Question: solve it by using decision analysis A business group is planning to build a Football Stadium in Halifax and wants to decide on the stadium

solve it by using decision analysis

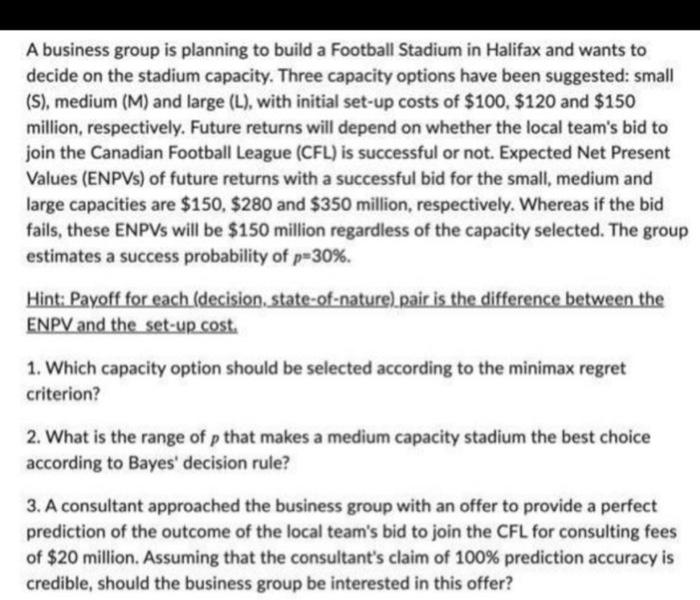

A business group is planning to build a Football Stadium in Halifax and wants to decide on the stadium capacity. Three capacity options have been suggested: small (S), medium (M) and large (L), with initial set-up costs of $100, $120 and $150 million, respectively. Future returns will depend on whether the local team's bid to join the Canadian Football League (CFL) is successful or not. Expected Net Present Values (ENPVS) of future returns with a successful bid for the small, medium and large capacities are $150, $280 and $350 million, respectively. Whereas if the bid fails, these ENPVs will be $150 million regardless of the capacity selected. The group estimates a success probability of p=30%. Hint: Payoff for each (decision, state-of-nature) pair is the difference between the ENPV and the set-up cost. 1. Which capacity option should be selected according to the minimax regret criterion? 2. What is the range of p that makes a medium capacity stadium the best choice according to Bayes' decision rule? 3. A consultant approached the business group with an offer to provide a perfect prediction of the outcome of the local team's bid to join the CFL for consulting fees of $20 million. Assuming that the consultant's claim of 100% prediction accuracy is credible, should the business group be interested in this offer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock