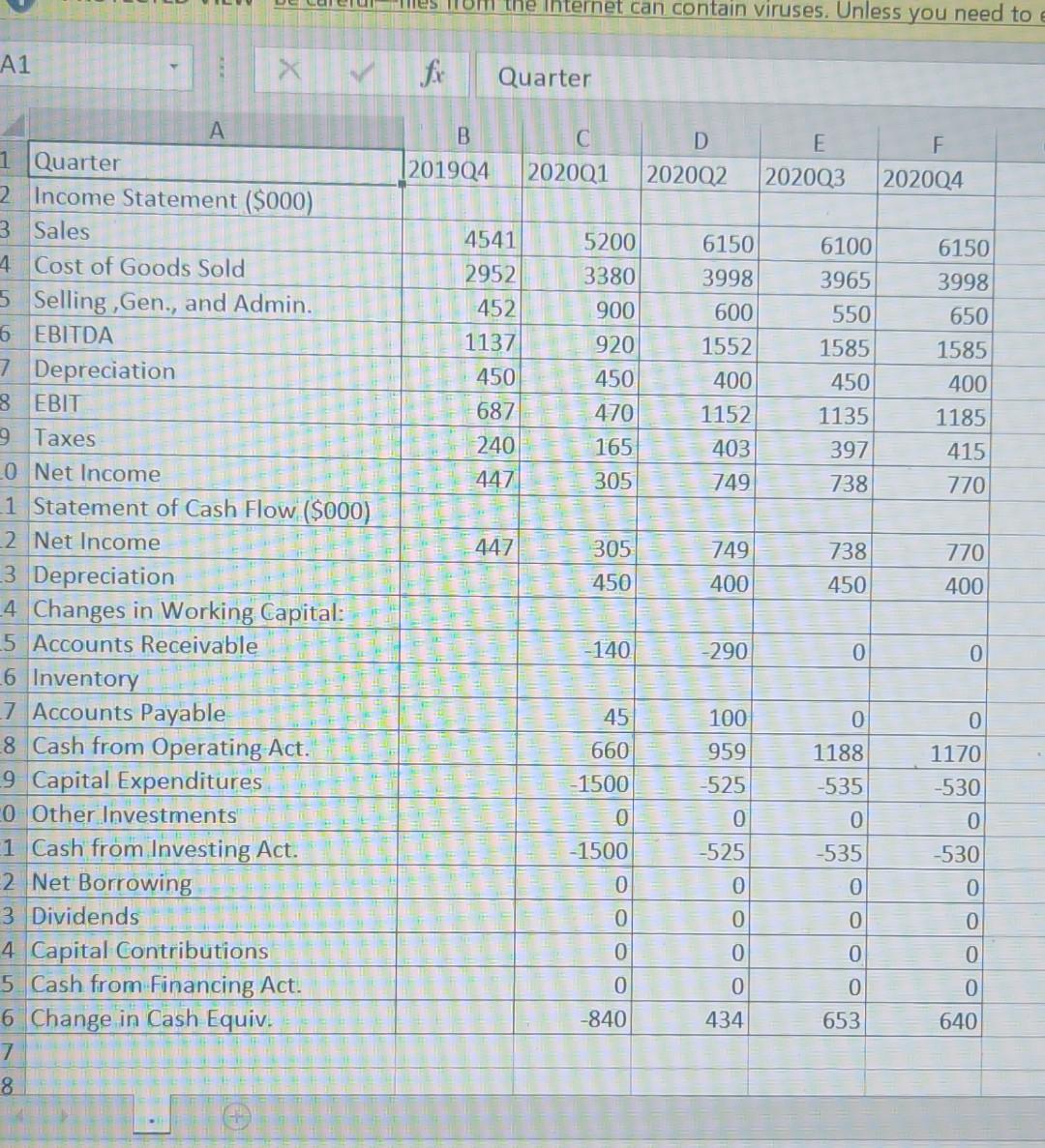

Construct a short-term financial plan for Whistler Snowboards based on its expansion opportunity described in the following table which forecasts additional capital expenditures, marketing (SG&A), and working capital in Q1 and Q2 along with higher sales in Q2 to Q4. Assume that Whistler ends 2019 with $1,01 million in cash and that its bank will offer it a short-term loan at the rate 2 25% per quarter. Assume that the minimum cash balance to be maintained is $515,000 Complete the cash budget based on the assumptions of the problem. (Round to the nearest $000) Cash Balance and Short-Term Financing ($000) 202001 $ $ $ Starting Cash Balance Change in Cash and Equivalents Minimum Cash Balance Surplus (Deficit) Relative to Minimum Increase (Decrease) in Short-Term Financing Existing Short-term Financing Total Short-term Financing $ $ $ $ Ending Cash Balance $ LecleS Tom the Internet can contain viruses. Unless you need to e A1 X fx Quarter B (201904 D 202002 202001 E 202003 F 202004 6150 3998 5200 3380 900 920 600 4541 2952 452 1137 450 687 240 447 6100 3965 550 1585 450 1135 397 738 6150 3998 650 1585 400 1185 415 1552 400 1152 403 749 450 470 165 305 770 447 305 749 770 A 1 Quarter 2 Income Statement ($000) 3 Sales 4 Cost of Goods Sold 5 Selling, Gen., and Admin. 6 EBITDA 7 Depreciation 8 EBIT 9 Taxes 0 Net Income 1 Statement of Cash Flow ($000) 2 Net Income 3 Depreciation 4 Changes in Working Capital: 5 Accounts Receivable _6 Inventory 7 Accounts Payable _8 Cash from Operating Act. 9 Capital Expenditures 0 Other Investments 1 Cash from Investing Act. 2 Net Borrowing 3 Dividends 4 Capital Contributions 5 Cash from Financing Act. 6 Change in Cash Equiv. 7 738 450 450 400 400 -140 -290 0 0 0 0 45 660 -1500 100 959 -525 1170 1188 -535 -530 0 0 0 -1500 0 -525 -535 -530 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 -840 434 653 640 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts