Question: solve it Case: Bank Statement Analysis ABC Bank started in the year 2018. Although the Bank is doing well, the management still believes there is

solve it

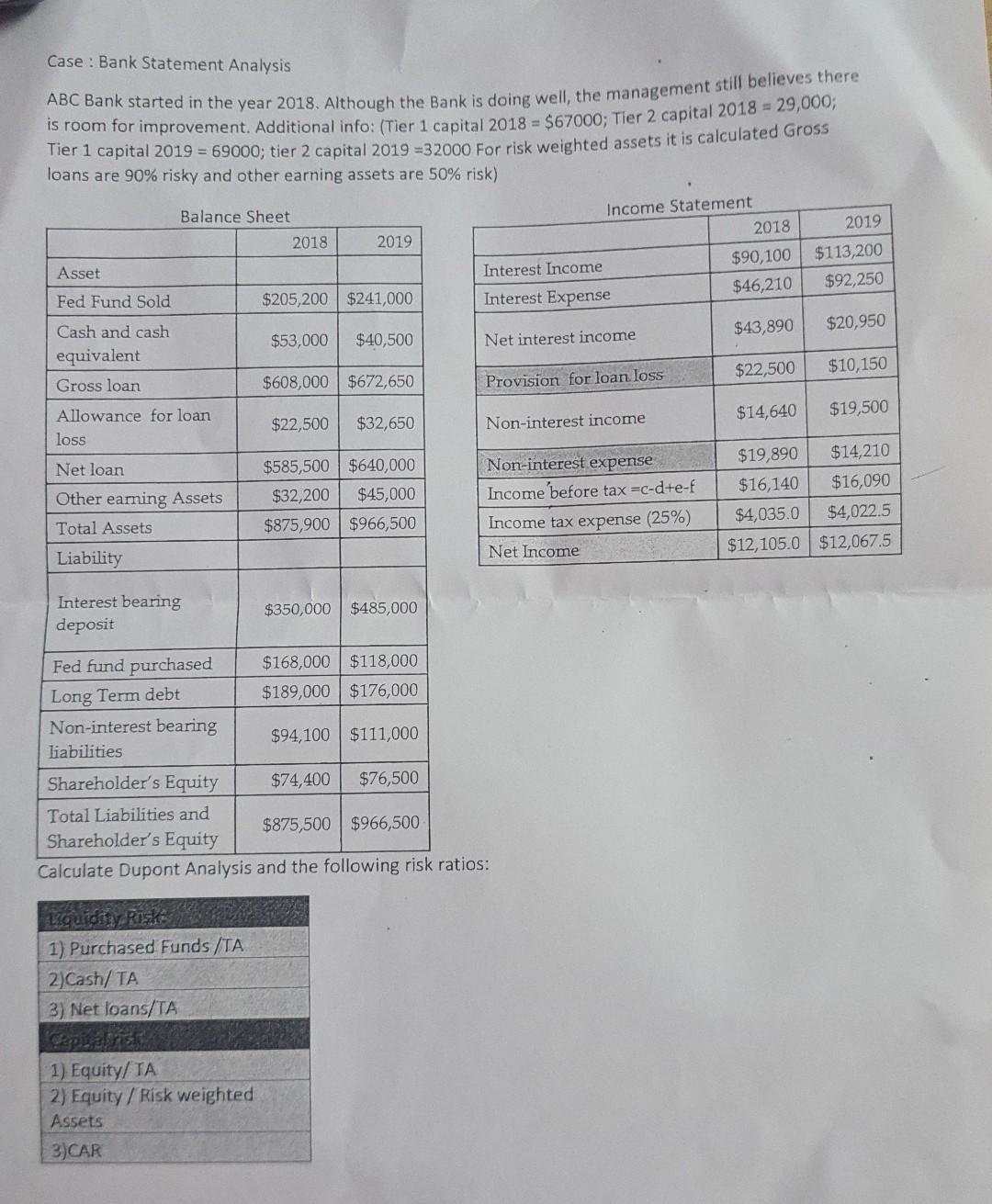

Case: Bank Statement Analysis ABC Bank started in the year 2018. Although the Bank is doing well, the management still believes there is room for improvement. Additional info: (Tier 1 capital 2018 = $67000; Tier 2 capital 2018 = 29,000; Tier 1 capital 2019 = 69000; tier 2 capital 2019-32000 For risk weighted assets it is calculated Gross loans are 90% risky and other earning assets are 50% risk) Balance Sheet Income Statement 2018 2019 2018. 2019 Asset $90,100 $113,200 Interest Income Interest Expense Fed Fund Sold $46,210 $92,250 $205,200 $241,000 Cash and cash equivalent $53,000 $40,500 $43,890 $20,950 Net interest income Gross loan $608,000 $672,650 $22,500 $10,150 Provision for loan loss Allowance for loan loss $22,500 $32,650 $14,640 $19,500 Non-interest income Net loan $585,500 $640,000 $19,890 $14,210 $16,140 $16,090 Other earning Assets Total Assets Liability $32,200 $45,000 $875,900 $966,500 Non-interest expense Income before tax =c-d+e-f Income tax expense (25%) Net Income $4,035.0 $4,022.5 $12,105.0 $12,067.5 Interest bearing deposit $350,000 $485,000 $168,000 $118,000 $189,000 $176,000 Fed fund purchased Long Term debt Non-interest bearing liabilities $94,100 $111,000 Shareholder's Equity $74,400 $76,500 Total Liabilities and $875,500 $966,500- Shareholder's Equity Calculate Dupont Analysis and the following risk ratios: Liquidity Risk: 1) Purchased Funds /TA 2)Cash/TA 3) Net loans/TA 1) Equity/TA 2) Equity/Risk weighted Assets 3)CAR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts