Question: solve it correctly please. I will rate accordingly. Formula attached Question 2 Genie Corporation expects cash flows from its risky assets in one year of

solve it correctly please. I will rate accordingly. Formula attached

solve it correctly please. I will rate accordingly. Formula attached

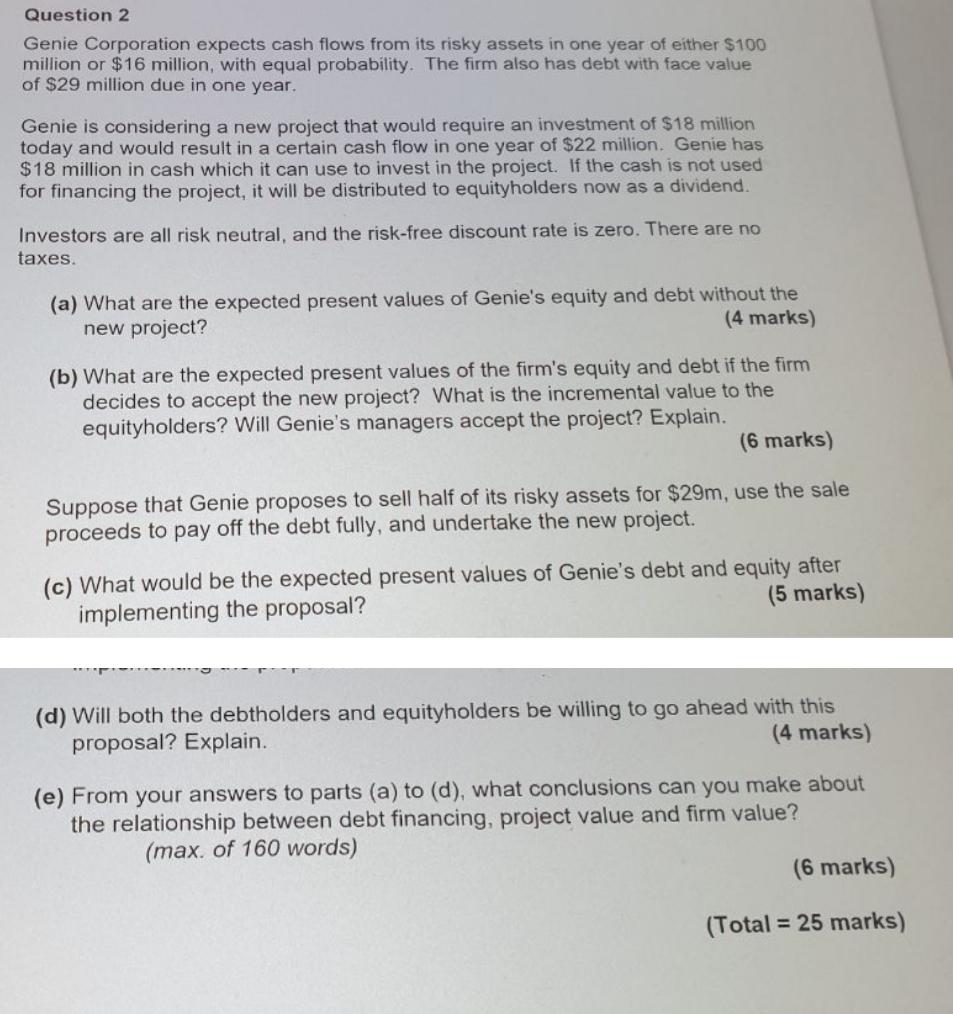

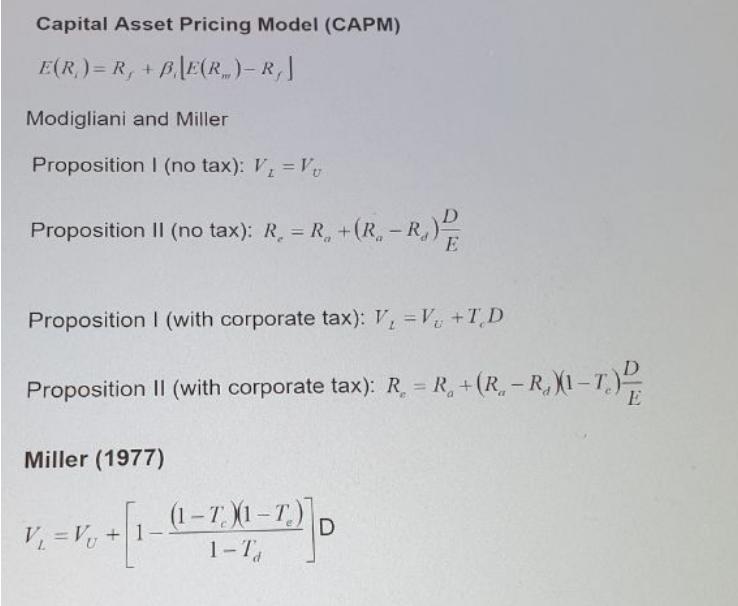

Question 2 Genie Corporation expects cash flows from its risky assets in one year of either $100 million or $16 million, with equal probability. The firm also has debt with face value of S29 million due in one year. Genie is considering a new project that would require an investment of $18 million today and would result in a certain cash flow in one year of $22 million. Genie has $18 million in cash which it can use to invest in the project. If the cash is not used for financing the project, it will be distributed to equityholders now as a dividend. Investors are all risk neutral, and the risk-free discount rate is zero. There are no taxes. (a) What are the expected present values of Genie's equity and debt without the new project? (4 marks) (b) What are the expected present values of the firm's equity and debt if the firm decides to accept the new project? What is the incremental value to the equityholders? Will Genie's managers accept the project? Explain. (6 marks) Suppose that Genie proposes to sell half of its risky assets for $29m, use the sale proceeds to pay off the debt fully, and undertake the new project. (c) What would be the expected present values of Genie's debt and equity after implementing the proposal? (5 marks) (d) Will both the debtholders and equityholders be willing to go ahead with this proposal? Explain. (4 marks) (e) From your answers to parts (a) to (d), what conclusions can you make about the relationship between debt financing, project value and firm value? (max. of 160 words) (6 marks) (Total = 25 marks) Capital Asset Pricing Model (CAPM) E(R)=R, +[E(R)-R] Modigliani and Miller Proposition 1 (no tax): V = V Proposition 11 (no tax): R = R +(R. - R.) Proposition 1 (with corporate tax): V, =V+TD Proposition II (with corporate tax): R = R. + (R. - R, XI-) (: R E Miller (1977) . V = V0 + v. +[1-0-10)) (1 - 1)(1-1)]. T, D Question 2 Genie Corporation expects cash flows from its risky assets in one year of either $100 million or $16 million, with equal probability. The firm also has debt with face value of S29 million due in one year. Genie is considering a new project that would require an investment of $18 million today and would result in a certain cash flow in one year of $22 million. Genie has $18 million in cash which it can use to invest in the project. If the cash is not used for financing the project, it will be distributed to equityholders now as a dividend. Investors are all risk neutral, and the risk-free discount rate is zero. There are no taxes. (a) What are the expected present values of Genie's equity and debt without the new project? (4 marks) (b) What are the expected present values of the firm's equity and debt if the firm decides to accept the new project? What is the incremental value to the equityholders? Will Genie's managers accept the project? Explain. (6 marks) Suppose that Genie proposes to sell half of its risky assets for $29m, use the sale proceeds to pay off the debt fully, and undertake the new project. (c) What would be the expected present values of Genie's debt and equity after implementing the proposal? (5 marks) (d) Will both the debtholders and equityholders be willing to go ahead with this proposal? Explain. (4 marks) (e) From your answers to parts (a) to (d), what conclusions can you make about the relationship between debt financing, project value and firm value? (max. of 160 words) (6 marks) (Total = 25 marks) Capital Asset Pricing Model (CAPM) E(R)=R, +[E(R)-R] Modigliani and Miller Proposition 1 (no tax): V = V Proposition 11 (no tax): R = R +(R. - R.) Proposition 1 (with corporate tax): V, =V+TD Proposition II (with corporate tax): R = R. + (R. - R, XI-) (: R E Miller (1977) . V = V0 + v. +[1-0-10)) (1 - 1)(1-1)]. T, D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts